The Hartford 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 18

We have experienced and may experience additional future downgrades in our financial strength or credit ratings, which may make

our products less attractive, increase our cost of capital and inhibit our ability to refinance our debt, which would have a material

adverse effect on our business, results of operations, financial condition and liquidity.

Financial strength and credit ratings, including commercial paper ratings, are an important factor in establishing the competitive position

of insurance companies. In 2009, our financial strength and credit ratings were downgraded by multiple rating agencies. Rating

agencies assign ratings based upon several factors. While most of the factors relate to the rated company, some of the factors relate to

the views of the rating agency, general economic conditions, and circumstances outside the rated company’ s control. In addition, rating

agencies may employ different models and formulas to assess the financial strength of a rated company, and from time to time rating

agencies have, at their discretion, altered these models. Changes to the models, general economic conditions, or circumstances outside

our control could impact a rating agency’ s judgment of its rating and the rating it assigns us. We cannot predict what actions rating

agencies may take, or what actions we may take in response to the actions of rating agencies, which may adversely affect us.

Our financial strength ratings, which are intended to measure our ability to meet policyholder obligations, are an important factor

affecting public confidence in most of our products and, as a result, our competitiveness. A downgrade or an announced potential

further downgrade in the rating of our financial strength or of one of our principal insurance subsidiaries could affect our competitive

position and reduce future sales of our products.

Our credit ratings also affect our cost of capital. A downgrade or an announced potential downgrade of our credit ratings could make it

more difficult or costly to refinance maturing debt obligations, to support business growth at our insurance subsidiaries and to maintain

or improve the financial strength ratings of our principal insurance subsidiaries. Downgrades could begin to trigger potentially material

collateral calls on certain of our derivative instruments and counterparty rights to terminate derivative relationships, both of which could

limit our ability to purchase additional derivative instruments. These events could materially adversely affect our business, results of

operations, financial condition and liquidity.

Our valuations of many of our financial instruments include methodologies, estimations and assumptions that are subject to

differing interpretations and could result in changes to investment valuations that may materially adversely affect our results of

operations and financial condition.

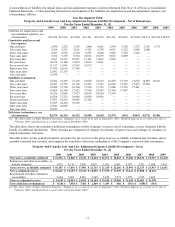

The following financial instruments are carried at fair value in the Company’ s consolidated financial statements: fixed maturities, equity

securities, freestanding and embedded derivatives, and separate account assets. The Company is required to categorize these securities

into a three-level hierarchy, based on the priority of the inputs to the respective valuation technique. The fair value hierarchy gives the

highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable

inputs (Level 3). In many situations, inputs used to measure the fair value of an asset or liability position may fall into different levels of

the fair value hierarchy. In these situations, the Company will determine the level in which the fair value falls based upon the lowest

level input that is significant to the determination of the fair value.

The determination of fair values are made at a specific point in time, based on available market information and judgments about

financial instruments, including estimates of the timing and amounts of expected future cash flows and the credit standing of the issuer

or counterparty. The use of different methodologies and assumptions may have a material effect on the estimated fair value amounts.

During periods of market disruption, including periods of rapidly widening credit spreads or illiquidity, it may be difficult to value

certain of our securities if trading becomes less frequent and/or market data becomes less observable. There may be certain asset classes

that were in active markets with significant observable data that become illiquid due to the financial environment. In such cases, more

securities may fall to Level 3 and thus require more subjectivity and management judgment. As such, valuations may include inputs and

assumptions that are less observable or require greater estimation thereby resulting in values that may differ materially from the value at

which the investments may be ultimately sold. Further, rapidly changing and unprecedented credit and equity market conditions could

materially impact the valuation of securities as reported within our consolidated financial statements and the period-to-period changes in

value could vary significantly. Decreases in value could have a material adverse effect on our results of operations and financial

condition. As of December 31, 2009, 9%, 75% and 16% of our available for sale securities and short-term investments were considered

to be Level 1, 2 and 3, respectively.

Evaluation of available-for-sale securities for other-than-temporary impairment involves subjective determinations and could

materially impact our results of operations.

The evaluation of impairments is a quantitative and qualitative process, which is subject to risks and uncertainties and is intended to

determine whether a credit and/or non-credit impairment exists and whether an impairment should be recognized in current period

earnings or in other comprehensive income. The risks and uncertainties include changes in general economic conditions, the issuer’ s

financial condition or future recovery prospects, the effects of changes in interest rates or credit spreads and the expected recovery

period. For securitized financial assets with contractual cash flows, the Company currently uses its best estimate of cash flows over the

life of the security. In addition, estimating future cash flows involves incorporating information received from third-party sources and

making internal assumptions and judgments regarding the future performance of the underlying collateral and assessing the probability

that an adverse change in future cash flows has occurred. The determination of the amount of other-than-temporary impairments is

based upon our quarterly evaluation and assessment of known and inherent risks associated with the respective asset class. Such

evaluations and assessments are revised as conditions change and new information becomes available.