The Hartford 2009 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-59

10. Sales Inducements

Accounting Policy

The Company offers enhanced crediting rates or bonus payments to contract holders on certain of its individual and group annuity

products. The expense associated with offering a bonus is deferred and amortized over the life of the related contract in a pattern

consistent with the amortization of deferred policy acquisition costs. The Company unlocks the amortization of the sales inducement

asset consistent with the DAC Unlock. For further information on the DAC Unlock, see Note 7.

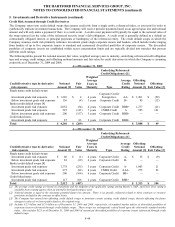

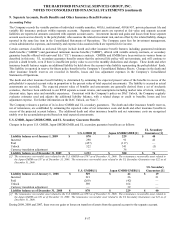

Deferred Sales Inducements

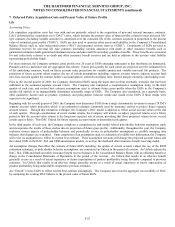

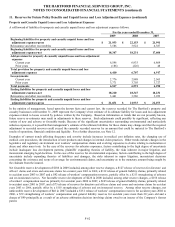

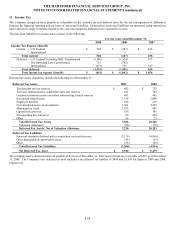

Changes in deferred sales inducement activity were as follows for the year ended December 31:

2009 2008

Balance, January 1 $ 553 $ 467

Sales inducements deferred 59 151

Amortization charged to income (105) (21)

Amortization – Unlock (69) (44)

Balance, end of period, December 31 $ 438 $ 553

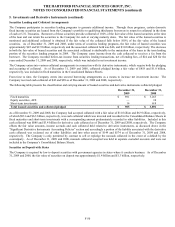

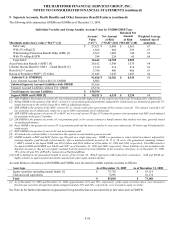

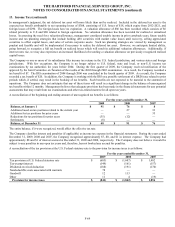

11. Reserves for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses

Life Accounting Policy

Liabilities for future policy benefits are calculated by the net level premium method using interest, withdrawal and mortality

assumptions appropriate at the time the policies were issued. The methods used in determining the liability for unpaid losses and future

policy benefits are standard actuarial methods recognized by the American Academy of Actuaries. For the tabular reserves, discount

rates are based on the Company’ s earned investment yield and the morbidity/mortality tables used are standard industry tables modified

to reflect the Company’ s actual experience when appropriate. In particular, for the Company’ s group disability known claim reserves,

the morbidity table for the early durations of claim is based exclusively on the Company’ s experience, incorporating factors such as

gender, elimination period and diagnosis. These reserves are computed such that they are expected to meet the Company’ s future policy

obligations. Future policy benefits are computed at amounts that, with additions from estimated premiums to be received and with

interest on such reserves compounded annually at certain assumed rates, are expected to be sufficient to meet the Company’ s policy

obligations at their maturities or in the event of an insured’ s death. Changes in or deviations from the assumptions used for mortality,

morbidity, expected future premiums and interest can significantly affect the Company’ s reserve levels and related future operations

and, as such, provisions for adverse deviation are built into the long-tailed liability assumptions.

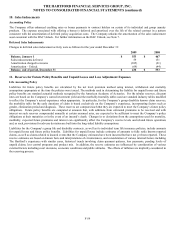

Liabilities for the Company’ s group life and disability contracts, as well as its individual term life insurance policies, include amounts

for unpaid losses and future policy benefits. Liabilities for unpaid losses include estimates of amounts to fully settle known reported

claims, as well as claims related to insured events that the Company estimates have been incurred but have not yet been reported. These

reserve estimates are based on known facts and interpretations of circumstances, and consideration of various internal factors including

The Hartford’ s experience with similar cases, historical trends involving claim payment patterns, loss payments, pending levels of

unpaid claims, loss control programs and product mix. In addition, the reserve estimates are influenced by consideration of various

external factors including court decisions, economic conditions and public attitudes. The effects of inflation are implicitly considered in

the reserving process.