The Hartford 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267

|

|

88

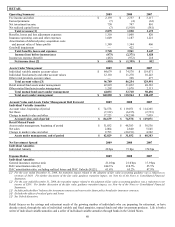

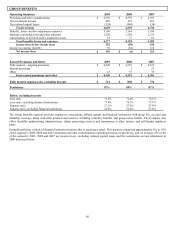

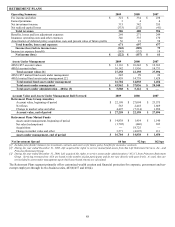

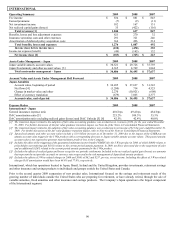

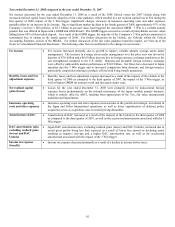

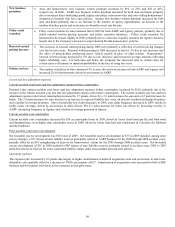

RETIREMENT PLANS

Operating Summary 2009 2008 2007

Fee income and other $ 321 $ 334 $238

Earned premiums 3 4 4

Net investment income 315 342 355

Net realized capital losses (333) (272) (41)

Total revenues 306 408 556

Benefits, losses and loss adjustment expenses 269 271 249

Insurance operating costs and other expenses 346 335 170

Amortization of deferred policy acquisition costs and present value of future profits 56 91 58

Total benefits, losses and expenses 671 697 477

Income (loss) before income taxes (365) (289) 79

Income tax expense (benefit) (143) (132) 18

Net income (loss) $ (222) $ (157) $61

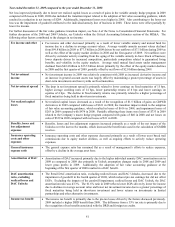

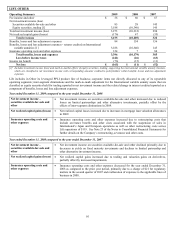

Assets Under Management

2009

2008

2007

403(b)/457 account values $ 11,116 $ 10,242 $12,363

401(k) account values 16,142 11,956 14,731

Total account values [1] 27,258 22,198 27,094

403(b)/457 mutual fund assets under management 245 99 26

401(k) mutual fund assets under management [2] 16,459 14,739 1,428

Total mutual fund assets under management 16,704 14,838 1,454

Total assets under management $ 43,962 $ 37,036 $28,548

Total assets under administration – 401(k) [3] $ 5,588 $ 5,122 $ —

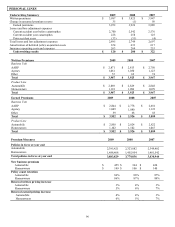

Account Value and Assets Under Management Roll Forward

2009

2008

2007

Retirement Plans Group Annuities

Account value, beginning of period $ 22,198 $ 27,094 $23,575

Net flows 563 2,418 1,669

Change in market value and other 4,497 (7,314) 1,850

Account value, end of period $ 27,258 $22,198 $27,094

Retirement Plans Mutual Funds

Assets under management, beginning of period $ 14,838 $ 1,454 $1,140

Net sales/(redemptions) (1,705) (446) 103

Acquisitions — 18,725 —

Change in market value and other 3,571 (4,895) 211

Assets under management, end of period $ 16,704 $14,838 $1,454

Net Investment Spread

66 bps

92 bps

162 bps

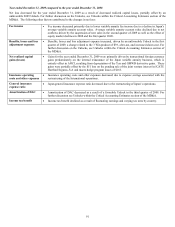

[1] Includes policyholder balances for investment contracts and reserves for future policy benefits for insurance contracts.

[2] During the year ended December 31, 2008, Life acquired the rights to service mutual fund assets from Sun Life Retirement Services, Inc., and

Princeton Retirement Group.

[3] During the year ended December 31, 2008, Life acquired the rights to service assets under administration (“AUA”) from Princeton Retirement

Group. Servicing revenues from AUA are based on the number of plan participants and do not vary directly with asset levels. As such, they are

not included in assets under management upon which asset based returns are calculated.

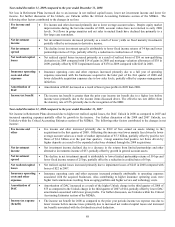

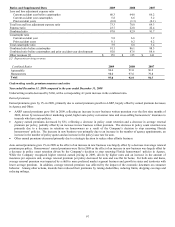

The Retirement Plans segment primarily offers customized wealth creation and financial protection for corporate, government and tax-

exempt employers through its two business units, 403(b)/457 and 401(k).