Travelers 2006 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

226

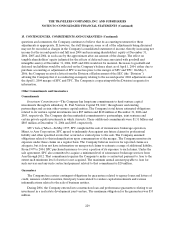

15. CONTINGENCIES, COMMITMENTS AND GUARANTEES (Continued)

On October 1, 2003, Gulf entered into a final settlement agreement with Employers, and all claims

and counterclaims with respect to Employers have beendismissed. On May 26, 2004, the Court denied

Gulf’s motion to dismiss certain claims asserted by Transatlantic and denied a joint motion by

Transatlantic, XL and Odyssey for summary judgment against Gulf. On December 22, 2006, Gulf and XL

entered into a final settlement agreement which resolves all claims between Gulf and XL under the

reinsurance agreements at issue in the litigation. Fact and expert discovery are complete with respect to

the remaining parties: Transatlantic, Odyssey and Gerling. Gulf, Transatlantic and Gerling have filed

motions for partial summary judgment. The Court has not yet set a trial date. Gulf denies the reinsurers’

allegations, believes that it has a strong legal basis to collect the amounts due under thereinsurance

contracts andintends to vigorously pursue the actions.

Based on the Company’s beliefs about its legal positions in its various reinsurance recovery

proceedings, the Companydoes not expect any of these matters will have a material adverse effect on its

results of operations in a future period.

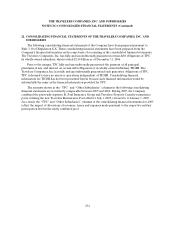

The Company is a defendant in three consolidated lawsuits in the United States District Court for the

Eastern District of Louisiana arising out of disputes with certain policyholders over whether insurance

coverage is available for flood losses arising fromHurricane Katrina: Chehardy, et al. v. State Farm, et al. ,

C.A. No. 06-1672, 06-1673 and06-1674, Vanderbrook, et al. v. State Farm Fire & Cas. Co., et al. C.A.

No. 05-6323;and Xavier University of Louisiana v. Travelers Property Ca. Co. of America, C.A. No. 06-516.

Chehardy and Vanderbrook are proposed class actions in which the Company is one of several insurer

defendants.Xavier is an individual suit involving a property insurance policy brought by one of the

Company’s insureds. The losses involved in all of these suits allegedly were caused by the failure of the

New Orleans levees. On November 27, 2006, the Court issued a ruling in the three consolidated cases

denying the motions of the Company and certain other insurers for a summary disposition of the cases.

The Court’s ruling does not determine that any additional amounts are owed under any of the Company’s

policiesor otherwise reach the merits of the policyholders’ claims.The Company disagrees with the ruling

and, along withcertain other insurers named in the consolidated lawsuits, filed a motion with the United

States Court of Appeals for the Fifth Circuit, seeking to have the Court of Appeals accept an immediate

appeal from the District Court’s ruling. OnFebruary 1, 2007, the Fifth Circuit accepted the appeal.

As part of ongoing, industry-wide investigations, the Company and its affiliates have received

subpoenas and written requests for information from government agencies and authorities. The areas of

pending inquiry addressed to the Company include its relationship with brokers and agents, and the

Company’s involvement with “non-traditional insurance and reinsurance products.” The Company or its

affiliates have received subpoenas or requests for information, in each case with respect to one or both of

the areas described above, from: (i) State of California Office of the Attorney General; (ii) State of

California Department of Insurance; (iii) Licensing and Market Conduct Compliance Division, Financial

Services Commission of Ontario, Canada; (iv) State of Connecticut InsuranceDepartment; (v) State of

Connecticut Office of the Attorney General; (vi) State of Delaware Department of Insurance; (vii) State of

Florida Department of Financial Services; (viii) State of Florida Office of Insurance Regulation; (ix) State

of Florida Department of Legal Affairs Office of the Attorney General; (x) State of Georgia Office of the

Commissioner of Insurance; (xi) State ofHawaii Office of the Attorney General; (xii) State of Illinois

Office of the Attorney General; (xiii) State of Illinois Department of Financial andProfessional

Regulation; (xiv) State of Iowa Insurance Division; (xv) State of Maryland Office of the Attorney General;