The Hartford 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267

|

|

86

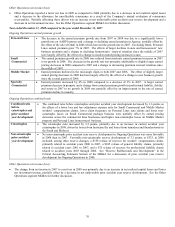

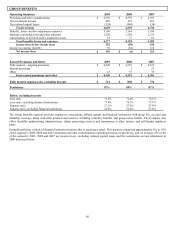

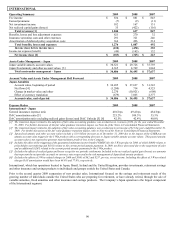

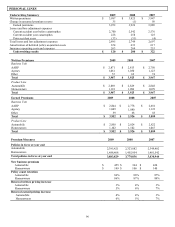

GROUP BENEFITS

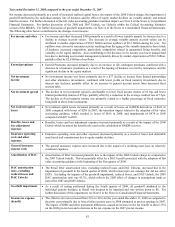

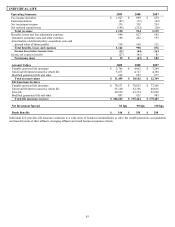

Operating Summary 2009 2008 2007

Premiums and other considerations $ 4,350 $ 4,391 $4,301

Net investment income 403 419 465

Net realized capital losses (124) (540) (30)

Total revenues 4,629 4,270 4,736

Benefits, losses and loss adjustment expenses 3,196 3,144 3,109

Insurance operating costs and other expenses 1,120 1,128 1,131

Amortization of deferred policy acquisition costs 61 57 62

Total benefits, losses and expenses 4,377 4,329 4,302

Income (loss) before income taxes 252 (59) 434

Income tax expense (benefit) 59 (53) 119

Net income (loss) $ 193 $(6) $315

Earned Premiums and Other 2009 2008 2007

Fully insured – ongoing premiums $ 4,309 $ 4,355 $ 4,239

Buyout premiums — 1 27

Other 41 35 35

Total earned premiums and other $ 4,350 $4,391 $4,301

Fully insured ongoing sales, excluding buyouts $741 $ 820 $770

Persistency 87% 89% 87%

Ratios, excluding buyouts

Loss ratio 73.5% 71.6% 72.1%

Loss ratio, excluding financial institutions 77.8% 76.3% 77.3%

Expense ratio 27.1% 27.0% 27.9%

Expense ratio, excluding financial institutions 22.6% 22.4% 23.0%

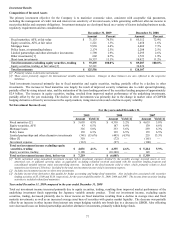

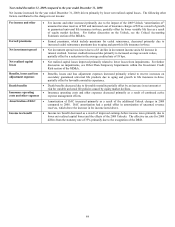

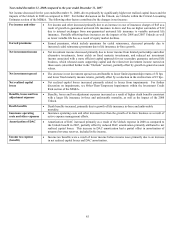

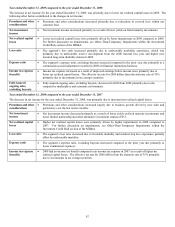

The Group Benefits segment provides employers, associations, affinity groups and financial institutions with group life, accident and

disability coverage, along with other products and services, including voluntary benefits, and group retiree health. The Company also

offers disability underwriting, administration, claims processing services and reinsurance to other insurers and self-funded employer

plans.

Group Benefits has a block of financial institution business that is experience rated. This business comprised approximately 9% to 10%

of the segment’ s 2009, 2008 and 2007 premiums and other considerations (excluding buyouts) respectively, and, on average, 2% to 4%

of the segment’ s 2009, 2008 and 2007 net income (loss), excluding realized capital losses and the commission accrual adjustment in

2009 discussed below.