Travelers 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78

The Company also commuted certain reinsurance agreements with a major reinsurer in 2004 resulting

in a $113 million prior year reserve charge (in addition to a current year loss of $40 million).

Commutations are a complete and final settlement with a reinsurer that results in a discharge of all

obligations of the parties to the terminated reinsurance agreement.

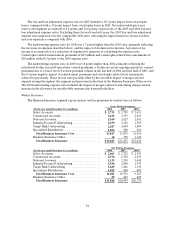

Cost ofCatastrophes.In 2006, the cost of catastrophes totaled $103 million (net of reinsurance), all

of which was incurred in the Personal Insurance segment and resulted from several wind, rain, hail and

snow storms in the United States throughout the year. In2005, the Company’s cost of catastrophes, net of

reinsurance and including reinstatement premiums of $121 million and state assessments of $43 million,

totaled $2.19 billion, primarily resulting from Hurricanes Katrina, Rita and Wilma. Reinstatement

premiums represent additional premiums payable to reinsurers to restore coverage limits that have been

exhausted as a result of reinsured losses under certain excess-of-loss reinsurance treaties and are recorded

as a reduction of net written and earned premiums. The majority of catastrophe costs in 2005 were

incurred in the Business Insurance segment ($1.41 billion) and in the Personal Insurance segment ($593

million) In 2004, the cost of catastrophes, net of reinsurance, totaled $772 million, all of which resulted

from four hurricanes—Charley, Frances, Ivan and Jeanne—that also made landfall in the southeastern

United States.

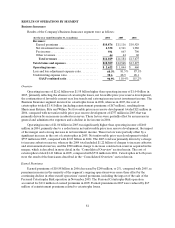

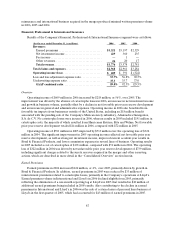

General and Administrative Expenses

General and administrative expenses totaled$3.46 billion in 2006, an increase of $229 million, or 7%,

over the comparable 2005 total of $3.23 billion. The increase in 2006 was driven by investments made

throughout the Company to support business growth and product development, costs related to the

Company’s national advertising campaign and legal expenses related to investigations of various business

practices by certain governmental agencies (see “Item 3—Legal Proceedings”). These factors were

partially offset by the impact of the favorable resolution of certain prior-year state tax matters, certain tax

benefits, the absence of catastrophe-related state assessments and lower premium tax-related expenses.

The $284 million increase in general and administrative expenses in 2005 compared with 2004

primarily reflected the impact of the merger. In addition, the 2005 total included $43 million of state

assessments related to catastrophe losses, and also reflected investments made for process re-engineering

and to support business growth and product development, primarily in the Personal Insurance segment.

These factors were partially offset by the benefit of expense efficiencies achieved since the completion of

the merger. Included in the 2005 and 2004 totals were $112 million and $92 million, respectively, of

amortization expense related to finite-lived intangible assets acquired in the merger, and a benefit of $12

million and $58 million, respectively, associated with the accretion of the fair value adjustment to claims

and claim adjustment expenses and reinsurance recoverables. The 2004 total included a $6 2 million

increase in the allowance for uncollectible amounts due from policyholders for loss-sensitive business

(primarily high-deductible business). This increase resulted from applying the Company’s credit-based

methodology for determining uncollectible amounts to the recoverables acquired in the merger. General

and administrative expenses in 2004 also included$29 million of restructuring charges related to the

merger.

Other 2004 Claims and Expenses. Other items increasing the 2004 claims and expenses included $296

million of charges to increase the allowances for estimated uncollectible amounts due from reinsurance

recoverables, policyholders receivables, and co-surety participations on a specific construction contractor

claim. The increase in the allowance for uncollectible reinsurance recoverables recognized a change in

estimated disputes with reinsurers and is based upon the Company’s reinsurance strategy of reduced

reinsurance utilization, including the cessation of ongoing business relationships w ith certain of SPC’s

reinsurers, and aggressive collection of reinsurance recoverables. A charge was also recorded to increase

the estimated uncollectible amounts due from policyholders for loss sensitive business (primarily high

deductible business). Thisincrease recognized a change in estimated uncollectible amounts dueand

resulted from applying the Company’s credit based methodology for determining uncollectible amounts to

the recoverables acquired in the merger. Because reinsurance recoverables and amounts due from