Travelers 2006 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

175

3. INVESTMENTS (Continued)

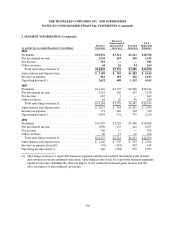

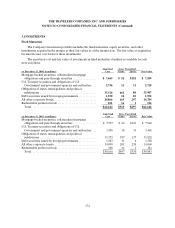

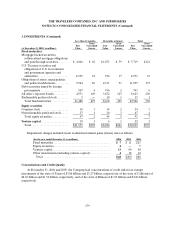

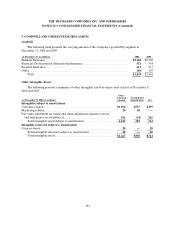

The amortized cost and fair value of fixed maturities by contractual maturity follow. Actual maturities

will differ from contractual maturities because borrowers may have the right to call or prepay obligations

with or without call or prepayment penalties.

(at December 31, 2006, in millions)

Amortized

Cost

Fair

Value

Due in one year or less....................................$ 3,484 $ 3,477

Due after1 yearthrough 5 years............................13,161 13,173

Due after5 years through 10years ..........................16,950 16,999

Due after10 years........................................20,984 21,428

54,579 55,077

Mortgage-backed securities................................7,665 7,589

Total .................................................$ 62,244$ 6 2,666

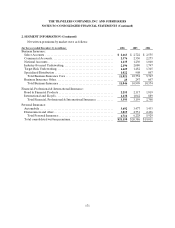

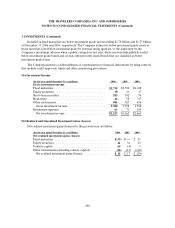

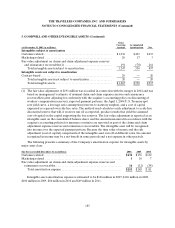

The Company makes investments in collateralized mortgage obligations (CMOs) that typically have

high credit quality, offer good liquidity and are expected to provide an advantage in yield compared to U.S.

Treasury securities. The Company’s investment strategy is to purchase CMO tranches which offer the most

favorable return given the risks involved. One significant risk evaluated is prepayment sensitivity. The

Company does not purchase residual interests in CMOs.

At December 31, 2006 and 2005, the Company held CMOs classified as available for sale with a fair

value of $3.56 billion and $3.43 billion, respectively (excluding Commercial Mortgage-Backed Securities of

$1.07 billion and $1.16 billion, respectively). Approximately 36% and 43% of the Company’s CMO

holdings are guaranteed byor fully collateralized by securities issued by GNMA, FNMA or FHLMC at

December 31, 2006 and 2005, respectively. In addition, the Company held $4.36 billion and $4.83 billion of

GNMA, FNMA, FHLMC or FHA mortgage-backed pass-through securities classified as available for sale

at December 31, 2006 and 2005, respectively. Virtually all of these securities are rated Aaa.

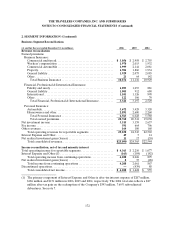

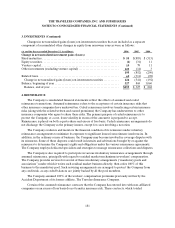

At December 31, 2006 and 2005, the Company had$1.67 billion and $2.67 billion, respectively, of

securities on loan as part of a tri-party lending agreement. At December 31, 2006 and 2005, respectively,

$0 and $119 million of securities were subject to dollar-roll repurchase agreements.

Proceeds from sales of fixed maturities classified as available for sale were $4.40 billion, $5.19 billion

and $7.95 billion in 2006, 2005 and2004, respectively. Gross gains of $95 million, $129million and

$202 million and gross losses of $121 million, $118 million and $126 million were realized on thosesales in

2006, 2005 and 2004, respectively.

At December 31, 2006 and 2005, the Company’s insurance subsidiaries had $4.44 billion and

$4.00 billion, respectively, of securities ondeposit at financial institutions in certain states pursuant to the

respective states’ insurance regulatory requirements.

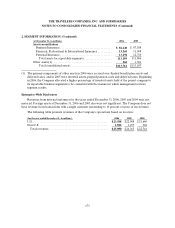

The Company has certain subsidiaries that are required to hold investments in trust in conjunction

with its runoff reinsurance businesses. These trust funds had a fair value of$298 million and$374 million

at December 31, 2006 and 2005, respectively. Additionally, these subsidiaries have funds deposited with

third parties to be used as collateral to secure various liabilities on behalf of insureds, cedants and other

creditors. These funds had a fair value of $43 million at both December 31, 2006 and 2005. The Company

alsohad $253 million of other investments pledged as collateral securing outstanding letters of credit.