The Hartford 2009 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-64

12. Commitments and Contingencies (continued)

In July 2009, The Hartford reached an agreement in principle to settle, for an immaterial amount, two consolidated derivative actions

filed in the United States District Court for the District of Connecticut by shareholders on behalf of the Company against its directors

and an additional executive officer alleging that the defendants knew adverse non-public information about the activities alleged in the

Marsh complaint and concealed and misappropriated that information to make profitable stock trades in violation of their duties to the

Company. The settlement received preliminary court approval in January 2010. A final approval hearing is scheduled for March 2010.

Investment and Savings Plan ERISA Class Action Litigation – In November and December 2008, following a decline in the share price

of the Company’ s common stock, seven putative class action lawsuits were filed in the United States District Court for the District of

Connecticut on behalf of certain participants in the Company’ s Investment and Savings Plan (the “Plan”), which offers the Company’ s

common stock as one of many investment options. These lawsuits have been consolidated, and a consolidated amended class-action

complaint was filed on March 23, 2009, alleging that the Company and certain of its officers and employees violated ERISA by

allowing the Plan’ s participants to invest in the Company’ s common stock and by failing to disclose to the Plan’ s participants

information about the Company’ s financial condition. The lawsuit seeks restitution or damages for losses arising from the investment of

the Plan’ s assets in the Company’ s common stock during the period from December 10, 2007 to the present. In January 2010, the

district court denied the Company’ s motion to dismiss the consolidated amended complaint. The Company disputes the allegations and

intends to defend this action vigorously.

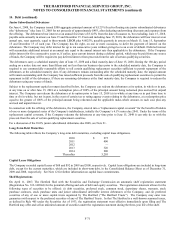

Structured Settlement Class Action – In October 2005, a putative nationwide class action was filed in the United States District Court for

the District of Connecticut against the Company and several of its subsidiaries on behalf of persons who had asserted claims against an

insured of a Hartford property & casualty insurance company that resulted in a settlement in which some or all of the settlement amount

was structured to afford a schedule of future payments of specified amounts funded by an annuity from a Hartford life insurance

company (“Structured Settlements”). The operative complaint alleges that since 1997 the Company has systematically deprived the

settling claimants of the value of their damages recoveries by secretly deducting 15% of the annuity premium of every Structured

Settlement to cover brokers’ commissions, other fees and costs, taxes, and a profit for the annuity provider, and asserts claims under the

Racketeer Influenced and Corrupt Organizations Act (“RICO”) and state law. The plaintiffs seek compensatory damages, punitive

damages, pre-judgment interest, attorney’ s fees and costs, and injunctive or other equitable relief. The Company vigorously denies that

any claimant was misled or otherwise received less than the amount specified in the structured-settlement agreements. In March 2009,

the district court certified a class for the RICO and fraud claims composed of all persons, other than those represented by a plaintiffs’

broker, who entered into a Structured Settlement since 1997 and received certain written representations about the cost or value of the

settlement. The district court declined to certify a class for the breach-of-contract and unjust-enrichment claims. The Company’ s

petition to the United States Court of Appeals for the Second Circuit for permission to file an interlocutory appeal of the class-

certification ruling was denied in October 2009. A trial on liability and the methodology for computing class-wide damages is

scheduled to commence in September 2010. It is possible that an adverse outcome could have a material adverse effect on the

Company’ s financial condition, consolidated results of operations or cash flows. The Company is defending this litigation vigorously.

Fair Credit Reporting Act Class Action – In February 2007, the United States District Court for the District of Oregon gave final

approval of the Company’ s settlement of a lawsuit brought on behalf of a class of homeowners and automobile policy holders alleging

that the Company willfully violated the Fair Credit Reporting Act by failing to send appropriate notices to new customers whose initial

rates were higher than they would have been had the customer had a more favorable credit report. The Company paid approximately

$84.3 to eligible claimants and their counsel in connection with the settlement, and sought reimbursement from the Company’ s Excess

Professional Liability Insurance Program for the portion of the settlement in excess of the Company’ s $10 self-insured retention.

Certain insurance carriers participating in that program disputed coverage for the settlement, and one of the excess insurers commenced

an arbitration that resulted in an award in the Company’ s favor and payments to the Company of approximately $30.1, thereby

exhausting the primary and first-layer excess policies. In June 2009, the second-layer excess carriers commenced an arbitration to

resolve the dispute over coverage for the remainder of the amounts paid by the Company. Management believes it is probable that the

Company’ s coverage position ultimately will be sustained.

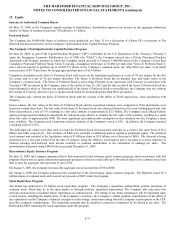

Shareholder Demand - Like the boards of directors of many other companies, The Hartford’ s Board of Directors (the “Board”) has

received a demand from SEIU Pension Plans Master Trust, which purports to be a current holder of the Company’ s common stock. The

demand requests the Board to bring suit to recover alleged excessive compensation paid to senior executives of the Company from 2005

through the present and to change the Company’ s executive compensation structure. The Board investigated the allegations in the

demand and, in December 2009, communicated to SEIU the Board’ s determination that there is no basis for the Company to assert the

requested claims and such claims would not be in the best interest of shareholders or the Company.