Travelers 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

The specific circumstances that led to the impairments described above did not materially impact

other individual investments held during2006, 2005 or 2004. The Company continually evaluates current

developments in the market that have the potential to affect the valuation of the Company’s investments.

At December 31, 2006, the Company had no fixed maturities or equity securities available for sale for

which fair value was less than 80% of amortized cost or cost, respectively.

At December 31, 2006, non-investment grade securities comprised 2.9% of the Company’s fixed

income investment portfolio. Included in those categories at December 31, 2006 were securities in an

unrealized loss position that, in the aggregate,had an amortized cost of $599 million and a fair value of

$581 million, resulting in a net pretax unrealized investment loss of $18 million. These securities in an

unrealized loss position represented less than 1% of the total amortized cost and less than1% of the fair

value of the fixed income portfolio at December 31, 2006, and accounted for 4% of the total pretax

unrealized investment loss in the fixed income portfolio.

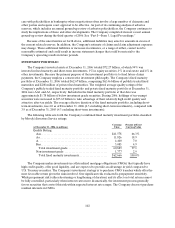

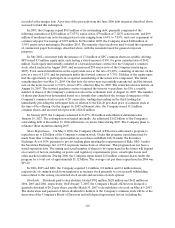

Following are the pretax realized losses on investments sold during the year ended

December 31, 2006:

(in millions) Loss Fair Value

Fixed maturities.............................................$ 121 $ 2,950

Equity securities. ............................................ 6 69

Other...................................................... 1 1

Total. ...................................................... $ 128 $ 3,020

Resulting purchases and sales of investments are basedon cash requirements, the characteristics of

the insurance liabilities and current marketconditions. The Company identifies investments to be sold to

achieve its primary investment goals of assuring the Company’s ability to meet policyholder obligations as

well as to optimize investment returns, given these obligations.

REINSURANCE RECOVERABLES

Ceded reinsurance involves credit risk, except with regard to mandatory pools, and is generally subject

to aggregate loss limits. Although the reinsurer is liable to the Company to the extent of the reinsurance

ceded, the Company remains liable as the direct insurer on all risks reinsured. Reinsurance recoverables

are reported after reductions for known insolvencies and after allowances for uncollectible amounts. The

Company also holds collateral, including trust agreements, escrow funds and letters of credit, under certain

reinsurance agreements. The Company monitors the financial condition of reinsurers on an ongoing basis

and reviews its reinsurance arrangements periodically. Reinsurers are selected based on their financial

condition, business practices and the price of their product offerings.

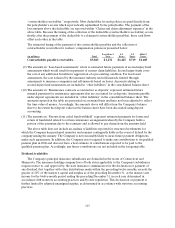

The following presents the Company’s topfive reinsurer groups, by reinsurance recoverables at

December 31, 2006 (in millions):

Reinsurer Group

Reinsurance

Recoverables A.M. Best Rating of Group’s Predominant Reinsurer

Swiss Re Group .......................... $1,478 A+ secondhighest of 16 ratings

Munich Re Group........................ 1,125A third highestof16 ratings

Berkshire Hathaway Group................ 900A++ highest of16 ratings

American International Group............. 718A+secondhighest of 16 ratings

XL Capital Group ........................ 552A+secondhighest of 16 ratings

At December 31, 2006, $3.30 billion of reinsurance recoverables were collateralized by letters of

credit, trust agreements and escrow funds.