The Hartford 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-10

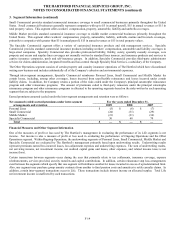

1. Basis of Presentation and Accounting Policies (continued)

Significant Accounting Policies

The Company’ s significant accounting policies are described below or are referenced below to the applicable Note where the

description is included.

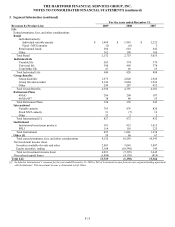

Accounting Policy Note

Fair Value Measurements – Financial Instruments Excluding Guaranteed Living Benefits 4

Fair Value Measurements – Guaranteed Living Benefits 4a

Investments and Derivative Instruments 5

Reinsurance 6

Deferred Policy Acquisition Costs and Present Value of Future Profits 7

Goodwill and Other Intangible Assets 8

Separate Accounts 9

Sales Inducements 10

Reserve for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses 11

Contingencies 12

Income Tax 13

Pension Plans and Postretirement Healthcare and Life Insurance Benefit Plans 17

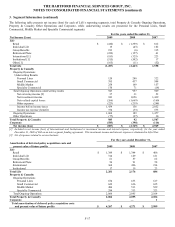

Dividends to Policyholders

Policyholder dividends are paid to certain life and property and casualty policies, which are referred to as participating policies. Such

dividends are accrued using an estimate of the amount to be paid based on underlying contractual obligations under policies and

applicable state laws.

Life — Participating ordinary life insurance in force accounted for 7% as of December 31, 2009, 2008 and 2007 of total life insurance in

force. Dividends to policyholders were $13, $14 and $11 for the years ended December 31, 2009, 2008 and 2007, respectively. There

were no additional amounts of income allocated to participating policyholders. If limitations exist on the amount of net income from

participating life insurance contracts that may be distributed to stockholders, the policyholder’ s share of net income on those contracts

that cannot be distributed is excluded from stockholders’ equity by a charge to operations and a credit to a liability.

Property & Casualty — Net written premiums for participating property and casualty insurance policies represented 8% of total net

written premiums for each of the years ended December 31, 2009, 2008 and 2007. Participating dividends to policyholders were $10,

$21 and $19 for the years ended December 31, 2009, 2008 and 2007, respectively.

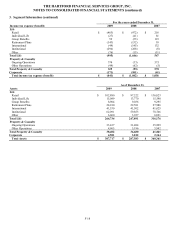

Foreign Currency Translation

Foreign currency translation gains and losses are reflected in stockholders’ equity as a component of accumulated other comprehensive

income (loss). The Company’ s foreign subsidiaries’ balance sheet accounts are translated at the exchange rates in effect at each year

end and income statement accounts are translated at the average rates of exchange prevailing during the year. The national currencies of

the international operations are generally their functional currencies.

Mutual Funds

The Company maintains a retail mutual fund operation, whereby the Company, through wholly-owned subsidiaries, provides investment

management and administrative services to series of The Hartford Mutual Funds, Inc.; The Hartford Mutual Funds II, Inc.; and The

Hartford Income Shares Fund, Inc. (collectively, “mutual funds”), consisting of 52 mutual funds and 1 closed-end fund, as of December

31, 2009. The Company charges fees to these funds, which are recorded as revenue by the Company. These mutual funds are registered

with the Securities and Exchange Commission under the Investment Company Act of 1940. The Company, through its wholly-owned

subsidiaries, also provides investment management and administrative services (for which it receives revenue) for 18 mutual funds

established under the laws of the Province of Ontario, Canada, and registered with the Ontario Securities Commission.

The mutual funds are owned by the shareholders of those funds and not by the Company. As such, the mutual fund assets and liabilities

and related investment returns are not reflected in the Company’ s Consolidated Financial Statements since they are not assets, liabilities

and operations of the Company.