The Hartford 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

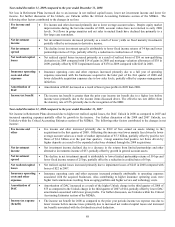

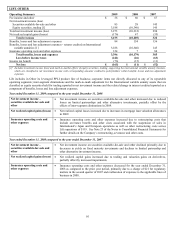

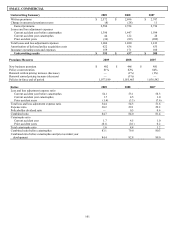

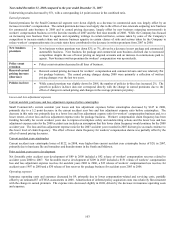

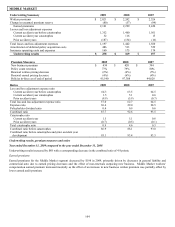

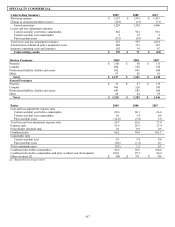

Year ended December 31, 2008 compared to the year ended December 31, 2007

Underwriting results decreased by $42, with a corresponding 1.2 point increase in the combined ratio.

Earned premiums

Earned premiums increased $37, or 1%, due primarily to earned premium growth in AARP, partially offset by earned premium

decreases in Agency and Other.

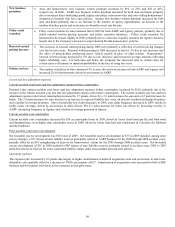

• AARP earned premium grew $97, reflecting modest renewal earned pricing increases for both auto and homeowners and the effect

of new business premium outpacing non-renewals in the last nine months of 2007. New business offset non-renewals in 2008 and

new business in 2008 was driven by growth in the size of the AARP target market, the effect of direct marketing programs and the

effect of cross-selling homeowners insurance to insureds who have auto policies.

• Agency earned premium decreased by $43 as the effect of a decline in new business premium and policy count retention since the

middle of 2007 was partially offset by the effect of modest renewal earned pricing increases. The market environment continued to

be intensely competitive in 2008. The increase in advertising for auto business among the top carriers also occurred with

homeowners’ business, particularly in non-coastal and non-catastrophe prone areas. In 2008, a number of Personal Lines carriers

began to increase rates although a significant portion of the market continued to compete heavily on price.

• Other earned premium decreased by $17, primarily due to a decision to reduce other affinity business.

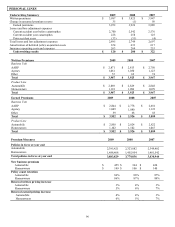

Auto earned premium was relatively flat in 2008 as the effect of renewal earned pricing increases of 4% was largely offset by a decrease

in new business since the middle of 2007. Homeowners’ earned premium grew 3% largely due to renewal earned pricing increases of

5%.

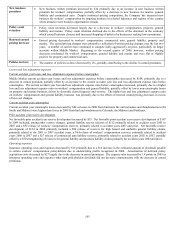

New business

premium

• Both auto and homeowners’ new business written premium decreased in 2008 including decreases in AARP

and Agency. Auto new business decreased by $60, or 14% and homeowners’ new business decreased by

$34, or 24%. AARP new business written premium decreased primarily due to lower auto and

homeowners’ policy conversion rates, driven by increased competition, including the effect of price

decreases by some carriers and the effect of continued advertising among carriers for new business.

Agency new business written premium decreased primarily due to price competition driven, in part, by a

greater number of agents using comparative rating software to obtain quotes from multiple carriers.

Policy count

retention

• Policy count retention for auto decreased, driven primarily by a decrease in policy retention for both AARP

and Agency business. Policy count retention for homeowners decreased for both AARP and Agency

business. The decrease in policy count retention for AARP homeowners’ business was driven by increased

price competition by some carriers. The decrease in policy count retention for Agency homeowners’

business was due, in part, to Florida policyholders non-renewing as a result of the Company’ s decision to

stop renewing Florida homeowners’ policies sold through agents.

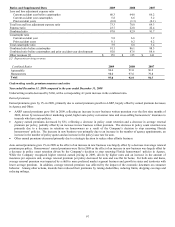

Renewal earned

pricing increase

• Auto renewal earned pricing increases of 4% represent the portion of the 4% increase in renewal written

pricing for 2008 that is reflected in earned premium. In 2008, the Company increased auto insurance rates

in certain states for certain classes to maintain profitability in the face of rising loss costs. Renewal written

pricing increases in 2008 included the effect of policyholders purchasing newer vehicle models in place of

older models. Homeowners’ renewal earned pricing increases of 5% primarily reflected the earning of a

blend of mid-single digit renewal written pricing increases recognized over the last nine months of 2007 and

renewal written pricing increases recognized in the first nine months of 2008. Renewal written pricing

increases in homeowners were largely driven by increases in coverage limits due to rising replacement

costs.

Policies in-force • The number of policies in-force decreased slightly for both auto and homeowners, primarily due to a 7%

decline in the number of Agency policies in-force, partially offset by a 1% increase in the number of AARP

policies in-force.

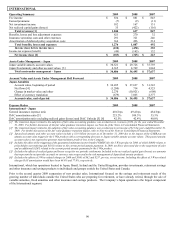

Losses and loss adjustment expenses

Current accident year losses and loss adjustment expenses before catastrophes

Personal Lines’ current accident year losses and loss adjustment expenses before catastrophes decreased by $34 due to a decrease in the

current accident year loss and loss adjustment expense ratio before catastrophes, partially offset by the effect of higher earned premium.

The current accident year loss and loss adjustment expense ratio before catastrophes decreased by 1.4 points, primarily due to favorable

expected frequency on auto liability claims and the effect of renewal earned pricing increases for both auto and homeowners, partially

offset by increased frequency and severity of non-catastrophe losses on homeowners business.

Current accident year catastrophes

Current accident year catastrophe losses of $258 in 2008 were higher than current accident year catastrophe losses of $125 in 2007,

primarily due to losses from hurricane Ike and tornadoes and thunderstorms in the South and Midwest.