Travelers 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79

During the second quarter of 2004, a participating co-surety on the specific construction contractor

described above announced that insurance regulators had approved its submittedrun-off plan. Based upon

industry’s knowledge of the co-surety’s run-off plan and the Company’s analysis of its financial condition,

the Company concluded thatit was unlikely to collect the full amount projected to be owed by the co-

surety and established an appropriate level of reserves. In the second quarter of 2005, the Company

reached a settlement with the co-surety whereby the co-surety made a paymentto the Company and was

released from further financial obligations tothe Company in connection with the specific construction

exposure. The settlement payment, coupled with the previously established co-surety reserves,

approximated the Company’s estimate of the co-surety’s share of the bonded losses related to this

exposure.

Interest Expense

Interest expense in 2006 was $38 million higher than in 2005, primarily due to the issuance in

November 2005 of $400 million, 5.50% senior notes due December 1, 2015, and theissuance in June 2006

policyholders for loss sensitive business are insurance contract-related assets, these assets are subject to the

same types of estimation variables as loss reserves.

of $400 million, 6.25% senior notes due June 20, 2016 and $400 million, 6.75% senior notes due June20,

2036. The proceeds from the 2006 debt issuances were used to fund the redemption and maturity in 2006

of certain of the Company’s outstanding debt.

The $50 million increase in interest expense in 2005 over 2004 primarily reflected the impact of a full

year of interest expense on SPC debt assumed in the merger on April 1, 2004. The Company’s debt

outstanding at December 31, 2005 declined by a net $463 million compared with year-end 2004.

Effective Tax Rate

The Company’s effective tax rate on income from continuing operations was 26.5%, 22.8% and 7.3%

in 2006, 2005 and 2004, respectively. The 2006and 2005 effective rate reflected a higher level of pretax

income associated with profitable underwriting performance. The low 2004 effective rate primarily

reflected the impact of nontaxable investment income on a lower level of pretax income.

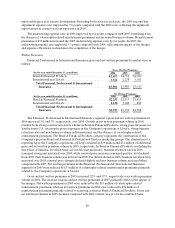

GAAP combined ratios

The consolidated loss and loss adjustment expense ratio of 57.5% in 2006 improved by 14.4 points

compared with 2005, primarily reflecting the decline in catastrophe losses. Catastrophe losses accounted

for 0.5 points of the 2006 loss and loss adjustment expense ratio, compared with a 10.3 point impact in

2005. The 2006 loss and loss adjustment expense ratio included a 1.9 point impact from net favorable prior

year reserve development, whereas the 2005 loss and loss adjustment expense ratio included a 1.6 point

impact from net unfavorable prior year reserve development. The 2006 loss and loss adjustment expense

ratio excluding catastrophe losses and prior year reserve development improved over the 2005 ratio on the

same basis, reflecting improvement in frequency and severity trends in several lines of business. The

underwriting expenseratio for 2006 was 1.2 points higher than the underwriting exp ense ratio in 2005. The

changes primarily reflect the impact of the increase in general and administrative expenses described

previously. In addition, the 2006 ratio was negatively impacted by a decline in National Accounts’ fee

income, a portion of which isaccounted for as a reduction of expenses for purposes of calculating the

expense ratio. The underwriting expense ratio in 2005 also included a 0.4 point impact from reinstatement

premiums and state assessments.

Catastrophe losses accounted for 10.3 points of the 2005 loss and loss adjustment expense ratio,

compared with 4.0points in 2004. The loss and loss adjustment expense ratio in 2005 included a 1.6 point

impact of net unfavorable prior year reserve development, whereas the 2004 ratio included a 12.6 point

impact of net unfavorable prior year reserve development. The2005 loss and loss adjustment expenseratio