Travelers 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

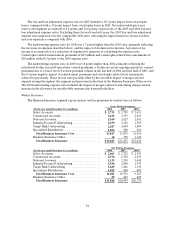

In Business Insurance Core operations, gross written premiums in 2006 were down slightly from 2005.

Net written premiums in 2006, however, increased slightly over 2005. The disparity between gross andnet

written premium growth rates in 2006 was primarily due to a change in the structure of reinsurance

coverage in the Company’s Discover Re subsidiary in National Accounts that resulted in a decline in ceded

premiums. For purposes of comparison between 2006 and 2005 net written premium volume, the impact of

a higher level of ceded premiums for property catastrophe reinsurance in 2006 was virtually equivalent to

the impact of the $67 million of catastrophe-related reinstatement premiums in 2005. Net writtenpremium

growth in Business Insurance Core operations in 2006 was primarily concentrated in Target Risk

Underwriting and Industry-Focused Underwriting, driven by continued strong business retention rates,

renewal price increases and higher new business volume throughout the majority of businesses comprising

thesemarkets. The decline in National Accounts’ net written premiums primarily reflected a reduction in

premiums related to favorable loss experience on business priced on a loss-sensitive basis and lower new

business volume, partially offset by the decline in cededpremiums at Discover Re due to a change in the

structure of reinsurance coverage. In Business Insurance Other operations, gross andnet written

premiums were down significantly from the comparable 2005 totals, reflecting the sale of the Personal

Catastrophe Risk operation in November 2005 and the intentional non-renewal of business in the runoff

operations comprising this category.

In 2005, Business Insurance Core gross and net written premiums in 2005 increased 10% over the

comparable 2004 totals, primarily reflecting the impact of the merger. However, 2005 written premium

volume in Business Insurance Core operations declined when compared with 2004 on a pro forma

combined basis, reflecting increased competition in the marketplace and the repositioning of the

Construction book of business. Throughout Business Insurance Core operations (excluding Construction,

due to the impact of repositioning the book of business), business retention levels increased over 2004,

renewalpricing was flat with 2004, and new business levels improved over 2004. Net written premiums in

2005 for Business Insurance Core operations were reduced by $67 million of catastrophe-related

reinstatement premiums. In Business Insurance Other operations, gross and net written premiums

declined 66% and 59%, respectively, from the comparable 2004 totals, primarily reflecting the intentional

non-renewal of business in the runoff operations comprising this category.

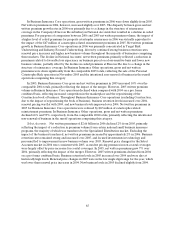

Select Accounts. Net written premiums of $2.66 billion in 2006 declined 2% from 2005, primarily

reflecting the impact of a reduction in premium volume from certain national small business insurance

programs, the majority of which was transferred to the Specialized Distribution market. Excluding the

impact of the business transferred, net written premiums increased by approximately 2% in 2006. Business

retention rates remained strong and increased over 2005, and focused investments in technology and

personnel led to improvement in newbusiness volume over 2005. Renewal price changes for the Select

Accounts market in 2006 were consistent with 2005, as modest pricing pressuresin non-coastal coverages

were largely offset by price increases for coastal coverages. In2005, net written premiums grew 7% over

2004, primarily reflecting the impact of the merger. However, 2005 written premiums declined from 2004

on a pro forma combined basis. Business retention levels in 2005 increased over 2004 and were also at

historically high levels. Renewal price changes in 2005 were inthe low single digit range for the year, which

was lower than renewal price increases in 2004. New business levels in 2005 declined slightly from 2004.