The Hartford 2009 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-74

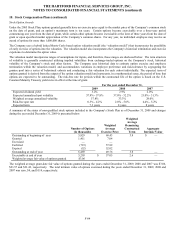

15. Equity (continued)

Noncontrolling Interests

Noncontrolling interest includes VIEs in which the Company has concluded that it is the primary beneficiary, see Note 5 for further

discussion of the Company’ s involvement in VIEs, and general account mutual funds where the Company holds the majority interest

due to seed money investments. The Company records noncontrolling interest as a component of equity. The noncontrolling interest

within these entities is likely to change, as these entities represent investment vehicles whereby investors may frequently redeem or

contribute to these investments. As such, the change in noncontrolling ownership interest represented in the Company’ s Consolidated

Statement of Changes in Equity will primarily represent redemptions and additional subscriptions within these investment vehicles.

Statutory Results (unaudited)

The domestic insurance subsidiaries of The Hartford prepare their statutory financial statements in conformity with statutory accounting

practices prescribed or permitted by the applicable state insurance department which vary materially from U.S. GAAP. Prescribed

statutory accounting practices include publications of the National Association of Insurance Commissioners (“NAIC”), as well as state

laws, regulations and general administrative rules. The differences between statutory financial statements and financial statements

prepared in accordance with U.S. GAAP vary between domestic and foreign jurisdictions. The principal differences are that statutory

financial statements do not reflect deferred policy acquisition costs and limit deferred income taxes, life benefit reserves predominately

use interest rate and mortality assumptions prescribed by the NAIC, bonds are generally carried at amortized cost and reinsurance assets

and liabilities are presented net of reinsurance.

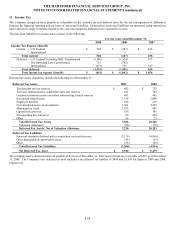

The statutory net income (loss) amounts for the years ended December 31, 2008 and 2007, and the statutory surplus amounts as of

December 31, 2008 and 2007 in the table below are based on actual statutory filings with the applicable U.S. regulatory authorities. The

statutory net income amounts for the year ended December 31, 2009 and the statutory surplus amounts as of December 31, 2009 are

estimates, as the respective 2009 statutory filings have not yet been made.

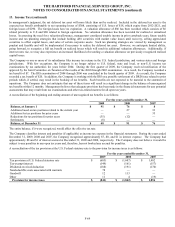

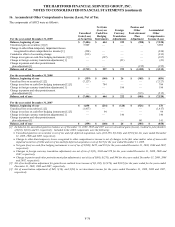

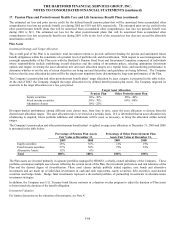

Statutory Net Income (Loss) For the years ended December 31,

2009 2008 2007

Life operations $1,928 $ (4,553) $729

Property & Casualty operations 889 497 1,803

Total $2,817 $ (4,056) $2,532

Statutory Surplus As of December 31,

2009 2008

Life Operations, includes domestic captive insurance subsidiaries $ 7,287 $6,046

Property & Casualty Operations, excluding non-Property & Casualty subsidiaries 7,364 6,012

Total $ 14,651 $12,058

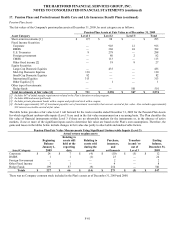

The Company also holds regulatory capital and surplus for its operations in Japan. Using the investment in subsidiary accounting

requirements defined in the U.S. National Association of Insurance Commissioners Statements of Statutory Accounting Practices, the

Company’ s statutory capital and surplus attributed to the Japan operations was $1,311 and $1,718 as of December 31, 2009 and 2008,

respectively.

The Company received approval from the Connecticut Insurance Department regarding the use of two permitted practices in the

statutory financial statements of its Connecticut-domiciled life insurance subsidiaries as of December 31, 2008. The first permitted

practice related to the statutory accounting for deferred income taxes. Specifically, this permitted practice modified the accounting for

deferred income taxes prescribed by the NAIC by increasing the realization period for deferred tax assets from one year to three years

and increasing the asset recognition limit from 10% to 15% of adjusted statutory capital and surplus. The benefits of this permitted

practice were not considered by the Company when determining surplus available for dividends. The second permitted practice related

to the statutory reserving requirements for variable annuities with guaranteed living benefit riders. Actuarial guidelines prescribed by

the NAIC required a stand-alone asset adequacy analysis reflecting only benefits, expenses and charges that are associated with the

riders for variable annuities with guaranteed living benefits. The permitted practice allowed for all benefits, expenses and charges

associated with the variable annuity contract to be reflected in the stand-alone asset adequacy test. These permitted practices resulted in

an increase to Life operations statutory surplus of $987 as of December 31, 2008. The effects of these permitted practices were included

in the 2008 Life operations surplus amount in the table above.

In December, 2009 the NAIC issued SSAP 10R which codified the three year realization period and 15% of adjusted statutory capital

and surplus recognition limits for accounting for deferred tax assets for both life and property and casualty companies. SSAP 10R will

expire for periods after December 31, 2010.