Travelers 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285

|

|

70

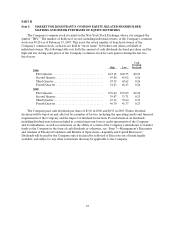

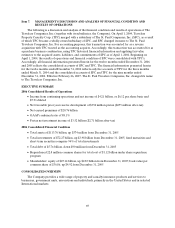

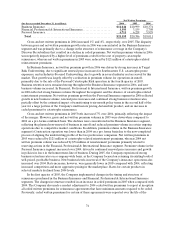

Consolidated Results of Operations

For the year ended December 31, 2006 2005 2004

Revenues

Premiums...................................................... $20,760 $ 2 0,341 $19,038

Net investment inco me .......................................... 3,517 3,165 2,663

Fee income .................................................... 591 664 706

Net realized investment gains (losses) ............................. 11 17 (39)

Other revenues ................................................. 211 178 176

Total revenues 25,090 24,365 22,544

Claims and expenses

Claims and claim adjustment expenses. ............................ 12,244 14,927 15,439

Amortizationof deferred acquisition costs ......................... 3,339 3,252 2,978

General and administrative expenses .............................. 3,458 3,229 2,945

Interest expense ................................................ 324 286 236

Total claims and expenses ................................. 19,365 21,694 21,598

Income from continuingoperations before income taxes and

minority interest ......................................... 5,725 2,671 946

Income tax expense ............................................. 1,517 610 69

Minority interest, net of tax ......................................—— 10

Income from continuing operations ........................... 4,208 2,061 867

Discontinued operations:

Operating income (loss), net of taxes ............................—(663) 88

Gain on disposal, net of taxes..................................—224 —

Income (loss) fromdiscontinuedoperations....................—(439) 88

Net income ................................................ $4,208 $1,622 $ 955

Incomefrom continuing operations pershare

Basic...................................................... $ 6.12 $3.04 $ 1.42

Diluted(1)................................................. $ 5.91 $2.95 $ 1.40

GAAP combined ratio

Loss and loss adjustment expense rati o........................ 57.5% 71.9 % 79.4%

Underwriting expense ratio.................................. 30.6 29.4 28.3

GAAP combined ratio ..................................... 88.1% 101.3 % 107.7%

(1) The weighted average number of common shares used in the diluted earnings per share calculation

for the year ended December 31, 2004 excluded the potentially dilutive effect of the Company’s

convertible junior subordinated notes because their effect was anti-dilutive.

The Company’s discussions related to all items, other than net income, income from continuing

operations, income (loss) from discontinued operations, and segment operating income (loss), are

presented on a pretax basis, unless otherwise noted. Throughout the following discussion, the Company

references the “impact of the merger” in the context of a comparison between 2005 and 2004, referring to

the fact that the Company’s 2005 results reflected a full year of combined post-merger operations, whereas

the Company’s 2004 results reflected combinedpost-merger operations for the nine months subsequent to

the April 1, 2004 mergerdate, plus the results of TPC only for the three months ended March 31, 2004.

Overview

Income from continuing operations in 2006 totaled $4.21 billion, or $5.91 per share diluted, compared

with 2005 income from continuing operations of $2.06 billion, or $2.95 per share diluted. The $2.15 billion

increase in 2006 operating results reflected a significant decline in catastrophe losses, net favorable prior