Travelers 2006 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

157

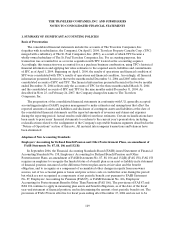

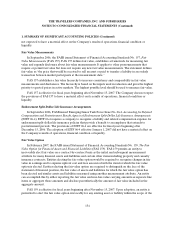

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

variety of factors in determining the valuation of the investments and the potential for other-than-

temporary impairments. Factors considered include the following:

•The investee’s most recent financing events;

•An analysis of whether a fundamental deterioration or improvement has occurred;

•Whether the investee’s progress has been substantially more or less than expected;

•Whether or not the valuations have improved ordeclined significantly in the investee’s market

sector;

•Whether or not the external fund manager and the Company believe it is probable that the investee

will need financing within six months at a lower price than our carrying value; and

•Whether or not the Company has the ability and intent to hold the investment for a period of time

sufficient to allow for recovery, enabling it to receive value equal to or greater than our cost.

The quarterly valuation procedures described above are in addition to the portfolio managers’

ongoing responsibility to frequently monitor developments affecting those invested assets, paying

particular attention to events that might give rise to impairment write-downs.

Non-Publicly Traded Investments

The Company’s investment portfolio includes non-publicly traded investments, such as venture capital

investments (as discussed above), private equity limited partnerships, joint ventures, other limited

partnerships, and certain fixed income securities. The Company uses the equity method of accounting for

joint ventures, limited partnerships and certain private equity securities. Certain other private equity

investments, including venture capital investments are reported at estimated fair value.These non-publicly

traded securities are valued based on factors such as management judgment, recent financial information

and other market data.

Investment Impairments

The Company recognizes an impairment loss when an invested asset’s value declines below cost,

adjusted for accretion, amortization and previous other-than-temporary impairments (new cost basis), and

the change is deemed tobeother-than-temporary, or if it is determined that the Company will not be able

to recover all amounts due pursuant to the issuers’ contractual obligations prior to sale or maturity. When

the Company determines that an invested asset is other-than-temporarily impaired, the invested asset is

written down to fair value and the amount of the impairment is included inearnings as a realized

investment loss. The fair value then becomes the newcost basis of the investment and any subsequent

recoveries in fair value are recognized at disposition.

The Company recognizes a realized loss when impairment is deemed to be other-than-temporary even

if a decision to sell an invested asset has not been made. When theCompany has decided to sell a

temporarily impaired available-for-sale invested asset and the Company does not expect the fair value of

the invested asset to fully recover prior to the expected time of sale, the invested asset is deemed to be

other-than-temporarily impaired in the period in which the decision to sell is made.

Factors considered in determining whether a decline is other-than-temporary include the length of

time and the extent to which fair value has been below cost, the financial condition andnear-term

prospects of the issuer, and the Company’s ability and intent to hold the investment for a period of time

sufficient to allow for any anticipated recovery.