The Hartford 2009 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-45

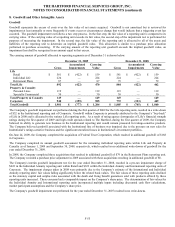

5. Investments and Derivative Instruments (continued)

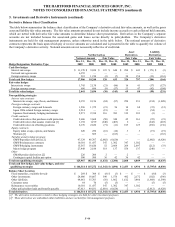

Change in Notional Amount

The increase in notional amount of derivatives since December 31, 2008, was primarily related to derivatives associated with the macro

hedge program, while GMWB related derivatives decreased, as a result of the Company rebalancing its risk management strategy to

place a greater relative emphasis on the protection of statutory surplus. Approximately $1.2 billion of the $25.3 billion increase in the

macro hedge notional amount represents short put option contracts therefore resulting in a net increase in notional of approximately

$24.1 billion. In addition, during the fourth quarter of 2009, the Company entered into approximately $6.4 billion notional of forward

rate agreements to hedge short term interest rate exposure. This $6.4 billion notional is comprised of a series of one month forward

contracts that are hedging the variability of cash flows related to coupon payments on $555 of variable rate securities for consecutive

monthly periods during 2010.

Change in Fair Value

The increase in the total fair value of derivative instruments since December 31, 2008, was primarily related to a net increase in fair

value of all GMWB related derivatives, partially offset by a decline in fair value of interest rate derivatives and credit derivatives.

• The net improvement in the fair value of GMWB related derivatives is primarily due to liability model assumption updates related

to favorable policyholder experience, the relative outperformance of the underlying actively managed funds as compared to their

respective indices, and the impacts of the Company’ s own credit standing. Additional improvements in the net fair value of

GMWB related derivatives include lower implied market volatility and a general increase in long-term interest rates, partially offset

by rising equity markets. For more information on the policyholder behavior and liability model assumption updates, see Note 4a.

• The fair value of interest rate derivatives used in cash flow hedge relationships declined due to rising long-term interest rates.

• The fair value related to credit derivatives that economically hedge fixed maturity securities decreased as a result of credit spreads

tightening. This decline was partially offset by an increase in the fair value related to credit derivatives that assume credit risk as a

part of replication transactions.

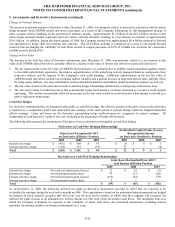

Cash Flow Hedges

For derivative instruments that are designated and qualify as cash flow hedges, the effective portion of the gain or loss on the derivative

is reported as a component of OCI and reclassified into earnings in the same period or periods during which the hedged transaction

affects earnings. Gains and losses on the derivative representing hedge ineffectiveness are recognized in current earnings. All

components of each derivative’ s gain or loss were included in the assessment of hedge effectiveness.

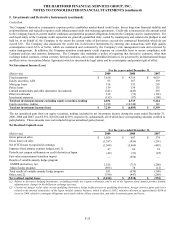

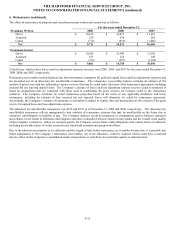

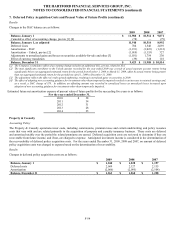

The following table presents the components of the gain or loss on derivatives that qualify as cash flow hedges:

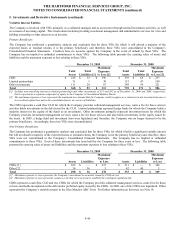

Derivatives in Cash Flow Hedging Relationships

Gain (Loss) Recognized in OCI

on Derivative (Effective Portion)

Net Realized Capital Gains (Losses)

Recognized in Income

on Derivative (Ineffective Portion)

2009 2008 2007 2009 2008 2007

Interest rate swaps $ (461) $ 908 $ 97 $ (3) $ 9 $ 3

Foreign currency swaps (194) 233 (53) 75 — (2)

Total $ (655) $ 1,141 $ 44 $ 72 $ 9 $ 1

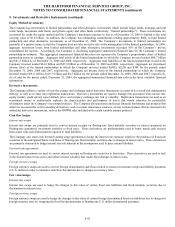

Derivatives in Cash Flow Hedging Relationships

Gain (Loss) Reclassified from AOCI

into Income (Effective Portion)

2009 2008 2007

Interest rate swaps Net realized capital gains (losses) $ 11 $ 34 $ (3)

Interest rate swaps Net investment income (loss) 47 (17) (20)

Foreign currency swaps Net realized capital gains (losses) (119) (83) (79)

Foreign currency swaps Net investment income (loss) 2 1 —

Total $ (59) $ (65) $ (102)

As of December 31, 2009, the before-tax deferred net gains on derivative instruments recorded in AOCI that are expected to be

reclassified to earnings during the next twelve months are $44. This expectation is based on the anticipated interest payments on hedged

investments in fixed maturity securities that will occur over the next twelve months, at which time the Company will recognize the

deferred net gains (losses) as an adjustment to interest income over the term of the investment cash flows. The maximum term over

which the Company is hedging its exposure to the variability of future cash flows (for forecasted transactions, excluding interest

payments on existing variable-rate financial instruments) is 3 years.