The Hartford 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-13

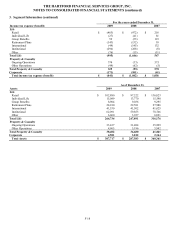

3. Segment Information

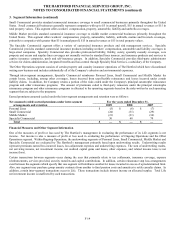

The Hartford is organized into two major operations: Life and Property & Casualty, each containing reporting segments. Within the

Life and Property & Casualty operations, The Hartford conducts business principally in eleven reporting segments. Corporate primarily

includes the Company’ s debt financing and related interest expense, as well as other capital raising activities, banking operations and

certain purchase accounting adjustments.

Life

Life’ s business is conducted by Hartford Life, Inc. (“Hartford Life” or “Life”), an indirect subsidiary of The Hartford, headquartered in

Simsbury, Connecticut, and is a financial services and insurance organization. Life is organized into six reporting segments, Retail

Products Group (“Retail”), Individual Life, Group Benefits, Retirement Plans, International and Institutional Solutions Group

(“Institutional”).

Retail offers individual variable and fixed market value adjusted (“MVA”) annuities, retail mutual funds, and 529 college savings plans.

Individual Life sells a variety of life insurance products, including variable universal life, universal life, interest sensitive whole life and

term life.

Group Benefits provides individual members of employer groups, associations, affinity groups and financial institutions with group life,

accident and disability coverage, along with other products and services, including voluntary benefits, and group retiree health.

Retirement Plans provides products and services to corporations pursuant to Section 401(k) and products and services to municipalities

and not-for-profit organizations under Section 457 and 403(b) of the IRS code.

International provides investments, retirement savings and other insurance and savings products to individuals and groups outside the

United States. The Company’ s Japan operation is the largest component of the International segment. In the second quarter 2009, after

a strategic review of the Company’ s core business structure, new product sales in International’ s Japan and European operations were

suspended. Subsequently, International’ s operations were restructured to maximize profitability and capital efficiency while continuing

to focus on risk management and maintain appropriate service levels.

Institutional primarily offers institutional liability products, such as variable Private Placement Life Insurance (“PPLI”) owned by

corporations and high net worth individuals, and mutual funds to institutional investors. Institutional continues to service existing

customers of its discontinued businesses which includes stable value products, structured settlements and institutional annuities

(primarily terminal funding cases, single premium immediate annuities and longevity assurance).

Life includes within its Other segment its leveraged PPLI product line of business; corporate items not directly allocated to any of its

reportable operating segments; intersegment eliminations and the mark-to-mark adjustment for the International variable annuity assets

that are classified as equity securities, trading, reported in net investment income and the related change in interest credited reported as a

component of benefits, losses and loss adjustment expenses.

Life charges direct operating expenses to the appropriate segment and allocates the majority of indirect expenses to the segments based

on an intercompany expense arrangement. Inter-segment revenues primarily occur between Life’ s Other category and the reporting

segments. These amounts primarily include interest income on allocated surplus and interest charges on excess separate account

surplus.

The accounting policies of the reporting segments are the same as those described in the summary of significant accounting policies in

Note 1. Life evaluates performance of its segments based on revenues, net income and the segment’ s return on allocated capital. Each

reporting segment is allocated corporate surplus as needed to support its business.

Property & Casualty

Property & Casualty is organized into five reporting segments: the underwriting segments of Personal Lines, Small Commercial, Middle

Market and Specialty Commercial (collectively “Ongoing Operations”); and the Other Operations segment.

Personal Lines sells automobile, homeowners and home-based business coverages directly to the consumer and through a network of

independent agents. Most of the Company’ s personal lines business sold directly to the consumer is to the members of AARP through a

direct marketing operation. Personal Lines also operates a member contact center for health insurance products offered through the

AARP Health program. AARP accounts for earned premiums of $2.8 billion, $2.8 billion, and $2.7 billion in 2009, 2008 and 2007,

respectively, which represented 29%, 27% and 26% of total Property & Casualty earned premiums for 2009, 2008 and 2007,

respectively.