The Hartford 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

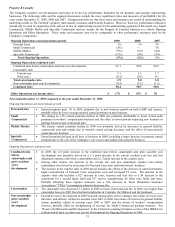

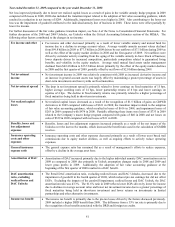

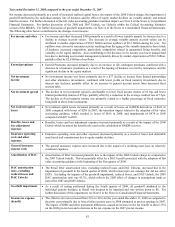

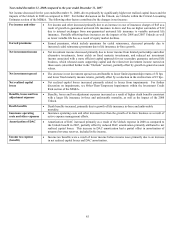

Year ended December 31, 2008 compared to the year ended December 31, 2007

Total net investment income decreased primarily due to equity securities, trading, resulting from a decline in the value of the underlying

investment funds supporting the Japanese variable annuity product due to negative market performance year over year. Total net

investment income, excluding equity securities, trading, decreased primarily due to lower income on limited partnerships and other

alternative investments and fixed maturities. The decline in limited partnerships and other alternative investments yield was largely due

to negative returns on hedge funds and real estate partnerships as a result of the lack of liquidity in the financial markets and a wider

credit spread environment. The decline in fixed maturity income was primarily due to lower yield on variable rate securities due to

declines in short-term interest rates and increased allocation to lower yielding U.S. Treasuries and short-term investments.

