Travelers 2006 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

195

7. DEBT (Continued)

scheduled payments of principal and intereston the senior notes to be redeemed (exclusive of interest

accrued to the date of redemption) discounted to the date of redemption on a semiannual basis (assuming

a 360-day year consisting of twelve 30-day months) at the then current treasury rate plus 20 basis points for

the 6.25% senior unsecured notes due June 20, 2016 and 25 basis points for the 6.75% senior unsecured

notes due June 20, 2036. Net proceeds from the issuances (after original issuediscount and expenses)

totaled approximately $786 million.

2006 Debt Redemptions and Maturities—In November 2006, the Company redeemed $593 million of

7.60% subordinated debentures originally issued in 2001 and due October 15, 2050. The debentures were

redeemable by the Company on or after November 13, 2006. In November 2001, St. Paul Capital Trust I, a

business trust, issued $575 million of preferred securities, the proceeds of which, along with $18 million in

capital provided by the Company, wereused to purchase the subordinated debentures issued by the

Company. Upon the Company’s redemption of its subordinated debentures in November 2006, St. Paul

Capital Trust I in turn used the proceeds to redeem its preferred securities. St. Paul Capital Trust I was

then liquidated, and the Company received an $18million distribution of capital .The Company recorded a

$42 million pretax gain on the redemption of the subordinated debentures, representing the remaining

unamortized fair value adjustment recorded at the merger date. The gain was recorded in “Other

revenues” on the Consolidated Statement of Income. On November 15, 2006, the Company’s $150 million,

6.75% senior notes matured. A portion of the net proceeds from the June 2006 debt issuances described

above was also used to fund this maturity.

2005 Equity Unit Transaction —In 2002, the Company issued 8.9 millionequity units, each of which

initially consisted of a forwardpurchase contract for the Company’s common stock, and an unsecured $50

senior note of the Company maturing in August 2007. In May 2005, the Company successfully remarketed

the $442 million senior note component of the equity units, resetting the annual interest rate from 5.25%

to 5.01%. The forward purchase contracts, which required the investor to purchase, for $50, a variable

number of shares of the Company’s common stock based on a specific formula, settled in August 2005. On

the settlement date, the Company issued 15.2 million common shares and received total proceeds of $442

million.

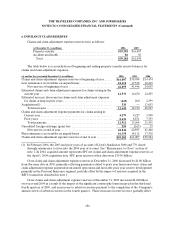

Description of Debt

Commercial Paper —The Company maintains an $800 million commercial paper program with $1

billion of back-up liquidity, consisting entirely of a bank credit agreement. Interest rates on commercial

paper issued in 2006 ranged from 4.5% to 5.4%, and in 2005 ranged from 2.3% to 4.4%.

Medium-Term Notes—The medium-term notes outstanding at December 31, 2006 bear interest rates

ranging from 6.38% to 7.42%, with a weighted average rate of6.71%. Maturity dates on remaining notes

outstanding at December 31, 2006 range from 2007 to 2010. During 2006 and 2005, medium-term notes

having a par value of $56 million and $99 million, respectively, matured.

Senior Notes—The Company’s various senior debt issues are unsecured obligations that rank equally

with one another. Interest payments are generally made semi-annually, except for the 5.01% senior notes,

for which interest payments are made quarterly. The Company generally may redeem some or all of the

notes prior to maturity in accordance with terms unique to each debt instrument.