The Hartford 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 51

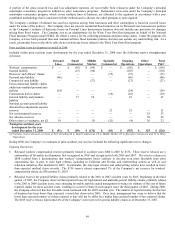

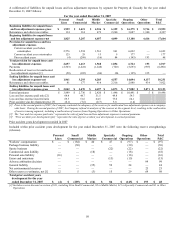

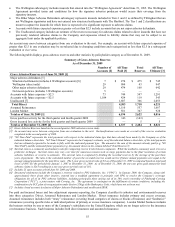

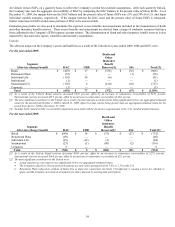

During the year ended December 31, 2007, the Company’ s reestimates of prior accident year reserves included the following significant

reserve changes.

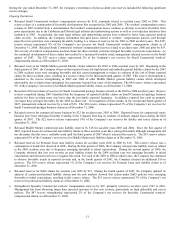

Ongoing Operations

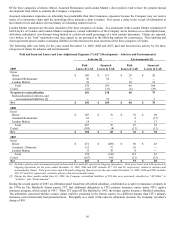

• Released Small Commercial workers' compensation reserves by $151, primarily related to accident years 2002 to 2006. This

reserve release is a continuation of favorable developments first recognized in 2005 and 2006. The workers' compensation reserve

releases in 2007 resulted from a determination that workers' compensation losses continue to develop even more favorably from

prior expectations due to the California and Florida legal reforms and underwriting actions as well as cost reduction initiatives first

instituted in 2003. In particular, the state legal reforms and underwriting actions have resulted in lower than expected medical

claim severity. In addition, the Company determined that paid losses related to workers’ compensation policies sold through

payroll service providers were emerging favorably, leading to a release of reserves for the 2003 to 2006 accident years. The $151

reserve release represented 9% of the Company’ s net reserves for Small Commercial workers’ compensation claims as of

December 31, 2006. Released Small Commercial workers' compensation reserves related to accident years 2000 and prior by $33.

The severity of workers' compensation medical claims for these accident years has emerged favorably to previous expectations. As

the continued development of these claims has resulted in a sustained favorable trend, management released reserves in the fourth

quarter of 2007. The $33 reserve release represented 2% of the Company’ s net reserves for Small Commercial workers’

compensation claims as of December 31, 2006.

• Released reserves for Middle Market general liability claims related to the 2003 to 2006 accident years by $49. Beginning in the

third quarter of 2007, the Company observed that reported losses for high hazard and umbrella general liability claims for the 2003

to 2006 accident years were emerging favorably and this caused management to reduce its estimate of the cost of future reported

claims for these accident years, resulting in a reserve release in the third and fourth quarter of 2007. This reserve development is

unrelated to the reserve strengthening in 2005 and 2006 of other Middle Market general liability claims which developed

unfavorably due to higher than anticipated loss payments beyond four years of development. The $49 reserve release represented

6% of the Company’ s net reserves for Middle Market general liability claims as of December 31, 2006.

• Recorded a $30 net release of reserves for Small Commercial package business related to the 2003 to 2006 accident years. Reserve

reviews completed during 2007 identified that the frequency of reported liability claims on Small Commercial package business

policies for these accident years was lower than the previously expected frequency. In addition, reported loss costs on property

coverages have emerged favorably for the 2006 accident year. In recognition of these trends, in the second and fourth quarter of

2007, management reduced reserves by a total of $30. The $30 reserve release represented 3% of the Company’ s net reserves for

Small Commercial package business claims as of December 31, 2006.

• Released reserves for commercial surety business by $22 for accident years 2003 to 2006. Reported losses for commercial surety

business have been emerging favorably resulting in the Company lowering its estimate of ultimate unpaid losses during the third

quarter of 2007. The $22 reserve release represented 14% of the Company’ s net reserves for fidelity and surety claims as of

December 31, 2006.

• Released Middle Market commercial auto liability reserves by $18 for accident years 2003 and 2004. Since the first quarter of

2007, reported losses for commercial auto liability claims in these accident years have emerged favorably although management did

not determine that this was a verifiable trend until the third quarter of 2007 when it released the reserves. The $18 reserve release

represented 6% of the Company’ s net reserves for Middle Market auto liability claims as of December 31, 2006.

• Released reserves for Personal Lines auto liability claims for accident years 2002 to 2006 by $16. This reserve release was a

continuation of trends first observed in 2006. During the first quarter of 2006, the Company released auto liability reserves related

to the 2005 accident year due to frequency emerging favorable to initial expectations. During the second quarter of 2006, the

Company observed that loss cost severity on auto liability claims for the 2004 accident year was emerging favorable to initial

expectations and released reserves to recognize this trend. For each of the 2002 to 2006 accident years, the Company has continued

to observe favorable trends in reported severity and, in the fourth quarter of 2007, the Company released an additional $16 in

reserves. The $16 reserve release represented 1% of the Company’ s net reserves for Personal Lines auto liability claims as of

December 31, 2006.

• Released reserves for E&O claims for accident year 2005 by $15. During the fourth quarter of 2007, the Company updated its

analysis of certain professional liability claims and the new analysis showed that claims under E&O policies were emerging

favorable to initial expectations, resulting in this reserve release. The $15 reserve release represented 3% of the Company’ s net

reserves for professional liability claims as of December 31, 2006.

• Strengthened Specialty Commercial workers' compensation reserves by $47, primarily related to accident years 1987 to 2001.

Management has been observing larger than expected increases in loss cost severity, particularly on high deductible and excess

policies. The $47 reserve strengthening represented 2% of the Company’ s net reserves for Specialty Commercial workers’

compensation claims as of December 31, 2006.