Travelers 2006 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

181

3. INVESTMENTS (Continued)

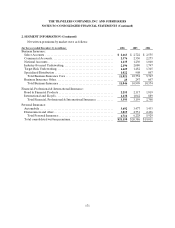

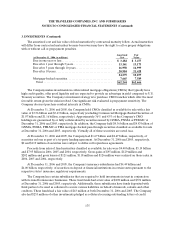

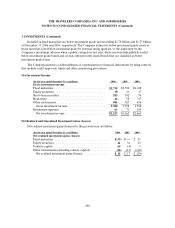

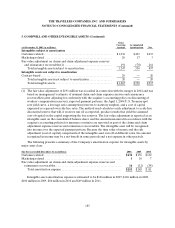

Changes in net unrealized gains (losses) on investment securities that are included as a separate

component of accumulated other changes in equity from nonowner sources were as follows:

(at and for the year ended December 31, in millions)2006 2005 2004

Change in net unrealized investment gains (losses)

Fixed maturities....................................................... $55

$ ( 885 ) $ (315)

Equity securities....................................................... (4 )(31 ) 11

Venture capital........................................................ 19

78 11

Other investments(excluding venture capital) ............................. 125 (14 ) 3

195 (852 ) (290)

Related taxes.......................................................... 69

(311 ) (98)

Change in net unrealized gains (losses) on investment securities ........... 126 (541 ) (192)

Balance, beginning of year.............................................. 327 868 1,060

Balance, end of year ................................................. $453

$ 327 $ 868

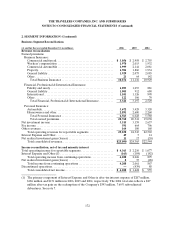

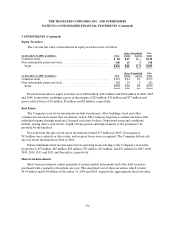

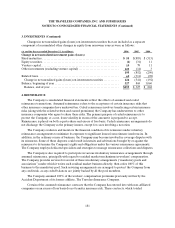

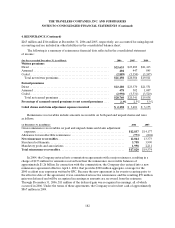

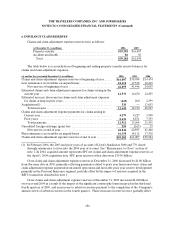

4. REINSURANCE

The Company’s consolidated financial statements reflect the effects of assumed and ceded

reinsurance transactions. Assumed reinsurance refers to the acceptance of certain insurance risks that

other insurance companies have underwritten. Ceded reinsurance involves transferring certain insurance

risks (along with the related written and earned premiums) the Company has underwritten to other

insurance companies who agree to share these risks. The primary purpose of ceded reinsurance is to

protect the Company, at a cost, from volatility in excess of the amount itis prepared to accept.

Reinsurance is placed on both a quota-share andexcess of loss basis. Cededreinsurance arrangements do

not discharge the Company as the primary insurer, except for cases involving a novation.

The Company evaluates and monitors the financial condition of its reinsurers under voluntary

reinsurance arrangements to minimize its exposure to significant losses from reinsurer insolvencies. In

addition, in the ordinary course of business, the Company may become involved in coverage disputes with

its reinsurers. Some of these disputes could result in lawsuits and arbitrations brought by or against the

reinsurers to determine the Company’s rights and obligations under the various reinsurance agreements.

The Company employs dedicated specialists and strategies to manage reinsurance collections and disputes.

The Company is also required to participate in various involuntary reinsurance arrangements through

assumed reinsurance, principally with regard to residual market mechanisms in workers’ compensation.

The Company provides services for several of these involuntary arrangements (“mandatory pools and

associations”) under which it writes such residual market business directly, then cedes 100% of this

business to the mandatory pool. Such servicing arrangements are arranged to protect the Company from

any credit risk, as any cededbalances are jointly backed by all the pool members.

The Company assumed 100% of the workers’ compensation premiums previously written by the

Accident Department of its former affiliate, The Travelers Insurance Company.

Certain of the assumed reinsurance contracts that the Company has entered into with non-affiliated

companies on an excess of loss basis do not transfer insurance risk. These contracts, which totaled