Travelers 2006 Annual Report Download - page 161

Download and view the complete annual report

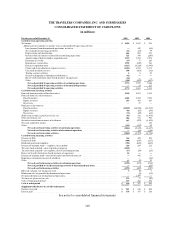

Please find page 161 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

149

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements include the accounts of The Travelers Companies, Inc.

(together with its subsidiaries, the Company). On April 1, 2004, Travelers Property Casualty Corp. (TPC)

merged with a subsidiary of The St. Paul Companies, Inc. (SPC), as a result of which TPC became a

wholly-owned subsidiary of The St. Paul Travelers Companies, Inc. For accounting purposes, this

transaction was accounted for as a reverse acquisition with TPC treated as the accounting acquirer.

Accordingly, this transaction was accounted for as a purchase business combination, using TPC’s historical

financial information and applyingfair value estimates to the acquired assets, liabilities and commitments

of SPC as ofApril 1, 2004. Beginning on April 1, 2004, the results of operations andfinancial condition of

SPC were consolidated with TPC’s results of operations and financial condition. Accordingly, all financial

information presented herein for the twelve months ended December 31, 2006 and 2005 reflects the

consolidated accounts of SPC and TPC. The financial information presented herein for the twelve months

endedDecember 31, 2004 reflects only the accounts ofTPC for the three months ended March 31, 2004

and the consolidated accounts of SPC and TPC for the nine months ended December 31, 2004. As

described in Note 23, on February 26, 2007, the Company changed its name to The Travelers

Companies, Inc.

The preparation of the consolidated financial statements in conformity with U.S. generally accepted

accounting principles (GAAP) requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of

the consolidated financial statements and the reported amounts of revenues and claims and expenses

during the reporting period. Actual results could differfrom those estimates. Certain reclassifications have

been made to prior years’ financial statements to conform to the current year’s presentation, including

reclassifications related to the realignment of the Company’s reportable business segments described in the

“Nature of Operations” section of this note. All material intercompany transactions and balances have

been eliminated.

Adoption of New Accounting Standards

Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of

FASB Statements No. 87, 88, 106 and 132(R)

In September2006, the Financial AccountingStandards Board (FASB) issued Statementof Financial

Accounting Standards No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and132(R) (FAS 158). FAS158

requires an employer to recognize the funded status of a benefit plan as an asset or liability in its statement

of financial position, measured as the difference between plan assets at fair value and the benefit

obligation, and to recognize as a component of accumulated other changes inequity from nonowner

sources, net of tax, actuarial gains or losses andprior service costs or credits that arise during theperiod

but which are not recognized as components of net periodic benefit cost pursuant to FASB Statement

No. 87, Employers’ Accounting for Pensions (FAS 87), or FASB Statement No. 106, Employers’

Accounting for Postretirement Benefits Other Than Pensions (FAS 106). The provisions of FAS 87 and

FAS 106 continue to apply in measuring plan assets and benefit obligations, as of the date of the fiscal

year-end statement of financial position, and in determining the amount of net periodic benefit cost. The

provisions of FAS 158 were effective for fiscal years ending after December 15, 2006 and are not to be