Travelers 2006 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

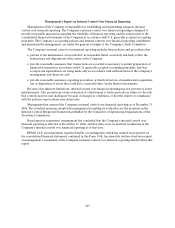

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

242

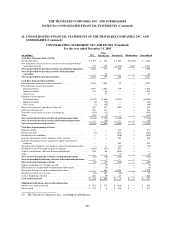

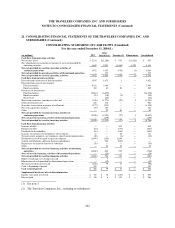

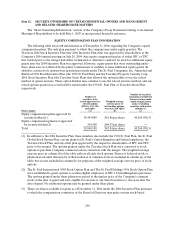

21. CONSOLIDATING FINANCIAL STATEMENTS OF THE TRAVELERS COMPANIES, INC. AND

SUBSIDIARIES (Continued)

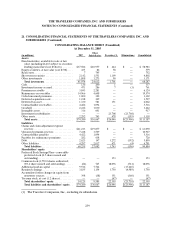

CONSOLIDATING STATEMENT OF CASH FLOWS (Unaudited)

For the yearended December31, 2004(1)

(in millions) TPC

Other

Subsidiaries Travelers(2) Eliminations Consolidated

Cash flows from operating activities

Net income (loss) ........................................ $ 2,314 $ (1,288)$ 955 $ (1,026 )$ 955

Net adjustments to reconcile net income to net cash provided by

operating activities..................................... 1,608 2,943 (1,465)1,025 4,111

Net cash providedby (used in) operating activities of

continuing operations ................................... 3,922 1,655 (510)(1)5,066

Net cash providedby operating activities ofdiscontinued operations .—175— — 175

Net cash providedby (used in) operating activities ............... 3,922 1,830 (510)(1)5,241

Cash flows frominvesting activities

Proceedsfrom maturitiesof fixed maturities.................... 3,947 1,673 1—5,621

Proceeds from sales of investments:

Fixed maturities. ....................................... 4,381 3,564 — — 7,945

Equity securities....................................... 18263 20 —265

Purchases of investments:

Fixed maturities. ....................................... (9,863)(6,659)— — (16,522)

Equity securities....................................... (55 )(38 )(1)—(94 )

Real estate............................................ —(22 )— — (22 )

Short-term securities, (purchases) sales,net .................... (556)(1,271)(87 )1(1,913)

Other investments,net .................................... 632332— — 964

Securities transactions in course of settlement ................... (877)(231)— — (1,108)

Net cash acquiredin merger ................................ (19 )167— — 148

Other ................................................. —29 40 —69

Net cash provided by (used in) investing activities of

continuing operations ................................... (2,228)(2,393)(27 )1(4,647)

Net cash usedin investing activities of discontinued operations .....—(139)— — (139)

Net cash provided by (used in) investing activities............... (2,228)(2,532)(27 )1(4,786)

Cash flows from financing activities

Issuance of debt ......................................... — — 302 —302

Payment of debt......................................... (54 )—(173)—(227)

Dividends to shareholders. ................................. (81 )—(561)—(642)

Issuance of common stock-employee share options............... 43 —68 —111

Treasury stock acquired—net employee share-based compensation .. (22 )—(1)—(23 )

Dividendsreceived by (paid to) parent company ................. (1,690)(150)1,840 — —

Capital contributions andloans between subsidiaries............. —940(940)— —

Repurchaseof minority interest of subsidiary ................... (76 )— — — (76 )

Other ................................................. —20 19 —39

Net cash providedby (used in) financing activities of continuing

operations............................................ (1,880)810554 —(516)

Net cash usedin financing activities of discontinued operations.....—(24 )— — (24 )

Net cash providedby (used in) financing activities ............... (1,880)786554 —(540)

Effectofexchange rate changes on cash....................... —7— — 7

Elimination of cash provided bydiscontinued operations .......... —(12 )— — (12 )

Net increase(decrease) in cash.............................. (186)79 17 —(90 )

Cash at beginning of period................................. 352— — — 352

Cash at end of period..................................... $ 166$ 79 $ 17 $ — $ 262

Supplemental disclosure of cash flow information

Income taxes paid(received) ................................ $ 747$ 78 $ (219)$ — $ 606

Interest paid............................................ $ 138$ 6$ 142 $ — $ 286

(1)See note 3.

(2)The Travelers Companies, Inc., excluding its subsidiaries.