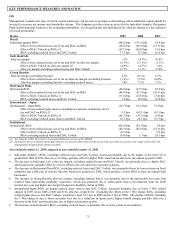

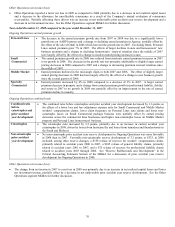

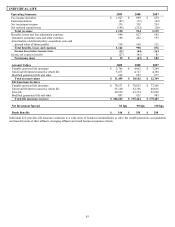

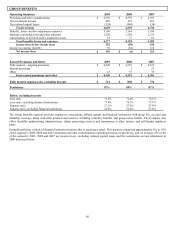

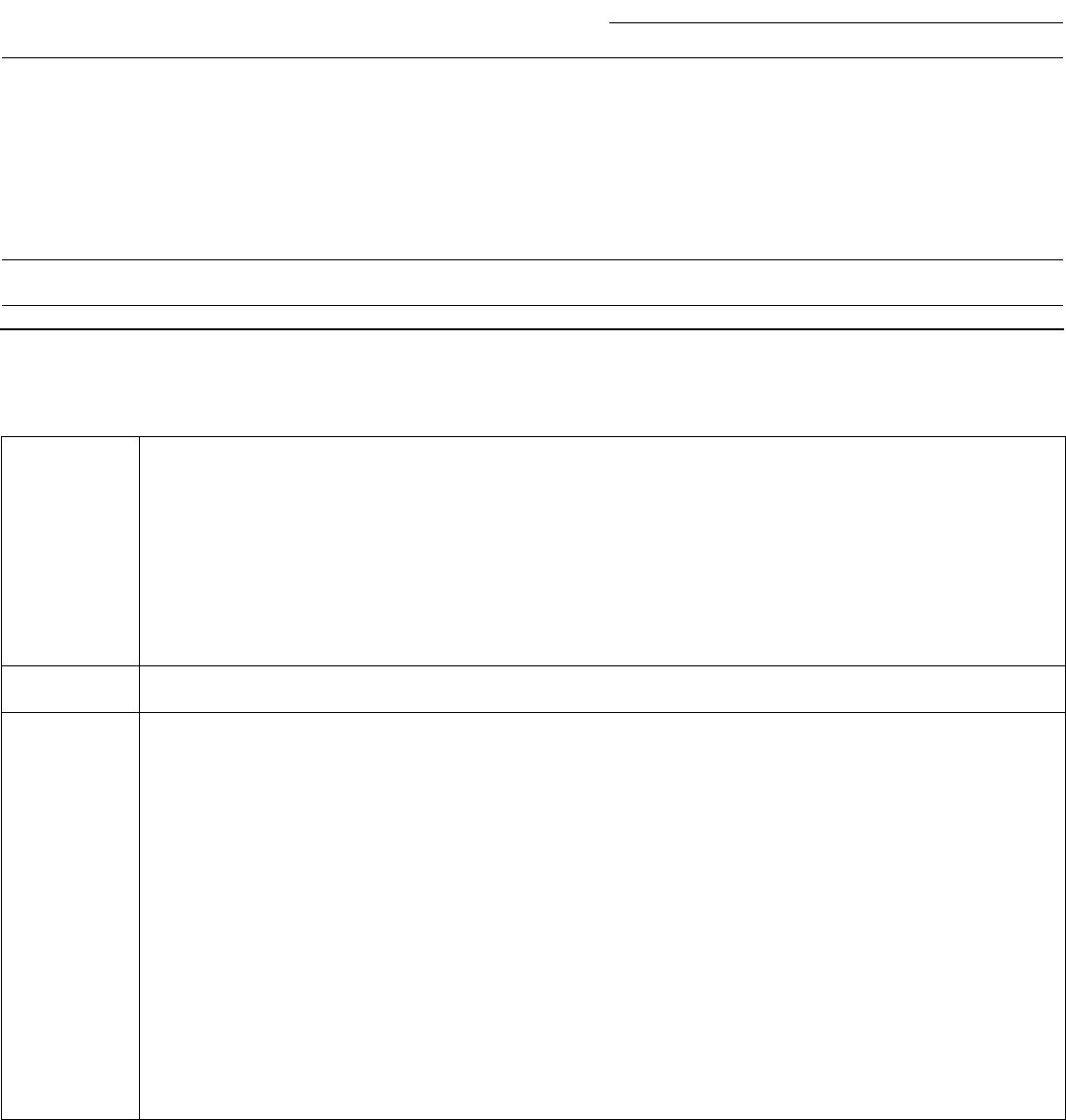

Net Realized Capital Losses

For the years ended December 31,

2009 2008 2007

Gross gains on sales $1,056 $ 607 $374

Gross losses on sales (1,397) (856) (291)

Net OTTI losses recognized in earnings (1,508) (3,964) (483)

Japanese fixed annuity contract hedges, net [1] 47 64 18

Periodic net coupon settlements on credit derivatives/Japan (49) (33) (25)

Fair value measurement transition impact [2] — (650) —

Results of variable annuity hedge program

GMWB derivatives, net 1,526 (713) (286)

Macro hedge program (895) 74 (12)

Total results of variable annuity hedge program 631 (639) (298)

Other, net (790) (447) (289)

Net realized capital losses, before-tax $(2,010) $ (5,918) $(994)

[1] Relates to derivative hedging instruments, excluding periodic net coupon settlements, and is net of the Japanese fixed annuity product liability

adjustment for changes in the dollar/yen exchange spot rate.

[2] See Note 4a of the Notes to Consolidated Financial Statements.

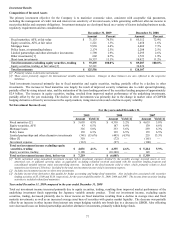

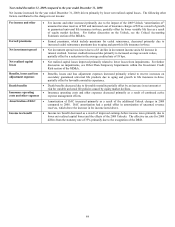

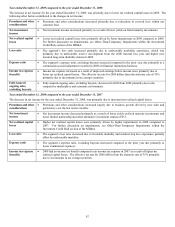

The circumstances giving rise to the Company’ s net realized capital gains and losses are as follows:

Gross

g

ains and

losses on sales

• Gross gains and losses on sales for the year ended December 31, 2009 were predominantly within corporate,

government and structured securities. Also included were gains of $360 related to the sale of Verisk/ISO

securities. Gross gains and losses on sales primarily resulted from efforts to reduce portfolio risk through sales

of subordinated financials and real estate related securities and from sales of U.S. Treasuries to manage

liquidity.

• Gross gains and losses on sales for the year ended December 31, 2008 primarily resulted from the decision to

reallocate the portfolio to securities with more favorable risk/return profiles. Also included was a gain of $141

from the sale of a synthetic CDO.

• Gross gains and losses on sales for the year ended December 31, 2007 were primarily comprised of corporate,

foreign government and municipal securities.

Net OTTI losses • For further information, see Other-Than-Temporary Impairments within the Investment Credit Risk section of

the MD&A.

Variable

annuity hedge

program

• For the year ended December 31, 2009, the net gain on GMWB related derivatives was primarily due to liability

model assumption updates related to favorable policyholder experience of $566, the relative outperformance of

the underlying actively managed funds as compared to their respective indices of $550, and the impact of the

Company’ s own credit standing of $154. Additional net gains of $56 resulted from lower implied market

volatility and a general increase in long-term interest rates, partially offset by rising equity markets. Increasing

equity markets resulted in a loss of $895 related to the Company’ s macro hedge program. Total gains related to

GMWB hedging in 2009 were $1.5 billion. For further information, see Note 4a of the Notes to Consolidated

Financial Statements. In addition, see the Company’ s variable annuity hedging program sensitivity disclosures

within Capital Markets Risk Management section of the MD&A.

• For the year ended December 31, 2008, the net loss on GMWB derivatives was primarily due to losses of $904

related to market-based hedge ineffectiveness due to extremely volatile capital markets and $355 related to the

relative underperformance of the underlying actively managed funds as compared to their respective indices,

partially offset by gains of $470 in the fourth quarter related to liability model assumption updates for lapse

rates.

• For the year ended December 31, 2007, the net loss on GMWB derivatives was primarily due to losses of $158

related to liability model assumption updates and model refinements made during the year, including those for

dynamic lapse behavior and correlations of market returns across underlying indices, as well as updates to

reflect newly reliable market inputs for volatility.