Travelers 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

2006 increased 4% over 2005, primarily reflecting growth in Bond & Financial Products and the absence of

catastrophe-related reinstatement premiums.

The $1.30 billion increase in earned premiums in 2005 over 2004 primarily reflected the impact of the

merger, which was partially offset by a significant decline in earned premiums in the Business Insurance

segment’s runoff operations and a decline in certain of Business Insurance’s ongoing operations due to a

lower level of net written premium volume in the last half of 2004 and first half of 2005. Earnedpremiums

in 2005 were reduced by the $121 million of reinstatement premiums related to catastrophe losses. Earned

premiums in 2004 were reduced by $76 million of reinstatement premiums primarily related to reserve

charges recorded in the surety operation. Partially offsetting these factors were the impacts of new business

growth and increased retention in many of the Company’s insurance operations in 2005.

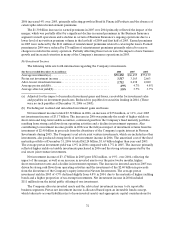

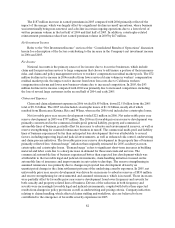

Net Investment Income

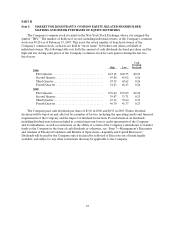

The following table sets forth information regarding the Company’s investments.

(for the year ended December 31, in millions)2006 2005 2004

Average investments(a).......................................... $ 7 1,252 $66,695 $ 5 5,139

Pretax net investment income.................................... 3,517 3,165 2,663

After-tax net investment income .................................. 2,712 2,438 2,020

Average pretaxyield(b). ......................................... 4.9%4.7% 4.8%

Average after-tax yield(b)........................................ 3.8%3.7% 3.7%

(a) Adjusted for the impact of unrealized investment gains and losses, receivables for investment sales

and payables on investment purchases. Reduced for payables for securities lending in 2004. (There

were no such payables at December 31, 2006 or 2005).

(b) Excluding net realized and unrealized investment gains and losses.

Net investment income totaled $3.52 billion in 2006, an increase of $352 million, or 11%, over 2005

net investment income of $3.17 billion. The increase in 2006 was primarily the result of higher yields on

short-term and long-term taxable securities, continued growth in the Company’s fixed maturity portfolio

resulting from strong cash flows from operating activities and a decline in investment expenses. Also

contributing to investment income growth in 2006 was the full-year impact of investment returns from the

investment of $2.40 billion in proceeds from the divestiture of the Company’s equity interest in Nuveen

Investments during 2005. The Company’s real estate joint venture investments, which are included in other

investments, also produced strong levels of net investment income in 2006. The amortized cost of the fixed

maturity portfolio at December 31, 2006 totaled $62.24 billion, $3.63 billion higher than year-end 2005.

The average pretax investment yield was 4.9% in 2006 compared with 4.7% in 2005. The increaseprimarily

reflected higher yields on taxable investments purchased in 2006 and the strong returns generated by the

real estate joint venture investments.

Net investment income of $3.17 billion in 2005 grew $502 million, or 19%, over 2004, reflecting the

impact of the merger, as well as an increase in invested assets over theprior twelve months, higher

short-term interest rates and a decline in investment expenses. The increase in invested assets in 2005 was

driven by strong cash flows from operating activities and the investment of the $2.40 billion in proceeds

from the divestiture of the Company’s equity interest in Nuveen Investments. The average pretax

investment yield in2005 of 4.7% declined slightly from 4.8% in 2004, due to the maturity of higher yielding

bonds and a higher proportion of tax-exempt investments. Net investment income in 2004 included

$111 million from the initial public offering of one investment.

The Company allocates invested assets and the related net investment income to its reportable

business segments. Pretax net investment income is allocated based upon an investable funds concept,

which takes into account liabilities (netof non-investedassets) and appropriate capital considerations for