The Hartford 2009 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-38

5. Investments and Derivative Instruments (continued)

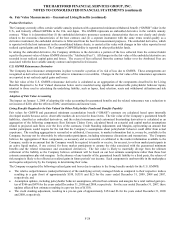

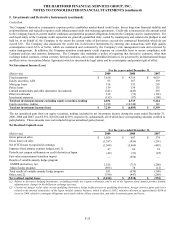

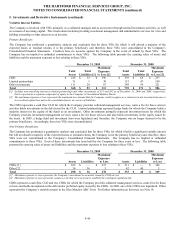

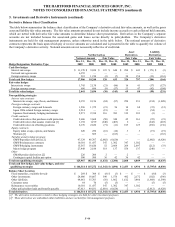

Security Unrealized Loss Aging

The following tables present the Company’ s unrealized loss aging for AFS securities by type and length of time the security was in a

continuous unrealized loss position.

December 31, 2009

Less Than 12 Months 12 Months or More Total

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

ABS $ 445 $ 376 $ (69) $ 1,574 $ 1,090 $ (484) $ 2,019 $ 1,466 $ (553)

CDOs 1,649 1,418 (231) 2,388 1,430 (958) 4,037 2,848 (1,189)

CMBS 1,951 1,628 (323) 6,330 4,347 (1,983) 8,281 5,975 (2,306)

Corporate 5,715 5,314 (401) 6,675 5,633 (1,042) 12,390 10,947 (1,443)

Foreign govt./govt. agencies 543 530 (13) 43 36 (7) 586 566 (20)

Municipal 2,339 2,283 (56) 2,184 1,862 (322) 4,523 4,145 (378)

RMBS 855 787 (68) 1,927 1,226 (701) 2,782 2,013 (769)

U.S. Treasuries 2,592 2,538 (54) 648 465 (183) 3,240 3,003 (237)

Total fixed maturities 16,089 14,874 (1,215) 21,769 16,089 (5,680) 37,858 30,963 (6,895)

Equity securities 419 356 (63) 676 547 (129) 1,095 903 (192)

Total securities in an unrealized loss $ 16,508 $ 15,230 $ (1,278) $ 22,445 $ 16,636 $ (5,809) $ 38,953 $ 31,866 $ (7,087)

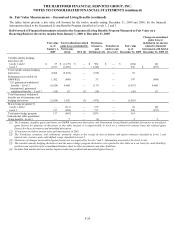

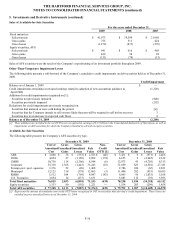

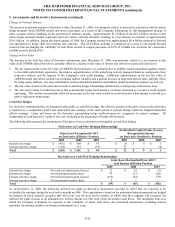

December 31, 2008

Less Than 12 Months 12 Months or More Total

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

ABS $ 1,190 $ 958 $ (232) $ 2,092 $ 1,353 $ (739) $ 3,282 $ 2,311 $ (971)

CDOs 688 440 (248) 3,941 2,144 (1,797) 4,629 2,584 (2,045)

CMBS 5,704 4,250 (1,454) 6,647 3,398 (3,249) 12,351 7,648 (4,703)

Corporate 16,604 14,145 (2,459) 7,028 4,986 (2,042) 23,632 19,131 (4,501)

Foreign govt./govt. agencies 1,263 1,211 (52) 43 30 (13) 1,306 1,241 (65)

Municipal 5,153 4,640 (513) 2,578 2,138 (440) 7,731 6,778 (953)

RMBS 731 546 (185) 2,607 1,759 (848) 3,338 2,305 (1,033)

U.S. Treasuries 4,120 4,083 (37) 66 64 (2) 4,186 4,147 (39)

Total fixed maturities 35,453 30,273 (5,180) 25,002 15,872 (9,130) 60,455 46,145 (14,310)

Equity securities 1,017 796 (221) 277 199 (78) 1,294 995 (299)

Total securities in an unrealized loss $ 36,470 $ 31,069 $ (5,401) $ 25,279 $ 16,071 $ (9,208) $ 61,749 $ 47,140 $ (14,609)

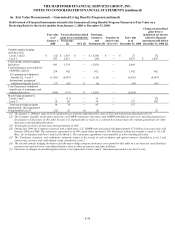

As of December 31, 2009, AFS securities in an unrealized loss position, comprised of 3,807 securities, primarily related to CMBS,

corporate securities primarily within the financial services sector and CDOs which have experienced significant price deterioration. As

of December 31, 2009, 69% of these securities were depressed less than 20% of amortized cost. The decline in unrealized losses during

2009 was primarily attributable to credit spread tightening, impairments and, to a lesser extent, sales, partially offset by rising interest

rates. The Company neither has an intention to sell nor does it expect to be required to sell the securities outlined above.