Travelers 2006 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285

|

|

135

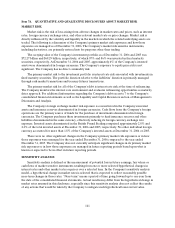

International and other book of business risk factors

Changes in policy provisions (e.g., deductibles, policy limits, endorsements, “claims made” language)

Changes in underwriting standards

Product mix (e.g., size of account, industries insured, jurisdiction mix)

Unanticipated changes in risk factors can affect reserves. As an indicator of the causal effect that a

change in one or more risk factors could have on reserves for International and other (excluding asbestos

and environmental), a 1% increase (decrease) in incremental paid loss development for each future

calendar year could result in a 1.3% increase (decrease) in loss reserves. International and other reserves

(excluding asbestos and environmental) represent approximately 10% of the Company’s total loss reserves.

International and other represents a combination of different product lines, some of which are in

runoff. Comparative historical information is not available for international product lines as insurers

domiciled outside of the U.S. do not file U.S. statutory reports. Comparative historical information on

runoff business is not indicative of reasonably possible one-year changes in the reserve estimate for this

mix of runoff business. Accordingly, the Company has not included comparative analyses for International

and other.

Reinsurance Recoverables

Amounts recoverable from reinsurers are estimated in a manner consistent with the associated claim

liability. The Company evaluates and monitors the financial condition of its reinsurers under voluntary

reinsurance arrangements to minimize its exposure to significant losses from reinsurer insolvencies. In

addition, in the ordinary course of business, the Company becomes involved in coverage disputes with its

reinsurers. Some of these disputes could result in lawsuits and arbitrations brought by or against the

reinsurers to determine the Company’s rights and obligations under the various reinsurance agreements.

The Company employs dedicated specialists and aggressive strategies to manage reinsurance collections

and disputes.

The Company reports its reinsurance recoverables net of an allowance for estimated uncollectible

reinsurance recoverables. The allowance is basedupon the Company’s ongoing review of amounts

outstanding, length of collection periods, changes in reinsurer credit standing, disputes, applicable

coverage defenses, and other relevant factors. Accordingly, the establishment of reinsurance recoverables

and the related allowance for uncollectible reinsurance recoverables is also an inherently uncertain process

involving estimates. Changes in these estimates could result in additional income statement charges. The

allowance for uncollectible reinsurance at December 31, 2006 declined by $31 million from the same date

in 2005.

Recoverables attributable to structured settlements relate primarily to personal injury claims, for

which the Company has purchased annuities and remains contingently liable in theevent of a default by

the companies issuing the annuities. Recoverables attributable to mandatory pools and associations relate

primarily to workers’ compensation service business and have the obligation of the participating insurance

companies on a joint and several basis supporting these cessions.