Travelers 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.107

Changes in the general interest rateenvironment affect the returns available on new investments.

While a rising interest rate environment enhances the returns available on new fixed income investments, it

reduces the market value of existing fixed maturity investments and the availability of gains on disposition.

A decline ininterest rates reduces the returns available on new investments but increases the market value

of existing investments and the availability of realized investment gains on disposition. In 2006, short-term

interest rates and long-term taxable interest rates continued to increase. Additionally, yields available on

new investments often exceeded those yields oninvestments maturing in the investment portfolio. The

continuation of an upward trend in interest rates in 2007 would favorably impact the average book yield of

the Company’s fixed income holdings.

If the Terrorism Risk Insurance Act of 2002 and Terrorism Risk Insurance Extension Act of 2005 (the

Program) is not renewed for periods after January 1, 2008, the benefits of the Program will not be available

to the Company, and the Company will be subject to losses from acts of terrorism subject only to the terms

and provisions of applicable policies, including policies written in 2007 for which the period of coverage

extends into 2008. Given the unpredictable frequency and severity of terrorism losses, as well as the limited

terrorism coverage in the Company’s own reinsurance program, future losses fromacts of terrorism,

particularly those involving nuclear, biological, chemical or radiological events, could be material to the

Company’s operating results, financial condition and/or liquidity in future periods, particularly if the

Program is not renewed.

There are currently various state and federal legislative and judicial proposals to require asbestos

claimants to demonstrate an asbestos illness. At this time it is not possible to predict the likelihood or

timing of such proposals being enacted or the effect if they are enacted. The Company’s ongoing analysis

of its asbestos reserves did not assume the adoption of any asbestos reforms. For information aboutthe

outlook with respect to asbestos-related claims and liabilities see “—Asbestos Claims and Litigation” and

“—Uncertainty Regarding Adequacy of Asbestos and Environmental Reserves.”

In recent years, the state insurance regulatory framework has come under increased federal scrutiny,

and some state legislatures have considered or enacted laws that may alter or increase state authority to

regulate insurance companies and insurance holding companies. Further, the National Association of

regulations, specifically focusing on modifications to holding company regulations, interpretations of

agencies from time to time investigate the current condition of insurance regulation in the United States to

Although the United States federal government does not directly regulate the insurance business, changes

in federal legislation, regulation and/or administrative policies in several areas, including changes in

For a discussion of potential risks that could impact the Company’s financial condition or results of

operations, see Item 1A—“Risk Factors” in this report.

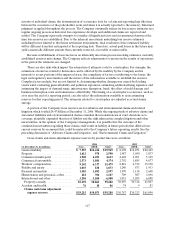

LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of a company’s ability to generate sufficient cash flows to meet the short- and

long-term cash requirements of its business operations. The liquidity requirements of the Company’s

business have been met primarily by funds generated from operations, asset maturities and income

received on investments. The Company also has access to liquidity through its shelf registration statement

determine whether to imposefederal or national regulation or to allow an optional federal charter, similar

financial services regulation (e.g. the repeal of the McCarran-Ferguson Act) and federal taxation, can

Insurance Commissioners (NAIC) and state insuranceregulators continually reexamine existing laws and

existing laws and the development of new laws and regulations. In addition, Congress and some federal

to the option available to most banks. The Company cannot predict with certainty the effect any proposed or

that are adopted or amended may be more restrictive than current requirements or may result in higher costs.

future legislation or NAIC initiatives may have on the conduct of its business. Insurance laws or regulations

significantly harm the insurance industry, including the Company.