The Hartford 2009 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-86

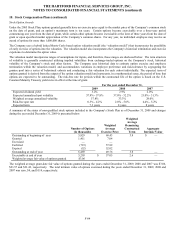

18. Stock Compensation Plans (continued)

Employee Stock Purchase Plan

In 1996, the Company established The Hartford Employee Stock Purchase Plan (“ESPP”). In 2009 and prior years, under this plan,

eligible employees of The Hartford purchased common stock of the Company at a 15% discount from the lower of the closing market

price at the beginning or end of the offering period. Employees purchase a variable number of shares of stock through payroll

deductions elected as of the beginning of the offering period. The Company may sell up to 15,400,000 shares of stock to eligible

employees under the ESPP. As of December 31, 2009, there were 7,970,259 shares available for future issuance. During the years

ended December 31, 2009, 2008 and 2007, 2,557,893, 964,365 and 372,993 shares were sold, respectively. The weighted average per

share fair value of the discount under the ESPP was $5.99, $14.12 and $18.98 during the years ended December 31, 2009, 2008 and

2007 respectively. The fair value is estimated based on the 15% discount off of the beginning stock price plus the value of six-month

European call and put options on shares of stock at the beginning stock price calculated using the Black-Scholes model and the

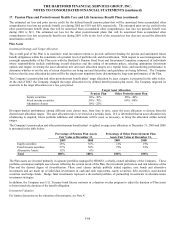

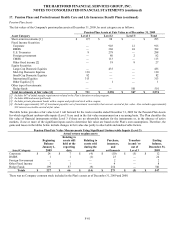

following weighted average valuation assumptions:

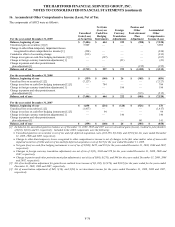

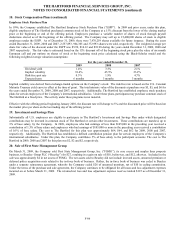

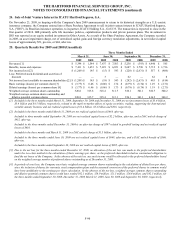

For the year ended December 31,

2009 2008 2007

Dividend yield 1.4% 3.5% 2.1%

Implied volatility 91.4% 45.5% 23.2%

Risk-free spot rate 0.3% 1.9% 4.7%

Expected term 6 months 3 months 3 months

Implied volatility was derived from exchange-traded options on the Company’ s stock. The risk-free rate is based on the U.S. Constant

Maturity Treasury yield curve in effect at the time of grant. The total intrinsic value of the discounts at purchase was $5, $5, and $6 for

the years ended December 31, 2009, 2008 and 2007, respectively. Additionally, The Hartford has established employee stock purchase

plans for certain employees of the Company’ s international subsidiaries. Under these plans, participants may purchase common stock of

The Hartford at a fixed price. The activity under these programs is not material.

Effective with the offering period beginning January 2010, the discount rate will change to 5% and the discounted price will be based on

the market price per share on the last trading day of the offering period.

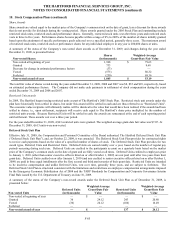

19. Investment and Savings Plan

Substantially all U.S. employees are eligible to participate in The Hartford’ s Investment and Savings Plan under which designated

contributions may be invested in common stock of The Hartford or certain other investments. These contributions are matched, up to

3% of base salary, by the Company. In 2009, employees who had earnings of less than $105,000 in the preceding year received a

contribution of 1.5% of base salary and employees who had earnings of $105,000 or more in the preceding year received a contribution

of 0.5% of base salary. The cost to The Hartford for this plan was approximately $64, $64, and $62 for 2009, 2008 and 2007,

respectively. Additionally, The Hartford has established a defined contribution pension plan for certain employees of the Company’ s

international subsidiaries. Under this plan, the Company contributes 5% of base salary to the participant accounts. The cost to The

Hartford in 2009, 2008 and 2007 for this plan was $2, $2 and $2, respectively.

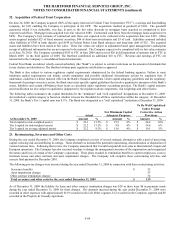

20. Sale of First State Management Group

On March 31, 2009, the Company sold First State Management Group, Inc. (“FSMG”), its core excess and surplus lines property

business, to Beazley Group PLC (“Beazley”) for $27, resulting in a gain on sale of $18, before-tax, and $12, after-tax. Included in the

sale was approximately $4 in net assets of FSMG. The net assets sold to Beazley did not include invested assets, unearned premium or

deferred policy acquisition costs related to the in-force book of business. Rather, the in-force book of business was ceded to Beazley

under a separate reinsurance agreement, whereby the Company ceded $26 of unearned premium, net of $10 in ceding commission.

Under the terms of the purchase and sale agreement, the Company continues to be obligated for all losses and loss adjustment expenses

incurred on or before March 31, 2009. The retained net loss and loss adjustment expense reserves totaled $125 as of December 31,

2009.