The Hartford 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

OUTLOOKS

Outlooks

The Hartford provides projections and other forward-looking information in the following discussions, which contain many forward-

looking statements, particularly relating to the Company’ s future financial performance. These forward-looking statements are

estimates based on information currently available to the Company, are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995 and are subject to the precautionary statements set forth on page 3 of this Form 10-K. Actual

results are likely to differ, and in the past have differed, materially from those forecast by the Company, depending on the outcome of

various factors, including, but not limited to, those set forth in each discussion below and in Item 1A, Risk Factors.

Life

Retail

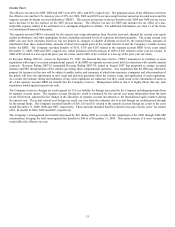

In the long-term, management continues to believe the market for retirement products will expand as individuals increasingly save and

plan for retirement. Demographic trends suggest that as the “baby boom” generation matures, a significant portion of the United States

population will allocate a greater percentage of their disposable incomes to saving for their retirement years due to uncertainty

surrounding the Social Security system and increases in average life expectancy.

Near-term, the Company is continuing to experience lower variable annuity sales as a result of market disruption, and the

competitiveness of the Company’ s current product offerings. The Company expects these lower sales levels to continue into 2010.

Despite the partial equity market recovery over the past nine months, the current market level and market volatility have resulted in

higher claim costs, and have increased the cost and volatility of hedging programs, and the level of capital needed to support living

benefit guarantees. Many competitors have responded to recent market turbulence by increasing the price of their guaranteed living

benefits and changing the amount of the guarantee offered. Management believes that the most significant industry de-risking changes

have occurred. In the first six months of 2009, the Company adjusted pricing levels and took other actions to de-risk its variable annuity

product features in order to address the risks and costs associated with variable annuity benefit features in the current economic

environment and continues to explore other risk limiting techniques such as changes to hedging or other reinsurance structures. The

Company will continue to evaluate the benefits offered within its variable annuities and launched a new variable annuity product in

October 2009 that responds to customer needs for growth and income within the risk tolerances of The Hartford.

Continued equity market volatility or significant declines in interest rates are also likely to continue to impact the cost and effectiveness

of our guaranteed minimum withdrawal benefit (“GMWB”) hedging program and could result in material losses in our hedging

program. For more information on the GMWB hedging program, see the Life Equity Product Risk Management section within Capital

Markets Risk Management.

The Company’ s fixed annuity sales have declined throughout 2009 as a result of lower interest rates and the transition to a new product.

Management expects fixed annuity sales to continue to be challenged until interest rates increase.

For the retail mutual fund business, net sales can vary significantly depending on market conditions, as was experienced throughout

2009. The continued declines in equity markets in the first quarter of 2009 helped drive declines in the Company’ s mutual fund deposits

and assets under management. During the last nine months of 2009, the equity markets improved from the first quarter and certain key

funds performed strongly relative to the market, and as a result, the Company’ s mutual fund assets under management and deposits have

increased correspondingly. As this business continues to evolve, success will be driven by diversifying net sales across the mutual fund

platform, delivering superior investment performance and creating new investment solutions for current and future mutual fund

shareholders.

The decline in assets under management as compared to 2008 is the result of continued depressed values of the equity markets in 2009

as compared to 2008, which has decreased the extent of the scale efficiencies that Retail has benefited from in recent years. The

significant reduction in assets under management has resulted in revenues declining faster than expenses causing lower earnings during

2009. The equity markets have partially recovered during the last nine months of 2009, which has helped improve profitability in recent

quarters, and management expects this improvement to continue into 2010. The equity markets have not recovered to their pre-2008

levels; so while profitability in 2010 is expected to be better than 2009 (barring any significant equity market declines), not withstanding

expense reduction the Company has not recovered the efficiency of scale that it had prior to 2008. Individual Annuity net investment

spread has been impacted by losses on limited partnership and other alternative investments, lower yields on fixed maturities and an

increase in crediting rates on renewals for MVA annuities. Management expects these conditions to persist in 2010. Management has

evaluated, and will continue to actively evaluate, its expense structure to ensure the business is controlling costs while maintaining an

appropriate level of service to our customers.