The Hartford 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

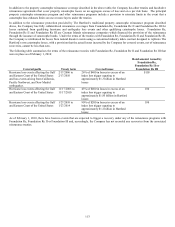

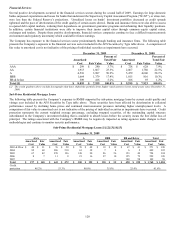

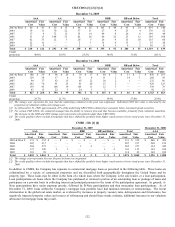

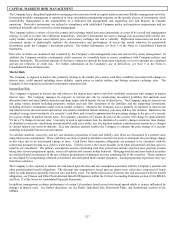

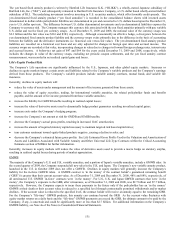

Commercial Mortgage Loans

December 31, 2009 December 31, 2008

Amortized

Cost [1]

Valuation

Allowance

Carrying

Value

Amortized

Cost [1]

Valuation

Allowance

Carrying

Value

Whole loans $ 3,319 $ (40) $ 3,279 $ 3,557 $ (2) $ 3,555

A-Note participations 391 — 391 460 (13) 447

B-Note participations 701 (176) 525 724 –– 724

Mezzanine loans 1,081 (142) 939 1,108 –– 1,108

Total [2] $ 5,492 $ (358) $ 5,134 $ 5,849 $ (15) $ 5,834

[1] Amortized cost represents carrying value prior to valuation allowances, if any.

[2] Excludes agricultural and residential mortgage loans. For further information on the total mortgage loan portfolio, see Note 5 of the Notes to

Consolidated Financial Statements.

Included in the table above are valuation allowances on mortgage loans held for sale associated with B-note participations and

mezzanine loans of $51 and $43, respectively, which had a carrying value of $47 and $96, respectively, as of December 31, 2009.

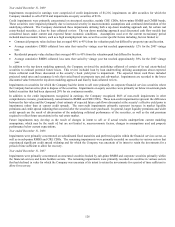

At origination, the weighted average loan-to-value (“LTV”) rate of the Company’ s commercial mortgage loan portfolio was

approximately 63%. As of December 31, 2009, the current weighted average LTV rate was approximately 83%. LTV rates compare

the loan amount to the value of the underlying property collateralizing the loan. The loan values are updated periodically through

property level reviews of the portfolio. Factors considered in the property valuation include, but are not limited to, actual and expected

property cash flows, geographic market data and capitalization rates.

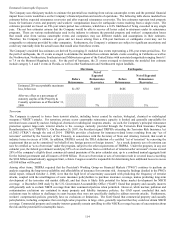

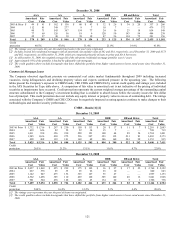

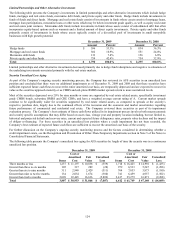

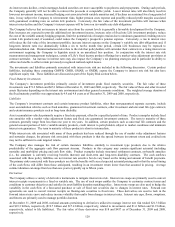

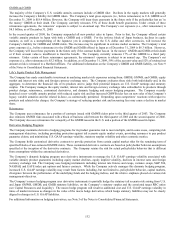

ABS Consumer Loans

The following table presents the Company’ s exposure to ABS consumer loans by credit quality, included in the AFS Securities by Type

table above. Currently, the Company expects its ABS consumer loan holdings will continue to pay contractual principal and interest

payments due to the ultimate expected borrower repayment performance and structural credit enhancements, which remain sufficient to

absorb a significantly higher level of defaults than are currently anticipated.

December 31, 2009

AAA AA A BBB

BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Auto [1] $ 136 $ 137 $ 47 $ 47 $ 96 $ 96 $ 105 $ 103 $ 22 $ 17 $ 406 $ 400

Credit card 703 714 — — 26 24 197 186 — — 926 924

Student loan [2] 292 186 326 249 137 66 — — — — 755 501

Total [3] $ 1,131 $ 1,037 $ 373 $ 296 $ 259 $ 186 $ 302 $ 289 $ 22 $ 17 $ 2,087 $ 1,825

December 31, 2008

AAA AA A BBB

BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Auto $ 135 $ 109 $ 29 $ 27 $ 142 $ 103 $ 209 $ 162 $ 30 $ 20 $ 545 $ 421

Credit card 419 367 6 3 108 97 351 248 58 39 942 754

Student loan 294 159 332 244 138 84 — — — — 764 487

Total $ 848 $ 635 $ 367 $ 274 $ 388 $ 284 $ 560 $ 410 $ 88 $ 59 $ 2,251 $ 1,662

[1] As of December 31, 2009, approximately 8% of the auto consumer loan-backed securities were issued by lenders whose primary business is to

sub-prime borrowers.

[2] As of December 31, 2009, approximately half of the student loan-backed exposure is guaranteed by the Federal Family Education Loan Program,

with the remainder comprised of loans to prime borrowers.

[3] The credit qualities above include downgrades that have shifted the portfolio from higher rated assets to lower rated assets since December 31,

2008.

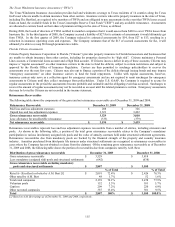

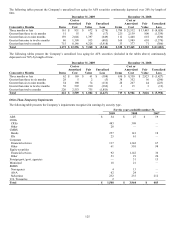

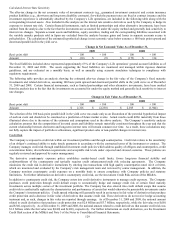

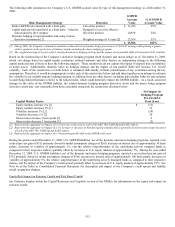

Municipal Bonds

The Company has investments in securities backed by states, municipalities and political subdivisions issuers (“municipal”) with an

amortized cost and fair value of $12.1 billion as of December 31, 2009 and $11.4 billion and $10.7 billion, respectively, as of December

31, 2008. The Company’ s municipal bond portfolio is diversified across the United States and primarily consists of general obligation

and revenue bonds issued by states, cities, counties, school districts and similar issuers. As of December 31, 2009, the largest

concentrations were in California, Georgia and Illinois which each comprised less than 3% of the municipal bond portfolio and were

primarily comprised of general obligation securities. Certain of the Company’ s municipal bonds were enhanced by third-party

insurance for the payment of principal and interest in the event of an issuer default. Excluding the benefit of this insurance, the average

credit rating was AA- and AA, respectively, as of December 31, 2009 and 2008.