The Hartford 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

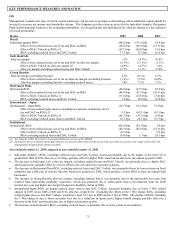

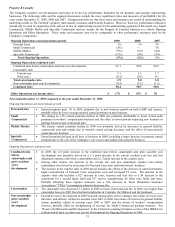

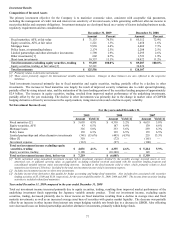

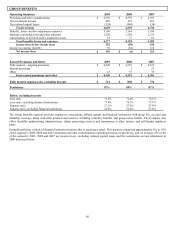

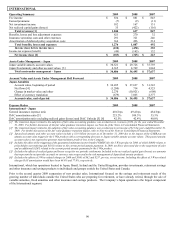

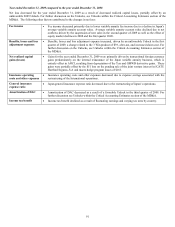

Year ended December 31, 2009 compared to the year ended December 31, 2008

Net loss improved primarily due to lower net realized capital losses as a result of gains in the variable annuity hedge program in 2009

compared with losses in 2008; 2008 also included the transition impact related to the adoption of fair value accounting guidance, which

resulted in a reduction in net income of $209. Additionally, impairment losses were higher in 2008. Also contributing to the lower net

loss was the impairment of goodwill attributed to the individual annuity line of business in 2008. These items were offset partially by

lower fee income.

For further discussion of the fair value guidance transition impact, see Note 4 of the Notes to Consolidated Financial Statements. For

further discussion of the 2009 and 2008 Unlocks, see Unlocks within the Critical Accounting Estimates section of the MD&A. The

following other factors contributed to the changes in net income:

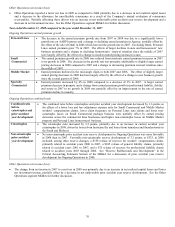

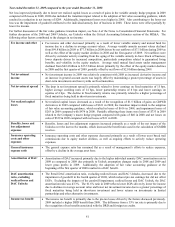

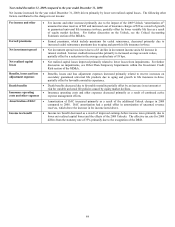

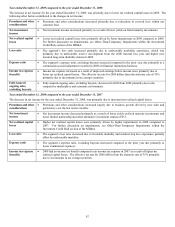

Fee income and other • Fee income and other decreased primarily as a result of lower variable annuity and mutual fund fee

income due to a decline in average account values. Average variable annuity account values declined

from $99.8 billion in 2008 to $77.3 billion in 2009 driven by net outflows of $7.1 billion during 2009 as

well as the effect of the equity market declines in 2008 and the first quarter of 2009. Net outflows were

driven by surrender activity resulting from the aging of the variable annuity in-force block of business;

lower deposits driven by increased competition, particularly competition related to guaranteed living

benefits, and volatility in the equity markets. Average retail mutual fund assets under management

declined from $42.4 billion to $35.5 billion driven primarily by the effect of the equity market declines

in 2008 and the first quarter of 2009, partially offset by net flows of $2.0 billion during 2009.

Net investment

income

• Net investment income in 2009 was relatively consistent with 2008 as increased derivative income and

an increase in general account assets was largely offset by maintaining a greater percentage of assets in

short-term investments and lower yields on fixed maturities.

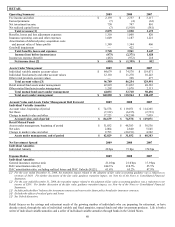

Net investment spread • The drop in net investment spread is primarily related to lower earnings on fixed maturities of 15 bps,

higher average crediting rates of 14 bps, lower partnership returns of 8 bps and lower earnings on

equities of 4 bps. The decline in fixed maturity returns was primarily related to a higher percentage of

fixed maturities being held in short-term investments.

Net realized capital

losses

• Net realized capital losses decreased as a result of the recognition of $1.5 billion of gains on GMWB

derivatives in 2009 compared with losses of $631 in 2008; the transition impact related to the adoption

of fair value accounting guidance, which resulted in losses of $616 in 2008; and impairment losses of

$263 in 2009 compared with $474 in 2008. Partially offsetting these items were losses of $733 in 2009

related to the Company’ s macro hedge program compared with gains of $40 in 2008 and net losses on

sales of $329 in 2009 compared with net losses of $31 in 2008.

Benefits, losses and

loss adjustment

expenses

• Benefits, losses and loss adjustment expenses increased primarily as a result of the net impact of the

Unlocks over the last twelve months, which increased the benefit ratio used in the calculation of GMDB

reserves.

Insurance operating

costs and other

expenses

• Insurance operating costs and other expenses decreased primarily as a result of lower asset based trail

commissions due to equity market declines, as well as ongoing efforts to actively reduce operating

expenses.

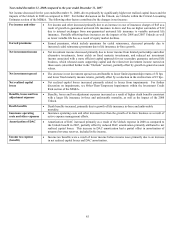

General insurance

expense ratio

• The general expense ratio has remained flat as a result of management’ s efforts to reduce expenses,

offset by a decline in the average asset base.

Amortization of DAC • Amortization of DAC increased primarily due to the higher individual annuity DAC amortization rate in

2009 as compared to 2008 due primarily to Unlock assumption changes made in 2008 and 2009 and

lower gross profits in 2009. Additionally, the adoption of fair value accounting guidance at the

beginning of the first quarter of 2008 resulted in a DAC benefit.

DAC amortization

ratio, excluding

realized losses and

DAC Unlocks

• The Retail DAC amortization ratio, excluding realized losses and DAC Unlocks, decreased due to the

impairment of goodwill in the fourth quarter of 2008, which reduced pre-tax earnings but did not affect

EGPs. Excluding the impacts of the goodwill impairment, realized losses and DAC Unlock, the DAC

amortization ratio was 43.3%. The 61.6% ratio in 2009 reflects lower EGPs driven by lower fee income

due to declines in average account value and lower net investment income due to a greater percentage of

fixed maturities being held in short-term investment and lower returns on investments in limited

partnerships and other alternative investments.

Income tax benefit • The income tax benefit is primarily due to the pre-tax losses driven by the factors discussed previously.

2009 included a higher DRD benefit than 2008. The difference from a 35% tax rate is primarily due to

the recognition of tax benefits associated with the DRD and foreign tax credits.