The Hartford 2009 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-56

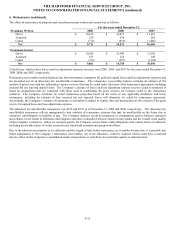

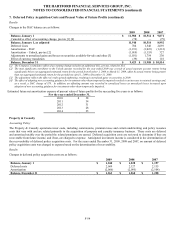

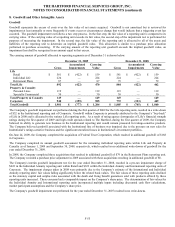

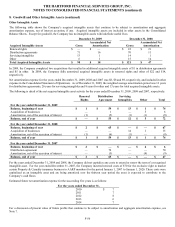

8. Goodwill and Other Intangible Assets (continued)

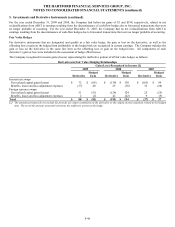

Other Intangible Assets

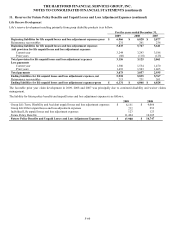

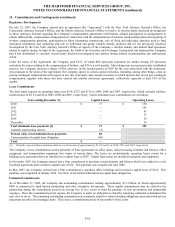

The following table shows the Company’ s acquired intangible assets that continue to be subject to amortization and aggregate

amortization expense, net of interest accretion, if any. Acquired intangible assets are included in other assets in the Consolidated

Balance Sheets. Except for goodwill, the Company has no intangible assets with indefinite useful lives.

December 31, 2009 December 31, 2008

Acquired Intangible Assets Gross

Accumulated Net

Amortization Gross

Accumulated Net

Amortization

Renewal rights $ — $ — $ 22 $ 21

Distribution agreements 71 16 70 11

Servicing intangibles 13 1 14 1

Other 6 1 15 14

Total Acquired Intangible Assets $ 90 $ 18 $ 121 $ 47

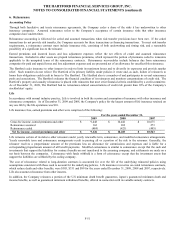

In 2009, the Company completed two acquisitions that resulted in additional acquired intangible assets of $1 in distribution agreements

and $5 in other. In 2009, the Company fully amortized acquired intangible assets in renewal rights and other of $22 and $14,

respectively.

Net amortization expense for the years ended December 31, 2009, 2008 and 2007 was $8, $8 and $9, respectively, and included in other

expense in the Consolidated Statement of Operations. As of December 31, 2009, the weighted average amortization period was 13 years

for distribution agreements, 20 years for servicing intangibles and 8 years for other and 13 years for total acquired intangible assets.

