The Hartford 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 68

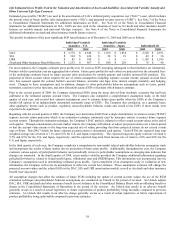

Definitions of measures and ratios for Life Operations

After-tax Margin

After-tax margin, excluding realized gains (losses) or DAC Unlock is a non-GAAP financial measure that the Company uses to

evaluate, and believes are important measures of, segment operating performance. After-tax margin is the most directly comparable

U.S. GAAP measure. The Hartford believes that the measure after-tax margin, excluding realized gains (losses) and DAC Unlock

provides investors with a valuable measure of the performance of the Company’ s on-going businesses because it reveals trends in our

businesses that may be obscured by the effect of realized gains (losses) or quarterly DAC Unlocks. Some realized capital gains and

losses are primarily driven by investment decisions and external economic developments, the nature and timing of which are unrelated

to insurance aspects of our businesses. Accordingly, these non-GAAP measures exclude the effect of all realized gains and losses that

tend to be highly variable from period to period based on capital market conditions. The Hartford believes, however, that some realized

capital gains and losses are integrally related to our insurance operations, so after-tax margin, excluding the realized gains (losses) and

DAC Unlock should include net realized gains and losses on net periodic settlements on the Japan fixed annuity cross-currency swap.

These net realized gains and losses are directly related to an offsetting item included in the statement of operations such as net

investment income. DAC Unlocks occur when the Company determines based on actual experience or other evidence, that estimates of

future gross profits should be revised. As the DAC Unlock is a reflection of the Company’ s new best estimates of future gross profits,

the result and its impact on the DAC amortization ratio is meaningful; however, it does distort the trend of after-tax margin. After-tax

margin, excluding realized gains (losses) and DAC Unlock should not be considered as a substitute for after-tax margin and does not

reflect the overall profitability of our businesses. Therefore, the Company believes it is important for investors to evaluate both after-tax

margin, excluding realized gains (losses) and DAC Unlock and after-tax margin when reviewing the Company’ s performance.

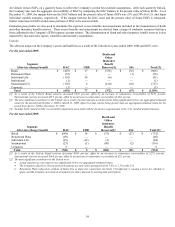

DAC amortization ratio

DAC amortization ratio, excluding realized gains (losses) and DAC Unlock is a non-GAAP financial measure that the Company uses to

evaluate, and believes is an important measure of, segment operating performance. DAC amortization ratio is the most directly

comparable U.S. GAAP measure. The Hartford believes that the measure DAC amortization ratio, excluding realized gains (losses) and

DAC Unlock provides investors with a valuable measure of the performance of the Company’ s on-going businesses because it reveals

trends in our businesses that may be obscured by the effect of realized gains (losses) or quarterly DAC Unlocks. Some realized capital

gains and losses are primarily driven by investment decisions and external economic developments, the nature and timing of which are

unrelated to insurance aspects of our businesses. Accordingly, these non-GAAP measures exclude the effect of all realized gains and

losses that tend to be highly variable from period to period based on capital market conditions. The Hartford believes, however, that

some realized capital gains and losses are integrally related to our insurance operations, so amortization of deferred policy acquisition

costs and the present value of future profits (DAC amortization ratio), which is typically expressed as a percentage of pre-tax income

before the cost of this amortization (an approximation of actual gross profits) and excludes the effects of realized capital gains and

losses, excluding the realized gains (losses) and DAC Unlock should include net realized gains and losses on net periodic settlements on

the Japan fixed annuity cross-currency swap. These net realized gains and losses are directly related to an offsetting item included in the

statement of operations such as net investment income. DAC Unlocks occur when the Company determines based on actual experience

or other evidence, that estimates of future gross profits should be revised. As the DAC Unlock is a reflection of the Company’ s new

best estimates of future gross profits, the result and its impact on the DAC amortization ratio is meaningful; however, it does distort the

trend of DAC amortization ratio. DAC amortization ratio, excluding realized gains (losses) and DAC Unlock should not be considered

as a substitute for DAC amortization ratio and does not reflect the overall profitability of our businesses. Therefore, the Company

believes it is important for investors to evaluate both DAC amortization ratio, excluding realized gains (losses) and DAC Unlock and

DAC amortization ratio when reviewing the Company’ s performance.

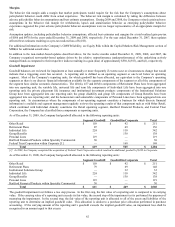

Fee Income

Fee income is largely driven from amounts collected as a result of contractually defined percentages of assets under management. These

fees are generally collected on a daily basis. For individual life insurance products, fees are contractually defined as percentages based

on levels of insurance, age, premiums and deposits collected and contract holder value. Life insurance fees are generally collected on a

monthly basis. Therefore, the growth in assets under management either through positive net flows or net sales, or favorable equity

market performance will have a favorable impact on fee income. Conversely, either negative net flows or net sales, or unfavorable

equity market performance will reduce fee income.

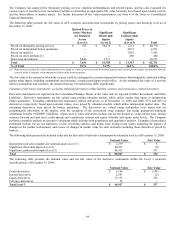

Life Expenses

There are three major categories for expenses. The first major category of expenses is benefits and losses. These include the costs of

mortality and morbidity, particularly in the group benefits business, and mortality in the individual life businesses, as well as other

contractholder benefits to policyholders. In addition, traditional insurance type products generally use a loss ratio which is expressed as

the amount of benefits incurred during a particular period divided by total premiums and other considerations, as a key indicator of

underwriting performance. Since Group Benefits occasionally buys a block of claims for a stated premium amount, the Company

excludes this buyout from the loss ratio used for evaluating the underwriting results of the business as buyouts may distort the loss ratio.

The second major category is insurance operating costs and expenses, which is commonly expressed in a ratio of a revenue measure

depending on the type of business. The third major category is the DAC amortization ratio. Retail - individual annuity business

accounts for the majority of the amortization of DAC and present value of future profits for Life.