Travelers 2006 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

196

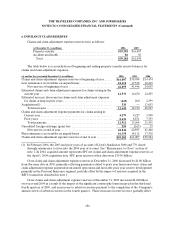

7. DEBT (Continued)

Zero Coupon Convertible Notes—The zero coupon convertible notes mature in 2009, but are

redeemable at the option of the Company for an amount equal to the original issue price plus accreted

original issue discount. Eachnote is convertible at the option of the holder at any time on or prior to

maturity, unless previously redeemed by the Company, into common stock of the Company at a conversion

rate of 16.6433 shares for each $1,000 principal amount of notes. If all notes outstanding at December 31,

2006 were converted, the Company would issue 2.4 million of its common shares.

Subordinated Debentures—The Company’s four subordinated debenture instruments are all similar in

nature. Four separate business trusts issued preferred securities to investors and used the proceeds to

purchase the Company’s subordinated debentures. Interest on each of the instruments is paid semi-

annually. In January 2007, the Company redeemed the$81 million, 8.47% subordinateddebentures due in

2027. The redemption was funded internally.

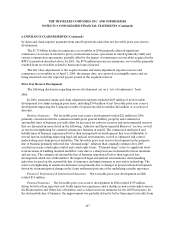

4.50% Convertible Junior Subordinated Notes—These notes will mature on April 15, 2032, unless

earlier redeemed,repurchased or converted. Interest is payable quarterly in arrears. The Company has the

option to defer interest payments on the notes for a period not exceeding 20 consecutive interest periods

nor beyond the maturity of the notes. During a deferral period, the amount of interest due to holders of

the notes will continue to accumulate, and such deferred interest payments will themselves accrue interest.

Deferral of any interest can create certain restrictions for the Company. Unlesspreviously redeemed or

repurchased, the notes are convertible into shares of common stock at the option of the holders at any time

after March27, 2003 andprior to April 15, 2032 if at any time (1) the average of the daily closing prices of

common stock for the 20 consecutive trading days immediately prior to the conversion date is at least 20%

above the then applicable conversion price on the conversion date, (2) the notes have been called for

redemption, (3) specified corporate transactions have occurred, or (4) specified credit rating events with

respect to the notes have occurred. The notes will be convertible into shares of common stock at a

conversion rate of0.4684 shares of common stock for each $25.00 principal amount of notes (equivalent to

an initial conversionprice of $53.37 per share of common stock), subject to adjustment in certain events.

On or after April 18, 2007, the notes may be redeemed at the Company’s option. The notes are general

unsecured obligations and are subordinated in right of payment to all existing and future Senior

Indebtedness. The notes are also effectively subordinated to all existing and future indebtedness and other

liabilities of any of the Company’s current or future subsidiaries. If all notes outstanding at December 31,

2006 were converted, the Company would issue 16.7 million of its common shares.

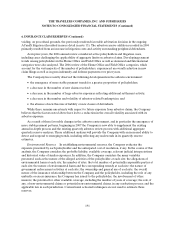

The Company’s consolidated balance sheet includes the debt instruments acquired in the merger,

which were recorded at fair value as of the acquisition date. The resulting fair value adjustment is being

amortized over the remaining life of the respective debt instruments using the effective-interest method.

The amortization of the fair value adjustment reduced interest expense by $34 million and $54 million for

the years ended December 31, 2006 and 2005, respectively.