The Hartford 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

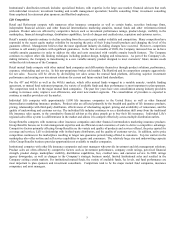

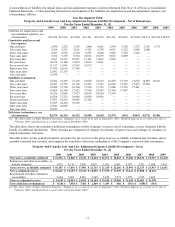

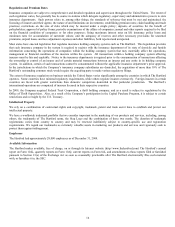

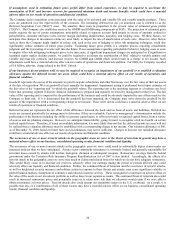

The following table is derived from the Loss Development table and summarizes the effect of reserve re-estimates, net of reinsurance,

on calendar year operations for the ten-year period ended December 31, 2009. The total of each column details the amount of reserve

re-estimates made in the indicated calendar year and shows the accident years to which the re-estimates are applicable. The amounts in

the total accident year column on the far right represent the cumulative reserve re-estimates during the ten-year period ended December

31, 2009 for the indicated accident year(s).

Effect of Net Reserve Re-estimates on Calendar Year Operations

Calendar Year

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Total

By Accident year

1999 & Prior $ (4) $ 55 $ 171 $ 2,911 $ 647 $ 312 $ 463 $ 624 $ 186 $ 214 $ 5,579

2000 — 88 146 73 177 152 1 80 8 25 750

2001 — — (24) 39 (232) 193 38 55 12 61 142

2002 — — — (199) (56) 180 36 (5) 2 (12) (54)

2003 — — — — (122) (237) (31) (126) (21) (6) (543)

2004 — — — — — (352) (108) (226) (83) (56) (825)

2005 — — — — — — (103) (214) (133) (47) (497)

2006 — — — — — — — (140) (148) (213) (501)

2007 — — — — — — — — (49) (113) (162)

2008 — — — — — — — — — (39) (39)

Total $ (4) $ 143 $ 293 $ 2,824 $ 414 $ 248 $ 296 $ 48 $ (226) $(186) $3,850

During the 2007 calendar year, the Company refined its processes for allocating incurred but not reported (“IBNR”) reserves by accident

year, resulting in a reclassification of $347 of IBNR reserves from the 2003 to 2006 accident years to the 2002 and prior accident years.

This reclassification of reserves by accident year had no effect on total recorded reserves within any segment or on total recorded

reserves for any line of business within a segment.

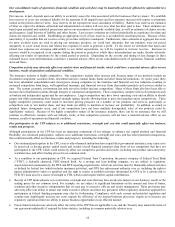

Reserve changes for accident years 1999 & Prior

The largest impacts of net reserve re-estimates are shown in the “1999 & Prior” accident years. The reserve re-estimates in calendar

year 2003 include an increase in reserves of $2.6 billion related to reserve strengthening based on the Company’ s evaluation of its

asbestos reserves. The reserve evaluation that led to the strengthening in calendar year 2003 confirmed the Company’ s view of the

existence of a substantial long-term deterioration in the asbestos litigation environment. The reserve re-estimates in calendar years 2004

and 2006 were largely attributable to reductions in the reinsurance recoverable asset associated with older, long-term casualty liabilities.

Reserve changes for accident year 2000

Prior to calendar year 2006, there was reserve deterioration, spread over several calendar years, on accident years 2000 and prior driven,

in part, by deterioration of reserves for assumed casualty reinsurance and workers’ compensation claims. Numerous actuarial

assumptions on assumed casualty reinsurance turned out to be low, including loss cost trends, particularly on excess of loss business,

and the impact of deteriorating terms and conditions. Workers’ compensation reserves also deteriorated, as medical inflation trends

were above initial expectations.

Reserve changes for accident years 2001 and 2002

Accident years 2001 and 2002 are reasonably close to original estimates. However, each year shows some swings by calendar period,

with some favorable development prior to calendar year 2005, largely offset by unfavorable development in calendar years 2005 through

2008. The release for accident year 2001 during calendar year 2004 relates primarily to reserves for September 11. Subsequent adverse

developments on accident year 2001 relate to assumed casualty reinsurance and unexpected development on mature claims in both

general liability and workers’ compensation. Reserve releases for accident year 2002 during calendar years 2003 and 2004 come largely

from short-tail lines of business, where results emerge quickly and actual reported losses are predictive of ultimate losses. Reserve

increases on accident year 2002 during calendar year 2005 were recognized, as unfavorable development on accident years prior to 2002

caused the Company to increase its estimate of unpaid losses for the 2002 accident year.