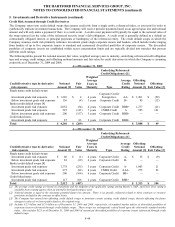

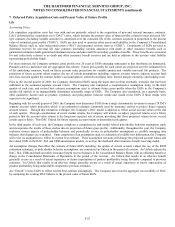

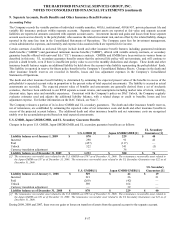

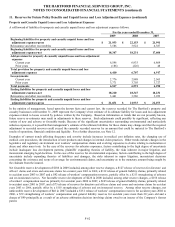

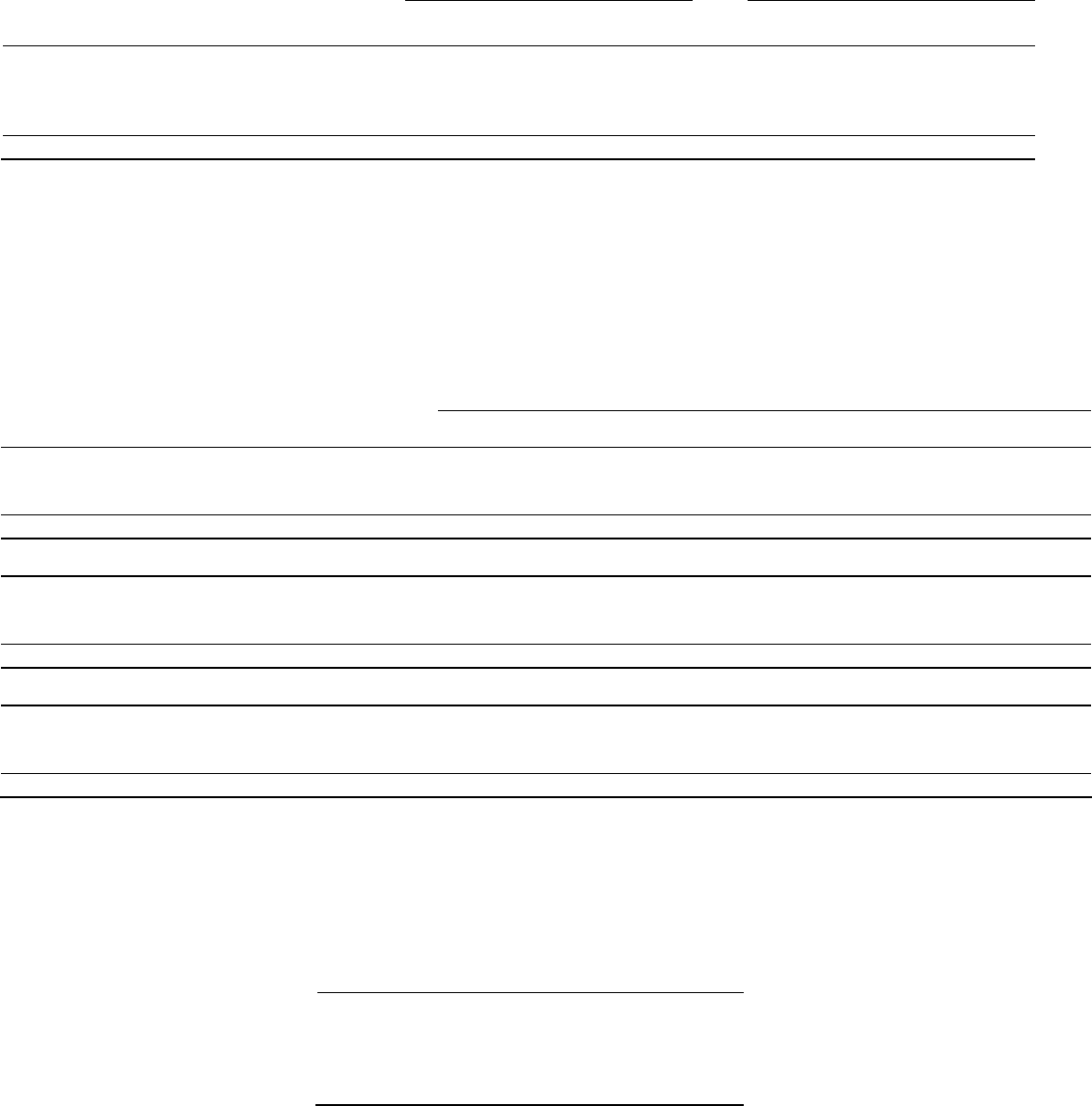

The following is detail of the net acquired intangible asset activity for the years ended December 31, 2009, 2008 and 2007, respectively.

Renewal

Rights

Distribution

Agreement

Servicing

Intangibles

Other

Total

For the year ended December 31, 2009

Balance, beginning of year $1 $59 $13 $ 1 $74

Acquisition of businesses — 1 — 5 6

Amortization, net of the accretion of interest (1) (5) (1) (1) (8)

Balance, end of year $ — $ 55 $12 $ 5 $72

For the year ended December 31, 2008

Balance, beginning of year $2 $65 $ — $ — $ 67

Acquisition of businesses — — 14 1 15

Amortization, net of the accretion of interest (1) (6) (1) — (8)

Balance, end of year $1 $59 $13 $ 1 $74

For the year ended December 31, 2007

Balance, beginning of year $2 $ — $ — $ 4 $6

Distribution agreement — 70 — — 70

Amortization, net of the accretion of interest — (5) — (4) (9)

Balance, end of year $2 $65 $ — $ — $ 67

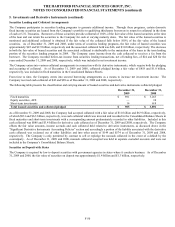

For the years ended December 31, 2009 and 2008, the Company did not capitalize any costs to extend or renew the term of a recognized

intangible asset. For the year ended December 31, 2007, the Company incurred renewal costs of $70 for the exclusive right to market

certain Property & Casualty insurance business to AARP members for the period January 1, 2007 to January 1, 2020. These costs were

capitalized as an intangible asset and are being amortized over the thirteen year period the asset is expected to contribute to the

Company’ s cash flows.

Estimated future net amortization expense for the succeeding five years is as follows:

For the years ended December 31,

2010 $ 7

2011 7

2012 8

2013 6

2014 7

For a discussion of present value of future profits that continue to be subject to amortization and aggregate amortization expense, see

Note 7.