Travelers 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.88

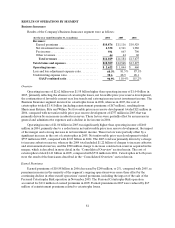

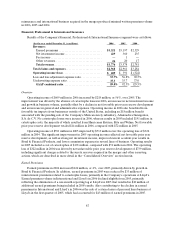

Earned premiums in 2005 increased $668 million, or 26%, over2004, primarily reflecting the impact

of the merger. Earned premiums in 2005 were reduced by $33 million in catastrophe-related reinstatement

premiums. Earned premiums in 2005 also reflected the inclusion of one additional month of premium

volume to eliminate a reporting lag at the Company’s operations at Lloyd’s, the impact of which was

partially offset by the sale of certain classes of personal insurance business at those Lloyd’s operations.

Earned premiums in 2004 were reduced by $76 million of reinstatement premiums primarily related to a

reserve charge inBond & Financial Products.

Net Investment Income

Refer to the “Net Investment Income” section of the “Consolidated Results of Operations” discussion

herein for a description of the factors contributing to the increase in the Company’s net investment income

in 2006 and 2005.

Claims and Expenses

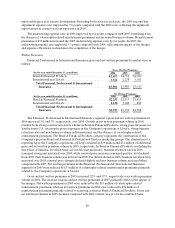

Claims and claims adjustment expenses in 2006 totaled $1.79 billion, compared with $1.82 billion

during the same period of 2005. The 2006 total included no catastrophe losses and $14 million of net

favorable prior year reserve development, whereas the2005 total included $158 million of catastrophe

losses and $72 million of net favorable prior year reserve development. Net favorable prior year reserve

developmentin2005 was attributable to the better than anticipated favorable impact from changes in

underwriting and pricing strategies for International property-related exposures.

Claim and claim adjustment expenses totaled $1.82 billion in 2005, down significantly from the 2004

total of $2.35 billion. The 2005 total included $158 million of catastrophe losses, compared with $40 million

of catastrophe costs recorded in 2004. Catastrophe losses in both periods were driven by the hurricanes

described previously. Net favorable prior year reserve development in 2005 of $72 million was driven by

International. Net unfavorable prior year reserve development totaled $739 million in 2004, which

included the $300 million charge to increase the estimate of the acquired net surety reserves in Bond &

Financial Products, and the $252 million charge relatedto the financial condition of a specific construction

contractor, both of which are described in moredetail in the “Consolidated Overview” section herein.

Results in 2004 also reflected a $60 million reserve increase related to the commutation of agreements

with a major reinsurer, a charge to increase the allowance for estimated uncollectible amounts due from a

co-surety on a specific construction contractor claim, and increased current year loss ratios on portions of

the Bond & Financial Products book of business.

General and administrative expenses in 2006 totaled $536 million, an increase of 5% over 2005. The

increase in 2006 primarily reflected the segment’s expenditures to support business growth and the

segment’s share of costs associated with the Company’s national advertising campaign and legal expenses

related to investigations of various business practices by certain governmental agencies. General and

administrative expenses in 2005 totaled $509 million, an increase of 26% over the 2004 total of $405

million which primarily reflected the impact of the merger. The 2005 total included the impacts of a

decline in commission expenses and expense efficienciesrealized asa result of the merger.

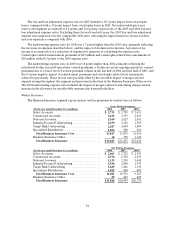

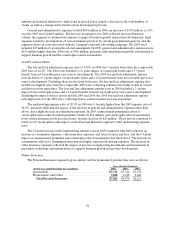

GAAP Combined Ratio

The loss and loss adjustment expense ratio of 53.7% in 2006 was 3.1 points lower than the ratio of

56.8% in 2005. The 2006 ratio included no impact of catastrophe losses and a 0.4 point benefit from net

favorable prior year reserve development, whereas the 2005 ratio included a 5.5 point impact from

catastrophes and a 2.3 point benefit from net favorable prior year reserve development. Excluding those

factors in each year, the 2006 ratio was slightly higher than the 2005 ratio. The loss and loss adjustment

expense ratio in 2004 included a 2.0 point impact from catastrophe losses, and a 29.3 point impact from net