Travelers 2006 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

Management’s estimates

At least once per quarter, certain Company management meets with its actuaries to review the latest

claim and claim adjustment expense reserve analyses. Based on these analyses, management determines

whether its ultimate claim liability estimatesshould be changed. In doing so, it must evaluate whether the

new data provided represents credible actionable information or an anomaly that will have no effect on

estimated ultimate claim liability. For example, as described above, payments may have decreased in one

geographic region due to fewer claim adjusters being available to process claims. The resulting claim

payment patterns would be analyzed to determine whether or not the change in payment pattern

represents a change in ultimate claim liability.

Such an assessment requires considerablejudgment. It is frequently not possible to determine whether

a change in the data is an anomaly until sometime after the event. Even if a change is determined to be

permanent, it is not always possible to reliably determine the extent of the change until sometime later.

The overall detailed analyses supporting such an effort can take several months to perform. This is due to

the need to evaluate the underlying cause of the trends observed, and may include the gathering or

assembling of data not previously available. It may also include interviews with experts involved with the

underlying processes. As a result, there can be a time lag between the emergence of a change and a

determination that the change should be reflected in the Company’s estimated claim liabilities. The final

estimate selected by management in a reporting period is based on these various detailed analyses of past

data, adjusted to reflect any new actionable information.

Discussion of Product Lines

The following section details reserving considerations and common risk factors by product line. There

are many additional risk factors that may impact ultimate claim costs. Each risk factor presented will have

a different impact on required reserves. Also, risk factors can have offsetting or compoundin geffects on

required reserves. For example, in workers’ compensation, the use of expensive medical procedures that

result in medical cost inflation may enable workers to return to work faster, thereby lowering indemnity

costs. Thus, in almost all cases, it is impossible to discretely measure the effect of a single risk factor and

constructa meaningful sensitivity expectation.

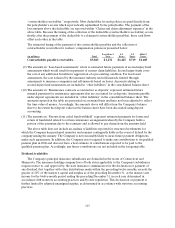

In order to provide information on reasonably possible reserving changes by product line, the

historical changes in year-end loss reserves over a one-year period are provided for the U.S. product lines.

This information is provided for both the Company and the industry for the nine most recent years, and is

based on themost recentpublicly available data for the reported line(s) that most closely match the

individual product line being discussed. These changes were calculated, net of reinsurance, from statutory

annual statement data found in Schedule P of those statements, and represent the reported reserve

development on the beginning-of-the-year claim liabilities divided by the beginning claim liabilities, all

accident years combined, excluding non-defense related claim adjustment expense. Data presented for the

Company includes history for the entire Travelers group (U.S. companies only), whether or not the

individual subsidiaries were originally part of SPC or TPC. This treatment is required by the statutory

reporting instructions promulgated by state regulatory authorities for Schedule P. Comparable data for

non-U.S. companies is not available.

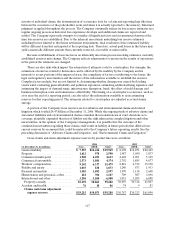

General Liability

General liability is generally considered a long tail line, as it takes a relatively long period of time to

finalize and settle claims from a given accident year. The speed of claim reporting and claim settlement is a

function of the specific coverage provided, the jurisdiction and specific policy provisions such as

self-insured retentions. There are numerous components underlying the general liability product line.

Some of these have relatively moderate payment patterns (with most of the claims for a given accident year