The Hartford 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267

|

|

116

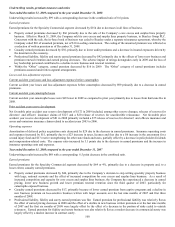

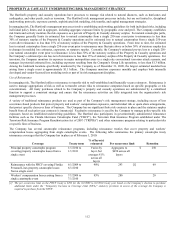

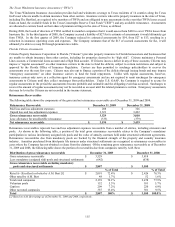

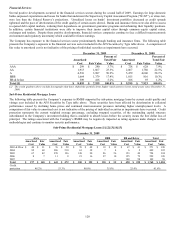

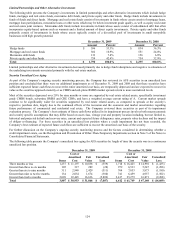

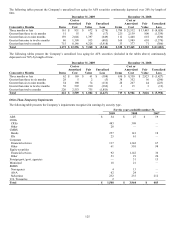

Where its contracts permit, the Company secures future claim obligations with various forms of collateral, including irrevocable letters

of credit, secured trusts, funds held accounts and group wide offsets. As part of its reinsurance recoverable review, the Company

analyzes recent developments in commutation activity between reinsurers and cedants, recent trends in arbitration and litigation

outcomes in disputes between cedants and reinsurers and the overall credit quality of the Company’ s reinsurers. Due largely to

investment losses sustained by reinsurers in 2008, the financial strength ratings of some reinsurers have been downgraded and the

financial strength ratings of other reinsurers have been put on negative watch. Nevertheless, as indicated in the above table,

approximately 98% of the gross reinsurance recoverables due from reinsurers rated by A.M. Best were rated A- (excellent) or better as

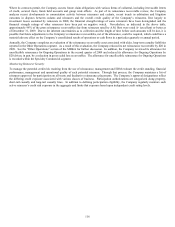

of December 31, 2009. Due to the inherent uncertainties as to collection and the length of time before such amounts will be due, it is

possible that future adjustments to the Company’ s reinsurance recoverables, net of the allowance, could be required, which could have a

material adverse effect on the Company’ s consolidated results of operations or cash flows in a particular quarterly or annual period.

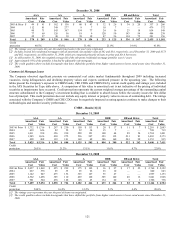

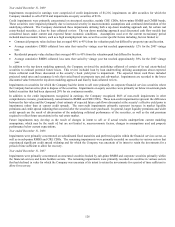

Annually, the Company completes an evaluation of the reinsurance recoverable asset associated with older, long-term casualty liabilities

reported in the Other Operations segment. As a result of this evaluation, the Company reduced its net reinsurance recoverable by $20 in

2009. See the “Other Operations” section of the MD&A for further discussion. In addition, the Company reviewed its allowance for

uncollectible reinsurance for Ongoing Operations in the second quarter of 2009 and reduced its allowance for Ongoing Operations by

$20 driven, in part, by a reduction in gross ceded loss recoverables. The allowance for uncollectible reinsurance for Ongoing Operations

is recorded within the Specialty Commercial segment.

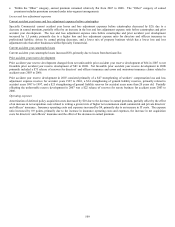

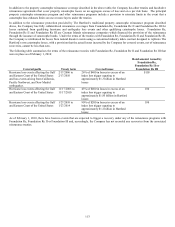

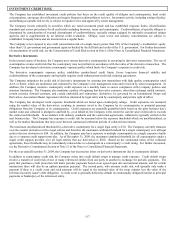

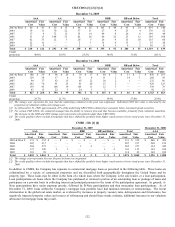

Monitoring Reinsurer Security

To manage the potential credit risk resulting from the use of reinsurance, management and ERM evaluate the credit standing, financial

performance, management and operational quality of each potential reinsurer. Through that process, the Company maintains a list of

reinsurers approved for participation on all treaty and facultative reinsurance placements. The Company’ s approval designations reflect

the differing credit exposure associated with various classes of business. Participation authorizations are categorized along property,

short-tail casualty and long-tail casualty lines. In addition to defining participation eligibility, the Company regularly monitors each

active reinsurer’ s credit risk exposure in the aggregate and limits that exposure based upon independent credit rating levels.