The Hartford 2009 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267

|

|

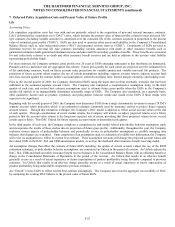

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-43

5. Investments and Derivative Instruments (continued)

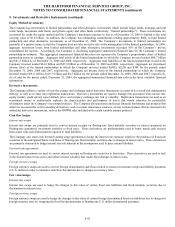

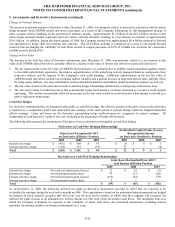

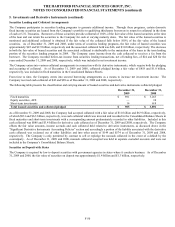

GMWB reinsurance contracts

The Company has entered into reinsurance arrangements to offset a portion of its risk exposure to the GMWB for the remaining lives of

covered variable annuity contracts. Reinsurance contracts covering GMWB are accounted for as free-standing derivatives. The

notional amount of the reinsurance contracts is the GRB amount.

GMWB hedging instruments

The Company enters into derivative contracts to partially hedge exposure to the income volatility associated with the portion of the

GMWB liabilities which are not reinsured. These derivative contracts include customized swaps, interest rate swaps and futures, and

equity swaps, options, and futures, on certain indices including the S&P 500 index, EAFE index, and NASDAQ index. As of December

31, 2009, the notional amount related to the GMWB hedging instruments is $15.6 billion and consists of $10.8 billion of customized

swaps, $1.8 billion of interest rate swaps and futures, and $3.0 billion of equity swaps, options, and futures.

Macro hedge program

The Company utilizes equity options, currency options, and equity futures contracts to partially hedge the statutory reserve impact of

equity risk and foreign currency risk arising primarily from guaranteed minimum death benefit (“GMDB”), GMIB and GMWB

obligations against a decline in the equity markets or changes in foreign currency exchange rates. As of December 31, 2009, the

notional amount related to the macro hedge program is $27.4 billion and consists of $25.1 billion of equity options, $2.1 billion of

currency options, and $0.2 billion of equity futures. The $27.4 billion of notional includes $1.2 billion of short put option contracts,

therefore resulting in a net notional amount for the macro hedge program of approximately $26.2 billion.

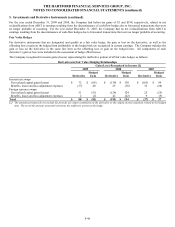

GMAB product derivatives

The GMAB rider associated with certain of the Company’ s Japanese variable annuity products is accounted for as a bifurcated

embedded derivative. The GMAB provides the policyholder with their initial deposit in a lump sum after a specified waiting period.

The notional amount of the embedded derivative is the Yen denominated GRB balance converted to U.S. dollars at the current foreign

spot exchange rate as of the reporting period date.

Contingent capital facility put option

The Company entered into a put option agreement that provides the Company the right to require a third-party trust to purchase, at any

time, The Hartford’ s junior subordinated notes in a maximum aggregate principal amount of $500. Under the put option agreement,

The Hartford will pay premiums on a periodic basis and will reimburse the trust for certain fees and ordinary expenses.