Travelers 2006 Annual Report Download - page 163

Download and view the complete annual report

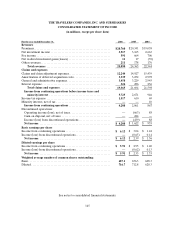

Please find page 163 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

151

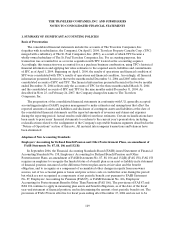

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

which cost is recognized for awards granted to those who become retirement-eligible before the vesting

date will be from the grant date to the retirement-eligible date rather than to the vesting date. This

guidance is to be applied prospectively tonew or modified awards granted upon adoption of FAS 123R.

The adoption of FAS 123R at January 1, 2006 using modified prospective application didnot have a

materialeffect on the Company’s results of operations, financial condition or liquidity. See note 11.

Accounting Changes and Error Corrections

In May 2005, the FASB issued Statementof Financial Accounting Standards No. 154, Accounting

Changes and Error Corrections (FAS154), which replaced APB Opinion No. 20, Accounting Changes, and

FASB Statement of Financial Accounting Standards No. 3, Reporting Changes in Interim Financial

Statements. FAS 154 changed the requirements for the accounting for and reporting of a change in

accounting principle. It requires retrospective application to prior period financial statements of voluntary

changes in accounting principle and changes required by new accounting standardswhen the standarddoes

not include specific transition provisions, unless it is impracticable to do so. FAS154 was effective for

accounting changes and corrections of errors in fiscal years beginning after December 15, 2005. Early

adoption was permitted for accounting changes and corrections of errors made in fiscal years beginning

after June 1, 2005. It did not change the transition provisions of any existing accounting pronouncements,

including those that were in a transition phase as of December 15, 2005. The adoption of FAS 154 at

January 1, 2006 had no effect on the Company’s results of operations, financial condition or liquidity.

The Meaningof Other-Than-Temporary Impairment and Its Application to Certain Investments

In November 2005, the FASB issued FASB Staff Position (FSP) FAS 115-1 and FAS124-1, The

Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments. The FSP

addresses the determination as to when an investment is considered impaired, whether that impairmentis

other-than-temporary, and the measurement of animpairment loss. It requires the establishmentof a new

cost basis subsequent to the recognition of an other-than-temporary impairment and certain disclosures

about unrealized losses that have not been recognized as other-than-temporary impairments. The FSP is

effective for reporting periods beginning after December 15, 2005. The Company had previously

implemented these requirements. Therefore, the adoption of the FSP had no effect on the Company’s

results of operations, financial condition or liquidity.

American Jobs Creation Act—Repatriation of Foreign Earnings

On October 22, 2004, Congress enacted theAmerican Jobs Creation Act (AJCA) which provided a

temporary incentive for U.S. corporations to repatriate earnings previously reinvested in foreign

subsidiaries to obtain an 85% dividends received deduction. InDecember 2004, FSP No. 109-2, Accounting

and Disclosure Guidance for the Foreign Earnings Repatriation Provision within the American Jobs Creation

Act of 2004 was issued. This FSP provides accounting and disclosure guidance on how to apply FASB

Statement ofFinancial AccountingStandards No. 109, Accounting for Income Taxes, to the repatriation

provision of the AJCA. In the fourth quarter of 2005, the Company approved a Domestic Reinvestment

Plan in accordance with the AJCA to repatriate foreignearnings prior to December 31, 2005. In

December 2005, the Company repatriated $158 million of cumulative foreign earnings invested outside of