Travelers 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

entered into agreements with several of these states to resolve issues related to broker and agent

compensation. The Company discontinued paying contingent commissions on excess casualty andumbrella

business effective September 30, 2006. In addition, the Company discontinued paying contingent

commissions for homeowners multi-peril, private passenger automobile physical damage, private passenger

automobile no-fault, other private passenger automobile liability, boiler and machinery and financial

guaranty insurance lines effective January 1, 2007. The Company has developed alternative compensation

arrangements for these lines of business that compensate brokers and agents in a manner that

differentiates for business performance and is consistent with all applicable laws. Beginning January 1,

2007, the Company is offering an optional fixed commission program for most commercial insurance lines.

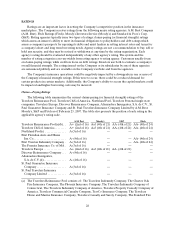

Insurance Regulation Concerning Dividends

TRV’s principal insurance subsidiaries are domiciled in the states of Connecticut and Minnesota. The

insuranceholding company laws of both states applicable to TRV’s subsidiaries require notice to,and

approval by, the state insurance commissioner for thedeclaration or payment of any dividend, that

together with other distributions made within the preceding twelve months, exceedsthe greater of 10% of

the insurer’s capital and surplus as of the preceding December 31, or the insurer’s net income for the

twelve-month period ending the preceding December 31, in each case determined in accordance with

statutory accountingpractices and by state regulation. This declaration or payment is further limited by

adjusted unassigned surplus, as determined in accordance with statutory accounting practices.

The insurance holding company laws of other states in which TRV’s insurance subsidiaries are

domiciled generally contain similar, although in some instances somewhat more restrictive, limitations on

the payment of dividends.

Premium Rate Approvals

TRV’s insurance subsidiaries are subject to each state’s regulations regarding premium rate approvals.

The applicable regulations are used by states to establish standards to ensure that rates arenot excessive,

inadequate, unfairly discriminatory, or used to engage in unfair price competition. An insurer’s ability to

increase premiums and the relative timing of the process, are dependent upon each respective state’s

requirements.

Requirements for Exiting Geographic Markets and/or Canceling orNonrenewing Policies

Several states have regulations which may impact the timing and/or the ability of an insurer to either

discontinue or substantially reduce its writings in that state. These regulations typically require prior

notice, and in some instances insurance department approval, prior to discontinuing a line of business or

withdrawing from that state.

Insurance Holding Company Statutes

As a holding company, TRV is not regulated as an insurance company. However, since TRV owns

capital stock in insurance subsidiaries, it is subject to state insurance holding company statutes, as well as

certain other laws, of each ofits insurance subsidiaries’ states of domicile. All holding company statutes, as

well as other laws, require disclosure and, in some instances, prior approval of material transactions

between an insurance company and an affiliate. The holding company statutes and other laws also require,

among other things,prior approvalof an acquisition of control of a domestic insurer, some transactions

between affiliates and the payment of extraordinary dividends or distributions.