The Hartford 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

THE HARTFORD’S OPERATIONS OVERVIEW

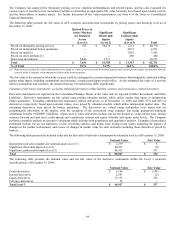

The Hartford is organized into two major operations: Life and Property & Casualty, each containing reporting segments. The following

discussion describes the Life and Property & Casualty operations.

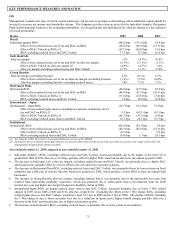

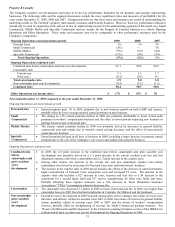

The Company considers several measures and ratios in assessing the performance its life and property and casualty underwriting

businesses. The following discussions include the more significant ratios and measures of profitability for the years ended December 31,

2009, 2008 and 2007. Management believes that these ratios and measures are useful in understanding the underlying trends in The

Hartford’ s businesses. However, these performance indicators should only be used in conjunction with, and not in lieu of, net income

for The Hartford as a whole. These ratios and measures may not be comparable to other performance measures used by the Company’ s

competitors.

Life Operations

Life is organized into six reporting segments, Retail Products Group (“Retail”), Individual Life, Group Benefits, Retirement Plans,

International and Institutional Solutions Group (“Institutional”). Through Life, the Company provides retail and institutional investment

products such as variable and fixed annuities, mutual funds, private placement life insurance and retirement plan services, individual life

insurance products including variable universal life, universal life, interest sensitive whole life and term life; and group benefit products,

such as group life and group disability insurance.

Life derives its revenues principally from: (a) fee income, including asset management fees, on separate account and mutual fund assets

and mortality and expense fees, as well as cost of insurance charges; (b) net investment income on general account assets; (c) fully

insured premiums; and (d) certain other fees. Asset management fees and mortality and expense fees are primarily generated from

separate account assets, which are deposited with Life through the sale of variable annuity and variable universal life products and from

mutual funds. Cost of insurance charges are assessed on the net amount at risk for investment-oriented life insurance products.

Premium revenues are derived primarily from the sale of group life, group disability and individual term insurance products.

Life’ s expenses essentially consist of interest credited to policyholders on general account liabilities, insurance benefits provided,

amortization of deferred policy acquisition costs, expenses related to selling and servicing the various products offered by the Company,

dividends to policyholders, and other general business expenses.

Life’ s financial results in its variable annuity, mutual fund and, to a lesser extent, variable universal life businesses, depends largely on

the amount of the contract holder account value or assets under management on which it earns fees and the level of fees charged.

Changes in account value or assets under management are driven by two main factors: net flows, which measure the success of the

Company’ s asset gathering and retention efforts, and the market return of the funds, which is heavily influenced by the return realized in

the equity markets. Net flows are comprised of new sales and other deposits less surrenders, death benefits, policy charges and

annuitizations of investment type contracts, such as variable annuity contracts. In the mutual fund business, net flows are known as net

sales. Net sales are comprised of new sales less redemptions by mutual fund customers. Life uses the average daily value of the S&P

500 Index as an indicator for evaluating market returns of the underlying account portfolios in the United States. Relative financial

results of variable products are highly correlated to the growth in account values or assets under management since these products

generally earn fee income on a daily basis. Equity market movements could also result in benefits for or charges against deferred

acquisition costs. See the Critical Accounting Estimates section of MD&A for further information on DAC Unlocks. During 2009,

primarily as a result of current market conditions, the Company recorded an after tax Unlock charge of $(1,034).

The profitability of Life’ s fixed annuities and other “spread-based” products depends largely on its ability to earn target spreads between

earned investment rates on its general account assets and interest credited to policyholders. Profitability is also influenced by operating

expense management including the benefits of economies of scale in the administration of its United States variable annuity businesses

in particular. In addition, the size and persistency of gross profits from these businesses is an important driver of earnings as it affects

the rate of amortization of deferred policy acquisition costs.

Life’ s profitability in its individual life insurance and group benefits businesses depends largely on the size of its in force block, the

adequacy of product pricing and underwriting discipline, actual mortality and morbidity experience, and the efficiency of its claims and

expense management.