Travelers 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

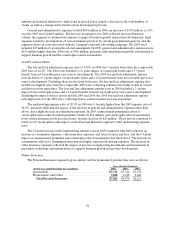

89

unfavorable prior year reserve development. Excluding both factors in each year, the 2005 loss and loss

adjustment expense ratio improved by 7.6 points compared with the 2004 ratio, reflecting the significant

improvement in current year loss experience in 2005.

The underwriting expense ratio in 2006 improved by 0.4 points compared with 2005, benefiting from

the absence of catastrophe-related reinstatement premiums and increased business volume. Reinstatement

premiums of $33 million increased the 2005 underwriting expense ratio by 0.4 points. In 2005, the

underwriting expense ratio improved 1.3 points compared with 2004, reflecting the impact of the merger

and expense efficiencies realized since the completion of the merger.

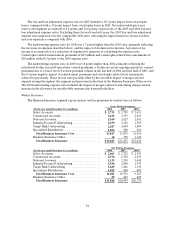

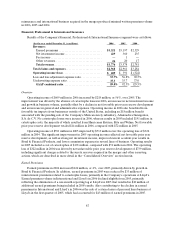

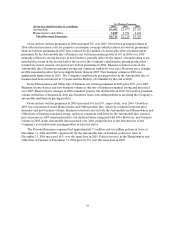

Written Premiums

Financial, Professional & International Insurance gross and net written premiums by market were as

follows:

Gross Written Premiums

(for the year ended December 31, in millions) 2006 2005 2004

Bond & FinancialProducts.......................... $2,657 $2,531 $ 2 ,102

International and Lloyd’s ............................ 1,324 1,278 1,011

Total Financial, Professional & International

Insurance..................................... $3,981 $3,809 $ 3 ,113

Net Written Premiums

(for the year ended December 31, in millions) 2006 2005 200 4

Bond & FinancialProducts........................... $2,255 $2,117 $1,819

International and Lloyd’s ............................. 1,138 1,042 889

Total Financial, Professional & International

Insurance...................................... $3,393 $3,159 $2,708

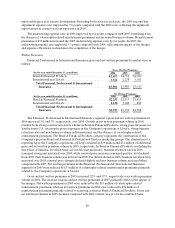

The Financial, Professional & International Insurance segment’s gross and net written premiums in

2006 increased 5% and 7%, respectively, over 2005. Growth in net written premium volume in 2006

resulted from strong construction surety volume in Bond& Financial Products, strong price increases for

Southeastern U.S. catastrophe-prone exposures in the Company’s operations at Lloyd’s, strong business

retention rates and new business volume in International, and the absence of catastrophe-related

reinstatement premiums. The Bond & Financial Products category represents the combination of the

Company’s previous Bond and Financial & Professional Services marketing groups. The elimination of a

reporting lagat the Company’s operations at Lloyd’s resulted in$39 million and $31 million of additional

gross and net written premium volume in 2005, respectively. In Bond & Financial Products (excluding the

surety line of business, for which these arenot relevant measures), business retention rates in 2006

remained strong and increased over 2005, while renewal price increases remained positive, but declined

from 2005.New business volume was down from 2005. For International in 2006, business retention rates

increased over 2005, renewal price changes declinedslightly and new business volume increased when

compared with 2005. Net written premiums in the Financial, Professional& International Insurance

segment for 2005 were reduced by $33 million of catastrophe-related reinstatement premiums, primarily

related to the Company’s operations at Lloyd’s.

Gross and net written premiums in 2005 increased 22% and 17%, respectively, over written premium

volume in 2004. The increase ingross and net written premiums in 2005 primarily reflected the impact of

the merger. Net written premiums in 2005 were reduced by the$33 million of catastrophe-related

reinstatement premiums, whereas net written premiums in2004 were reduced by $76 million of

reinstatement premiums primarily related to reserving actions in Bond & Financial Products. Gross and

net written premiums in 2005 declined compared with 2004 volume on a pro forma combined basis.