The Hartford 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

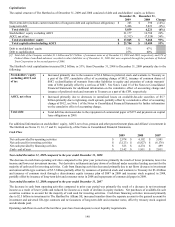

Capital Purchase Program

On June 26, 2009, as part of the Capital Purchase Program (“CPP”) established by the U.S. Department of the Treasury (“Treasury”)

under the Emergency Economic Stabilization Act of 2008 (the “EESA”), the Company entered into a Private Placement Purchase

Agreement with Treasury pursuant to which the Company issued and sold to the Treasury 3,400,000 shares of the Company’ s Fixed

Rate Cumulative Perpetual Preferred Stock, Series E, having a liquidation preference of $1,000 per share (the “Series E Preferred

Stock”), and a ten-year warrant to purchase up to 52,093,973 shares of the Company’ s common stock, par value $0.01 per share, at an

initial exercise price of $9.79 per share, for an aggregate purchase price of $3.4 billion. To satisfy a key eligibility requirement for

participation in the CPP, The Hartford acquired Federal Trust Corporation and has agreed with OTS to serve as a source of strength to

its wholly-owned subsidiary Federal Trust Bank (“FTB”), which included the contribution of $195 of CPP funds to FTB in the second

and third quarter of 2009 and could require further contributions of capital to FTB in the future. In addition, The Hartford has

contributed $1.7 billion of the CPP funds to its indirect wholly-owned subsidiary Hartford Life Insurance Company and used $500 to

purchase a surplus note from a wholly-owned captive insurance company. The remaining $1.0 billion is held at the HFSG Holding

Company in a segregated account.

Cumulative dividends on the Series E Preferred Stock will accrue on the liquidation preference at a rate of 5% per annum for the first

five years, and at a rate of 9% per annum thereafter. The Series E Preferred Stock has no maturity date and ranks senior to the

Company’ s common stock. The Series E Preferred Stock is non-voting. Payments on the cumulative dividends are approximately $170

over the next twelve months. The cumulative dividends on preferred stock and related accretion of discount on preferred stock will

reduce net income available to common shareholders. Pursuant to the Private Placement Purchase Agreement the Company has certain

restrictions on dividends for its common stock, for further information on common stock dividend restrictions see Note 15 in the Notes

to Consolidated Financial Statements.

Discretionary Equity Issuance Program

On August 6, 2009, the Company completed its discretionary equity issuance program. The Hartford issued 56.1 million shares of

common stock and received net proceeds of $887 under this program.

Additionally, this program triggered an anti-dilution provision in The Hartford’ s investment agreement with Allianz, which resulted in

the adjustment to the warrant exercise price to $25.25 from $25.32 and to the number of shares that may be purchased to 69,314,987

from 69,115,324.

Shelf Registrations

On April 11, 2007, The Hartford filed with the SEC an automatic shelf registration statement (Registration No. 333-142044) for the

potential offering and sale of debt and equity securities. The registration statement allows for the following types of securities to be

offered: (i) debt securities, preferred stock, common stock, depositary shares, warrants, stock purchase contracts, stock purchase units

and junior subordinated deferrable interest debentures of the Company, and (ii) preferred securities of any of one or more capital trusts

organized by The Hartford (“The Hartford Trusts”). The Company may enter into guarantees with respect to the preferred securities of

any of The Hartford Trusts. In that The Hartford is a well-known seasoned issuer, as defined in Rule 405 under the Securities Act of

1933, the registration statement went effective immediately upon filing and The Hartford may offer and sell an unlimited amount of

securities under the registration statement during the three-year life of the shelf.

Contingent Capital Facility

On February 12, 2007, The Hartford entered into a put option agreement (the “Put Option Agreement”) with Glen Meadow ABC Trust,

a Delaware statutory trust (the “ABC Trust”), and LaSalle Bank National Association, as put option calculation agent. The Put Option

Agreement provides The Hartford with the right to require the ABC Trust, at any time and from time to time, to purchase The Hartford’ s

junior subordinated notes in a maximum aggregate principal amount not to exceed $500.