The Hartford 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 35

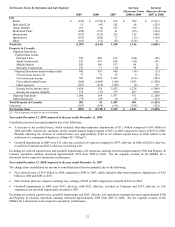

Individual Life

Future sales for all products will be influenced by active management of current distribution relationships, responding to the negative

impact of recent merger and consolidation activity on existing distribution relationships and the development of new sources of

distribution, and the Company’ s ratings, as published by the various ratings agencies, while offering competitive and innovative

products and product features. The current economic environment poses challenges for future sales; while life insurance products

respond well to consumer demand for financial security and wealth accumulation solutions, individuals may be reluctant to transfer

funds when market volatility has recently resulted in significant declines in investment values. In addition, the availability and terms of

capital solutions in the marketplace, as discussed below, to support universal life products with secondary guarantees, may reduce future

growth in these products.

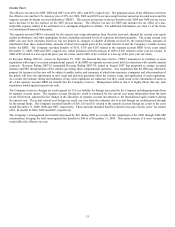

Effective November 1, 2007, Individual Life reinsured the policy liability related to statutory reserves in universal life with secondary

guarantees to a captive reinsurance affiliate. An unaffiliated standby third-party letter of credit supports a portion of the statutory

reserves that have been ceded to this subsidiary. The use of the letter of credit enhanced statutory capital but resulted in a decline in net

investment income and increased expenses in future periods for Individual Life. As of December 31, 2009, the transaction provided

approximately $585 of statutory capital relief associated with the Company’ s universal life products with secondary guarantees. The

Company received notice from the issuer of the letter of credit that they will be terminating the letter of credit as it applies to new

business written after January 31, 2010. In addition, the issuer has notified the Company that it will not extend the letter of credit,

covering the in-force, beyond its current expiration date of December 31, 2028. The letter of credit is expected to provide sufficient

coverage for the reinsured business through 2028. Management is reviewing product design alternatives with the objective of

developing a competitively priced product that meets the Company’ s capital efficiency objectives.

For risk management purposes, Individual Life accepts and retains up to $10 in risk on any one life. Individual Life uses reinsurance

where appropriate to protect against the severity of losses on individual claims; however, death claim experience may continue to lead to

periodic short-term earnings volatility. In the fourth quarter of 2008, Individual Life began ceding insurance under a new reinsurance

structure for all new business excluding term life insurance. The new reinsurance structure allows Individual Life greater flexibility in

writing larger policies, while retaining less of the overall risk associated with individual insured lives. This new reinsurance structure

will help balance the overall profitability of Individual Life’ s business. The financial results of this change in the reinsurance structure

will be recognized over time as the percentage of new business subject to the structure grows. This will result in Individual Life

recognizing increasing reinsurance premiums while reducing earnings volatility associated with mortality experience over time.

Individual Life continues to face uncertainty surrounding estate tax legislation, aggressive competition from other life insurance

providers, reduced availability and higher price of reinsurance, and the current regulatory environment related to reserving for term life

insurance and universal life products with no-lapse guarantees. Additionally, volatility in the equity markets may reduce the

attractiveness of variable universal life products. These risks may have a negative impact on Individual Life’ s future sales and earnings.

Despite these risks, management believes there are opportunities to increase future sales by implementing strategies to expand

distribution capabilities, including utilizing independent agents and continuing to build on the strong relationships within the financial

institution marketplace.

Group Benefits

Group Benefits’ sales may fluctuate based on the competitive pricing environment in the marketplace. In this competitive environment

the Company has seen weakness in its first quarter 2010 sales. The Company anticipates relatively stable loss ratios and expense ratios

over the long-term based on underlying trends in the in-force business and disciplined new business and renewal underwriting. The

Company experienced higher disability loss ratios in 2009; however, the Company believes this is within the normal range of volatility.

The economic downturn, which resulted in rising unemployment, combined with the potential for employees to lessen spending on the

Company’ s products, negatively impacted premium levels in 2009. Premium levels are expected to remain relatively flat in 2010, or

until there is economic expansion and lower unemployment rates compared to the end of 2009 levels. Over time, as employers design

benefit strategies to attract and retain employees, while attempting to control their benefit costs, management believes that the need for

the Company’ s products will continue to expand. This combined with the significant number of employees who currently do not have

coverage or adequate levels of coverage, creates continued opportunities for our products and services.

Retirement Plans

The future financial results of the Retirement Plans segment will depend on Life’ s ability to increase assets under management across all

businesses, achieve scale in areas with a high degree of fixed costs and maintain its investment spread earnings on the general account

products sold largely in the 403(b)/457 business. Disciplined expense management will continue to be a focus of the Retirement Plans

segment as necessary investments in service and technology are made to effect the integration of the acquisitions made in 2008.

Retirement Plans deposits have been negatively impacted by market volatility and by the market declines in 2008 and the first quarter

of 2009 as businesses reduce their workforces and offer more modest salary increases and as workers potentially allocate less to

retirement accounts in the near term. The impact of the partial equity markets recovery over the last nine months has been offset by a

few large case surrenders, resulting in an overall decline in average assets under management compared to 2008. The reduction in

average assets under management has strained net income in 2009, and this earnings strain is expected to continue until average account

value exceeds the level seen in the first half of 2008.