The Hartford 2009 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-61

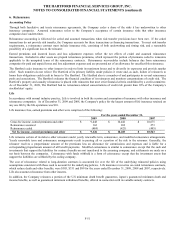

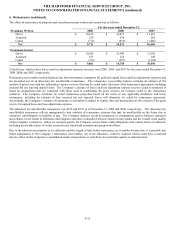

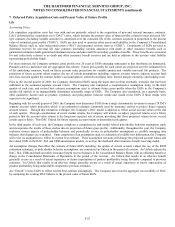

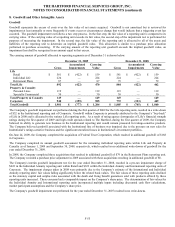

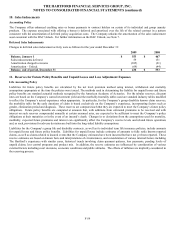

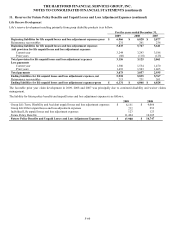

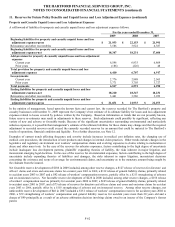

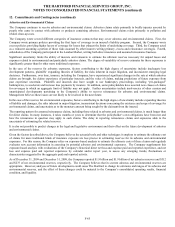

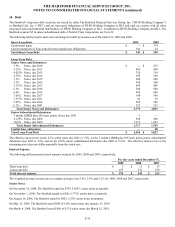

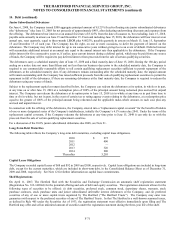

11. Reserves for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses (continued)

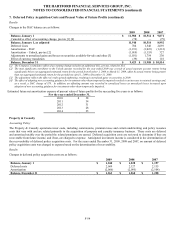

Property and Casualty Accounting Policy

The Hartford establishes property and casualty reserves to provide for the estimated costs of paying claims under insurance policies

written by the Company. These reserves include estimates for both claims that have been reported and those that have been incurred but

not reported, and include estimates of all losses and loss adjustment expenses associated with processing and settling these claims.

Estimating the ultimate cost of future losses and loss adjustment expenses is an uncertain and complex process. This estimation process

is based significantly on the assumption that past developments are an appropriate predictor of future events, and involves a variety of

actuarial techniques that analyze experience, trends and other relevant factors. The uncertainties involved with the reserving process

have become increasingly difficult due to a number of complex factors including social and economic trends and changes in the

concepts of legal liability and damage awards. Accordingly, final claim settlements may vary from the present estimates, particularly

when those payments may not occur until well into the future.

The Hartford regularly reviews the adequacy of its estimated losses and loss adjustment expense reserves by line of business within the

various reporting segments. Adjustments to previously established reserves are reflected in the operating results of the period in which

the adjustment is determined to be necessary. Such adjustments could possibly be significant, reflecting any variety of new and adverse

or favorable trends.

Most of the Company’ s property and casualty reserves are not discounted. However, the Company has discounted liabilities funded

through structured settlements and has discounted certain reserves for indemnity payments due to permanently disabled claimants under

workers' compensation policies. Structured settlements are agreements that provide fixed periodic payments to claimants and include

annuities purchased to fund unpaid losses for permanently disabled claimants and, prior to 2008, agreements that funded loss run-offs

for unrelated parties. Most of the annuities have been purchased from Life and these structured settlements are recorded at present value

as annuity obligations of Life, either within the reserve for future policy benefits if the annuity benefits are life-contingent or within

other policyholder funds and benefits payable if the annuity benefits are not life-contingent. If not funded through an annuity, reserves

for certain indemnity payments due to permanently disabled claimants under workers' compensation policies are recorded as property

and casualty reserves and were discounted to present value at an average interest rate of 5.0% in 2009 and 5.4% in 2008. As of

December 31, 2009 and 2008, property and casualty reserves were discounted by a total of $511 and $488, respectively. The current

accident year benefit from discounting property and casualty reserves was $40 in 2009, $38 in 2008 and $46 in 2007. Contributing to the

decrease in the benefit from discounting over the past three years has been a reduction in the discount rate, reflecting a lower risk-free

rate of return over that period. Accretion of discounts for prior accident years totaled $24 in 2009, $26 in 2008, and $31 in 2007. For

annuities issued by Life to fund certain P&C workers’ compensation indemnity payments where the claimant has not released the P&C

Company of its obligation, Life has recorded annuity obligations totaling $924 as of December 31, 2009 and $945 as of December 31,

2008.