Travelers 2006 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

198

7. DEBT (Continued)

Shelf Registration

In December 2005, the Company filed with the Securities and Exchange Commission a shelf

registration statement for the potential offering and sale of securities. The Company may offer these

securities from time to time at prices and on other terms to be determined at the time of offering. During

2006, the Company issued senior debt with a par value of $800 million (as described above) under this shelf

registration statement.

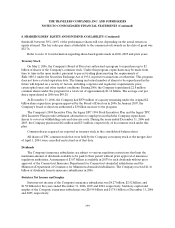

8. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY

Preferred Stock

The Company’s preferred shareholders’ equity represents the par value of preferred shares

outstanding that the Company assumed in the merger related to The St. Paul Companies, Inc. Stock

Ownership Plan (SOP) Trust, less theremaining principal balance on the SOP Trust debt. The SOP Trust

borrowed funds from a U.S. underwriting subsidiary to finance the purchase of the preferred shares, and

the Company guaranteed the SOP debt. The final payment on theSOP debt was madein January 2005.

The SOP Trust may at any time convert any or all of the preferred shares into shares of the

Company’s common stock at a rate of eight shares of common stock for each preferred share. The Board

of Directors has reserved a sufficient number of authorized common shares to satisfy the conversion of all

preferred shares issued to the SOP Trust and the redemption of preferred shares to meet employee

distribution requirements. Upon the redemption of preferred shares, the Companywill issue shares of

common stock to the trust to fulfill the redemption obligations. See note 12. Holders of thepreferred stock

have a preference upon liquidation, dissolution or winding up of the Company of $100 per share.

In September 2005, the SOP was merged intothe St. Paul Travelers 401(k) Savings Plan (the

401(k) Savings Plan). See note 12.

Common Stock

The Company is governed by the Minnesota Business Corporation Act. All authorized shares of

voting common stock have no par value. Shares of common stock reacquired are consideredauthorized

and unissued shares. The number of authorized shares of the company is 1.75 billion. The articles of

incorporation allow the Company to issue five million undesignated shares. The Board of Directors may

designate thetype of shares and set the terms thereof. The Board designated 1,450,000 shares as Series B

Convertible Preferred Stock in connection with the 401(k) Savings Plan.

On February 6, 2007, the Company, under The Travelers2004Stock Incentive Plan, granted 1,678,215

common stock awards in the form of restricted stock units, deferred stock and performance share awards

to participating officers and other key employees. The restricted stock units and deferred stock awards,

totaling 1,097,720shares, generally vest in fullafter a three-year period from date of grant. The

performance share awards, totaling 580,495 target shares, represent shareswhich the recipient may earn

upon the Company’s attainment of certain performance goals. The performance goals are based upon the

Company’s adjusted returnonequity over a three-year performanceperiod. Vesting of any performance

shares is contingent upon the Company attaining the relevant performance period minimum threshold

return on equity. If the performance period return on equity is below the minimum threshold, none of the

shares will vest; if performance meets or exceeds the minimum performance