Travelers 2006 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

205

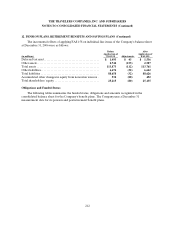

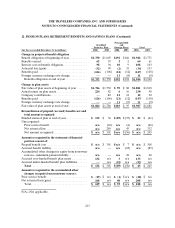

11. SHARE-BASED INCENTIVE COMPENSATION (Continued)

Plan for Non-Employee Directors that the Board adopted after the merger and is vested upon grant. The

annual deferred stock awards vest one year after the date of award. Any of the deferredstock awards may

accumulate until distribution at a future date or upon termination of a director’s service. The shares of the

Company’s common stock issued under the 2004 Director Compensation Program, including shares of

deferred stock, are awarded under the 2004 Incentive Plan.

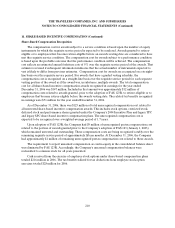

Stock Option Awards

Stock option awards granted to eligible officers and key employees weregrantedhaving a ten-year

term. Prior toJanuary 1, 2007, stock options were granted with an exercise price equal to the fair market

value of the Company’s common stock on the day preceding the date of grant. Beginning January 1, 2007,

all stock options are granted with an exercise price equal to the fair market value of the Company’s

common stock on the date of grant. The stock options granted generally vest upon meeting certain years of

service criteria. Except as the Compensation Committee of the Board may allow in the future, stock

options cannot be sold or transferred by the participant. The vesting terms for stock options granted under

the 2004 Incentive Plan and the legacy TPC and legacy SPC plans are generally as follows:

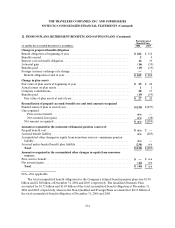

Period Option granted Option AwardVesting terms

2006.....................Options vest at end of 3-year period (cliff vest)

April 2004 through 2005 ...Options vest over 4-year period, 50% on 2 nd anniversary of the date of

grant, and 25% of the option shares vest on each of the 3 rd and 4th

anniversaries of the grant date. Certain 2005 special option shares vest

50% on each of the 4th and 5th anniversaries of the grant date.

Prior to April 2004 ........Options vest over 4-year period, 25% each year on the anniversary of the

grant date; or options vest over 5-year period, 20% each year on the

anniversary of the grant date.

In addition to the regular stock option awards described above, certain stock option awards that were

granted under the legacy share-based incentive plans of TPC and SPC permit an employeeexercising an

option to be granted a new option (a reload option) at an exercise price equal to the fair market value of

the Company common stock on the day preceding the reload grant. The legacy TPC reload option is

permitted on the stock option awards granted prior to January 2003 at an amount equal to the number of

shares of the common stock used to satisfy both the exercise price and withholding taxesdue upon exercise

of an option and vest six months after the grant date and areexercisable for the remaining term of the

related original option. The legacy SPC reload option is permitted onstock option awards granted between

February 2002 and November 2003 in an amount equal to the number of shares of the common stock used

to satisfy both the exercise price and withholding taxes due upon exercise of an option and vest one year

after the grant date and are exercisable for the remaining term of the related original option.

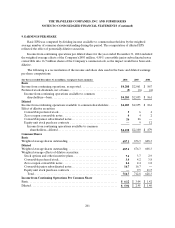

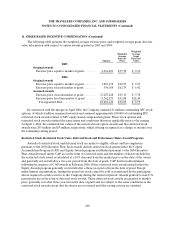

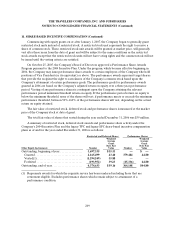

The fair value of each option award is estimated on the date of grant by application of a variation of

the Black-Scholes option pricing model using the assumptions noted in the following table. The expected

term of newly granted stock options is the time to vest plus half the remaining time to expiration. This

considers the vesting restriction and represents an evenpattern of exercise behavior over the remaining

term. Reload options are exercisable for the remaining term of the original option and therefore would