Travelers 2006 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

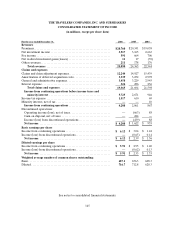

See notes to consolidated financial statements.

148

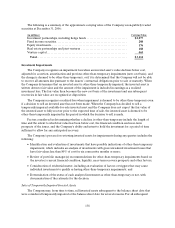

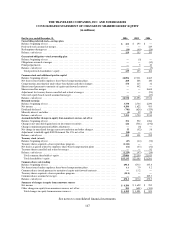

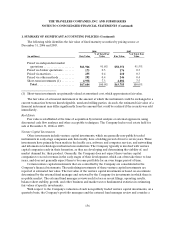

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

For the year ended December 31, 2006 2005 2004

Cash flows from operating activities

Net income........................................................................ $ 4,208 $ 1,622 $ 955

Adjustmentsto reconcile net income tonet cash provided by operating activities:

Loss (income) from d iscontinued opera tions, net of tax..................................... — 439 (88)

Netrealized investment (gains) losses.................................................. (11)(17 ) 39

Depreciation and amortization....................................................... 808 691 522

Deferred federal income tax (benefit) on continuing operations ............................... 521 500 (280)

Amortization of deferred policy acqui sition costs. ......................................... 3,339 3,252 2,978

Premiums receivable.............................................................. (57)77 320

Reinsurance recove rables .......................................................... 1,998 (520 ) 584

Deferred acquisition costs.......................................................... (3,427)(3,220 ) (2,948)

Claims and claim adjustment expense reserves ........................................... (2,565)2,032 3,473

Unearned premiumreserves........................................................ 300 (383 ) (42)

Trading account activities.......................................................... 6 6 20

Gain onredemption of subordinated deb entures. ......................................... (42) — —

Excess tax benefits from share-based payment arrangements................................. (16) — —

Other. ........................................................................ (288)(890 ) (467)

Net cashprovided by operating activities of continuing operations ........................... 4,774 3,589 5,066

Net cashprovided by operating activities of discontinued operations.......................... — 24 175

Net cashprovided by operating activities.............................................. 4,774 3,613 5,241

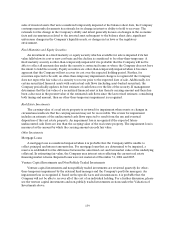

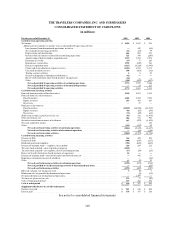

Cash flows from investing activities

Proceedsfrom maturities offixed maturities................................................ 5,810 4,952 5,621

Proceeds from sales of investments:

Fixed maturities ................................................................... 4,401 5,192 7,945

Equity securities. .................................................................. 285 403 265

Real estate. ...................................................................... — 37 —

Purchases of investments:

Fixed maturities ................................................................... (13,845)(16,046 ) (16,522)

Equity securities. .................................................................. (83)(63 ) (94)

Real estate. ...................................................................... (75)(49 ) (22)

Short-term securities, (purchases) sales, net. ................................................ (85)142 (1,913)

Other investments, net................................................................ 406 724 964

Securities transactions incourse of settlement............................................... 447 (595 ) (1,108)

Net cashacquired in merger............................................................ — — 148

Other............................................................................ (325)(132 ) 69

Net cash used in investing activities of continuing operations ............................... (3,064)(5,435 ) (4,647)

Net cash used in investing activities of discontinued operations ............................. — (20 ) (139)

Net cash used in investing activities ................................................. (3,064)(5,455 ) (4,786)

Cash flows from financing activities

Issuance of debt ..................................................................... 786 400 302

Payment of debt..................................................................... (806)(815 ) (227)

Dividends paidtoshareholders.......................................................... (702)(628 ) (642)

Issuance of common stock—- employee share options......................................... 216 164 111

Treasury stock acquired—share repurchase program .......................................... (1,103)— —

Treasury stock acquired—net employee share-based compensation. ............................... (17)(33 ) (23)

Excess taxbenefits from share-based payment arrangements..................................... 16 — —

Issuance of common stock—maturity of equity unit forward contracts.............................. — 442

—

Repurchase of minority interest of subsidiary................................................ — — (76)

Other............................................................................ 17 (3 ) 39

Net cash used in financing activities of continuing operations............................... (1,593)(473 ) (516)

Net cashprovided by (used in) financing activities of discontinued operations................... — 4 (24)

Net cash used in financing activities ................................................. (1,593)(469 ) (540)

Effect of exchangerate changes on cash.................................................... 5 (5 ) 7

Elimination of cash provided by discontinued operations ....................................... — (8 ) (12)

Net proceeds from sale of discontinued operations. ........................................... — 2,399 —

Net increase (decrease) incash.......................................................... 122 75 (90)

Cash at beginning of period ............................................................ 337 262 352

Cash at end of period................................................................. $ 459 $ 337 $ 262

Supplemental disclosure of cash flow information

Income taxes paid ................................................................... $ 861 $ 826 $ 606

Interest paid....................................................................... $ 358 $ 337 $ 286